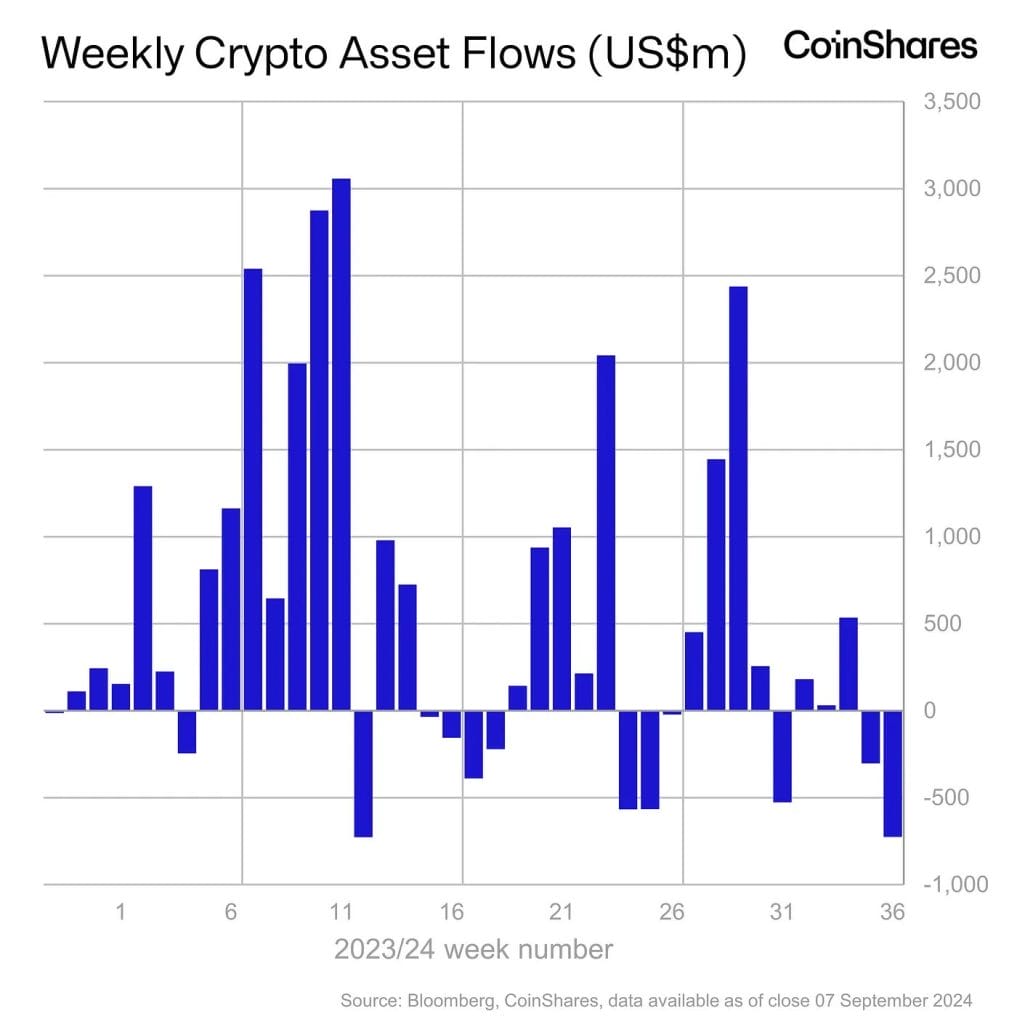

Digital asset investment products have experienced a significant downturn, with outflows totaling $726 million over the past week.

The figure matches the largest recorded outflow, which occurred in March of this year, CoinShares said in a recent report.

Per the report, the primary driver behind the negative sentiment was stronger-than-expected macroeconomic data from the previous week, which led to increased speculation of a 25 basis point (bp) interest rate cut by the US Federal Reserve.

Employment Data Falls Short of Expectations

However, the market sentiment showed some signs of stabilization later in the week, as employment data fell short of expectations.

This tempered some fears, leading to a divided outlook on whether the Fed might implement a larger, 50bp rate cut.

All eyes are now on the upcoming Consumer Price Index (CPI) inflation report, set to be released on Tuesday.

If inflation numbers come in lower than expected, a 50bp rate cut becomes more likely, which could have further implications for the crypto market.

The recent outflows were overwhelmingly concentrated in the United States, which accounted for $721 million of the total $726 million.

Canada also saw significant outflows, contributing $28 million to the overall figure.

In contrast, European markets showed more positive sentiment, with inflows in some regions.

Germany led the way in Europe with inflows of $16.3 million, while Switzerland followed with $3.2 million.

Bitcoin and Ethereum Lead the Digital Asset Outflows Leaderboard

Bitcoin was hit particularly hard by the recent downturn, experiencing outflows totaling $643 million.

Interestingly, short-Bitcoin products saw minor inflows of $3.9 million, indicating that some investors are still hedging against further price drops in the leading cryptocurrency.

Ethereum also faced significant losses, with outflows reaching $98 million.

Much of this came from the Grayscale Ethereum Trust, a major player in the market.

Meanwhile, inflows from newly issued Ethereum-based exchange-traded funds (ETFs) have nearly dried up, signaling that investor confidence in Ethereum may be waning, at least for the time being. What’s more, VanEck has announced that its Ethereum Futures Exchange-Traded Fund (ETF) will be closed and liquidated, with the final trading day scheduled for September 16, 2024.

Amid the widespread outflows, Solana emerged as a rare bright spot in the digital asset market.

The cryptocurrency saw the largest inflows of any asset during this period, totaling $6.2 million.

Meanwhile, in a recent note, QCP Capital said that the crypto market has seen some stabilization following last week’s price swings, though implied volatility remains elevated.

QCP: It seems the market is still anticipating some volatility heading into this week's events, specifically the Trump v Harris debate (10 Sep, 9pm ET) and CPI (11 Sep, 830am ET). Risk Reversals until October are still skewed towards Puts in both BTC and ETH. But some…

— Wu Blockchain (@WuBlockchain) September 9, 2024

“It seems the market is still anticipating some volatility heading into this week’s events, specifically the Trump v Harris debate (10 Sep, 9pm ET) and CPI (11 Sep, 830am ET),” the investment firm wrote.

It added that despite last week’s sharp dip, market sentiment remains cautious, particularly around the potential downside risk.

Risk reversals for both Bitcoin and Ethereum are currently skewed toward puts, reflecting traders’ apprehension.

Nevertheless, many institutions remain structurally bullish and are taking advantage of the market’s recent downturn to place longer-term bullish trades.

Notably, there has been significant buying activity for 28 March 2025 call options with strikes at 85k, 100k, and 120k, suggesting that some institutional investors see current price levels as a buying opportunity.

The post Digital Asset Products See Largest Outflows Since March, Totaling $726M appeared first on Cryptonews.