BitcoinWorld

Crypto Concern and Greed Index Hits 63: Navigating the Greed Zone

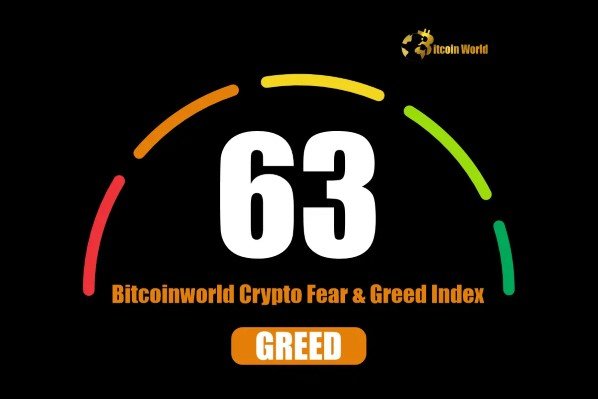

The cryptocurrency market is a dynamic surroundings, usually pushed as a lot by emotion as by elementary evaluation. Understanding the prevailing sentiment is essential for traders and merchants alike. Probably the most fashionable instruments for gauging this collective temper is the Crypto Concern and Greed Index. Just lately, this index has proven a major shift, rising to 63 and firmly positioning itself throughout the ‘Greed’ zone.

What’s the Crypto Concern and Greed Index and Why Does it Matter?

The Crypto Concern and Greed Index is a novel software designed by Different.me to visualise the emotional state of the cryptocurrency market. It aggregates varied information factors to provide a single quantity between 0 (Excessive Concern) and 100 (Excessive Greed). The core concept is that excessive concern can point out a possible shopping for alternative for these courageous sufficient to enter a falling market, whereas excessive greed can sign that the market is due for a correction.

Why does this matter? As a result of human psychology performs a large position in monetary markets. Concern can result in panic promoting, driving costs down additional than fundamentals may recommend. Greed can result in irrational exuberance, FOMO (Concern Of Lacking Out), and speculative shopping for, pushing costs into bubble territory.

The index offers a snapshot of this emotional temperature, serving to individuals probably make extra rational selections by understanding the group’s present mindset.

Breaking Down the Crypto Concern and Greed Index Rating

The index categorizes sentiment throughout a spectrum:

- 0-24: Excessive Concern

- 25-49: Concern

- 50-74: Greed

- 75-100: Excessive Greed

A studying of 63, as not too long ago reported, falls comfortably throughout the ‘Greed’ class. This means that market individuals are feeling optimistic, even perhaps euphoric, about present and future worth actions. Whereas not but within the ‘Excessive Greed’ territory, it suggests a powerful constructive bias is presently dominating the Crypto Market Sentiment.

Traditionally, durations of ‘Excessive Concern’ have usually coincided with market bottoms, presenting alternatives for long-term traders. Conversely, durations of ‘Excessive Greed’ have generally preceded market tops or vital pullbacks, as speculative extra turns into unsustainable.

How is the Bitcoin Concern and Greed Index Calculated?

Whereas usually referred to within the context of the broader crypto market, the index is closely influenced by Bitcoin’s efficiency, given its market dominance. The calculation incorporates six key components, every weighted otherwise:

- Volatility (25%): Measures the present volatility and most drawdown of Bitcoin in comparison with common values. Excessive volatility usually signifies a fearful market.

- Market Momentum / Quantity (25%): Compares present market quantity and momentum to historic averages. Excessive shopping for quantity in a constructive market suggests grasping or optimistic conduct.

- Social Media (15%): Analyzes tweets and posts for particular phrases associated to crypto, monitoring sentiment and engagement velocity. Excessive interplay and constructive sentiment can point out rising greed.

- Surveys (15%): Polls customers about their market sentiment. (Be aware: As talked about within the supply, surveys are presently paused, which could barely have an effect on this part’s enter, though the weighting is utilized to the remaining lively components).

- Bitcoin Dominance (10%): Measures Bitcoin’s share of the full cryptocurrency market cap. Rising dominance can point out concern (as traders transfer to the perceived ‘safer’ asset, BTC) or just robust efficiency in Bitcoin itself. Falling dominance can sign growing greed as altcoins rally extra aggressively.

- Google Traits (10%): Analyzes search queries associated to Bitcoin and different cryptocurrencies. Rising search curiosity, particularly for phrases like ‘Bitcoin worth manipulation’ or ‘Bitcoin bubble’, can sign concern, whereas phrases associated to purchasing or particular initiatives may recommend greed.

By combining these numerous information factors, the index goals to supply a extra holistic view of the underlying Crypto Market Sentiment than merely taking a look at worth charts alone.

What Does Being within the ‘Greed Zone Crypto’ Imply for You?

A studying of 63 within the ‘Greed’ zone carries a number of implications for these concerned available in the market:

Potential Implications:

- Elevated Optimism: Individuals are usually feeling constructive concerning the market’s course.

- Greater Threat Urge for food: Traders could also be extra keen to tackle threat, probably transferring into extra speculative altcoins.

- FOMO Setting In: The concern of lacking out on potential features can drive impulsive shopping for.

- Potential for Overheating: Markets pushed purely by emotion and hypothesis can grow to be indifferent from underlying worth, growing the danger of a pointy correction.

Whereas ‘Greed’ isn’t ‘Excessive Greed’, it serves as a yellow flag. It suggests warning is warranted. Costs might proceed to rise, however the chance of a major downturn will increase as sentiment strikes larger into the greed spectrum.

Utilizing the Crypto Concern and Greed Index in Your Crypto Investing Technique

The index is finest used as one software amongst many, not as a standalone sign. Right here’s the way it can match right into a broader Crypto Investing Technique:

Advantages:

- Sentiment Verify: Gives a fast, aggregated view of market temper.

- Contrarian Indicator: May help establish potential alternatives throughout ‘Excessive Concern’ (purchase when others are fearful) or warn of potential tops throughout ‘Excessive Greed’ (be cautious when others are grasping).

- Historic Context: Evaluating present readings to historic ranges can provide perspective on the place the market is perhaps in its cycle.

Challenges & Limitations:

- Not a Crystal Ball: The index can not predict future worth actions with certainty. A excessive greed rating doesn’t assure a right away crash, nor does a excessive concern rating assure a backside.

- Lagging Indicator: It displays *present* sentiment, which is commonly a response to current worth motion, not essentially a predictor of future motion.

- Part Reliance: Adjustments within the calculation technique or information sources (like paused surveys) can have an effect on its reliability.

- Bitcoin-Centric: Whereas indicative of the general market, it’s closely weighted in direction of Bitcoin. Altcoin sentiment may differ.

Actionable Insights:

- Mix with Evaluation: Use the index alongside technical evaluation (charts, patterns), elementary evaluation (challenge utility, adoption), and macroeconomic components.

- Handle Threat: Excessive greed scores are a superb time to overview your portfolio, probably take some income, set stop-losses, or scale back leverage.

- Keep away from FOMO: When the index is excessive within the greed zone, resist the urge to chase quickly rising costs. Keep on with your predefined funding plan.

- Search for Alternatives in Concern: Conversely, low concern scores can sign potential shopping for alternatives if fundamentals stay robust.

Consider the index as a temperature gauge for the market’s emotional state. It tells you if persons are sizzling (grasping) or chilly (fearful), but it surely doesn’t let you know *why* or *how lengthy* that temperature will final.

Historic Examples and the Greed Zone

Wanting again, the Bitcoin Concern and Greed Index has usually offered fascinating insights. As an illustration, through the peak of the 2017 bull run and the late 2020/early 2021 rally, the index constantly registered within the ‘Excessive Greed’ zone (usually above 90). These durations have been adopted by vital market corrections. Conversely, throughout main crashes, like March 2020 or the bear market lows of 2022, the index plummeted into ‘Excessive Concern’ (generally beneath 10), which in hindsight, represented robust accumulation zones for long-term holders.

Being within the ‘Greed Zone Crypto’ at 63 isn’t as excessive as these historic peaks, but it surely locations the market firmly in a state the place warning ought to begin outweighing extreme optimism. It’s a reminder that timber don’t develop to the sky and corrections are a pure a part of market cycles.

What Might Shift the Crypto Market Sentiment?

The index is consistently reacting to market forces. A number of components might trigger the Crypto Market Sentiment to shift from its present grasping state:

- Important Value Drop: A pointy decline in Bitcoin or different main cryptocurrencies would rapidly inject concern into the market.

- Detrimental Information: Regulatory crackdowns, change hacks, or main challenge failures can set off widespread panic.

- Macroeconomic Adjustments: Shifts in world rates of interest, inflation information, or recession fears can affect risk-on belongings like crypto.

- Constructive Developments: Conversely, constructive information like institutional adoption, regulatory readability, or technological breakthroughs might push the index additional into Excessive Greed.

Monitoring these exterior components alongside the index offers a extra sturdy understanding of potential future actions.

Conclusion: Navigating Greed with Warning

The rise of the Crypto Concern and Greed Index to 63 signifies that optimism and confidence are presently the dominant forces available in the market, inserting it firmly within the ‘Greed’ zone. Whereas this displays constructive worth motion and momentum, it additionally serves as an necessary reminder to mood enthusiasm with prudence. The index is a invaluable sentiment software, serving to traders gauge the emotional temperature of the market and probably act as a contrarian sign. Nevertheless, it isn’t a standalone predictor. Profitable navigation of the ‘Greed Zone Crypto’ requires combining this sentiment perception with thorough analysis, technical evaluation, elementary understanding, and disciplined threat administration as a part of a well-defined Crypto Investing Technique. Keep knowledgeable, keep cautious, and keep away from letting greed dictate your selections.

To be taught extra concerning the newest crypto market traits, discover our articles on key developments shaping Bitcoin worth motion and broader market sentiment.

This publish Crypto Concern and Greed Index Hits 63: Navigating the Greed Zone first appeared on BitcoinWorld and is written by Editorial Workforce