BitcoinWorld

Essential Shift: Crypto Worry and Greed Index Enters Impartial Zone

Are you watching the crypto market carefully? A big indicator, the Crypto Worry and Greed Index, has simply moved into a brand new section, suggesting a shift within the prevailing crypto market sentiment. For buyers and merchants navigating the digital asset panorama, understanding this index is vital to deciphering potential market actions.

What’s the Crypto Worry and Greed Index?

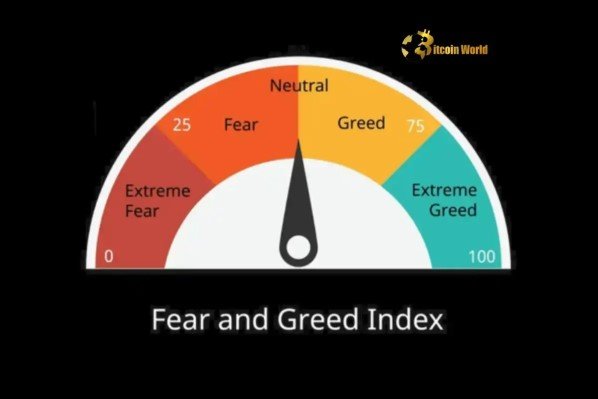

The Crypto Worry and Greed Index, offered by software program improvement platform Different, is a well-liked instrument used to gauge the final sentiment within the cryptocurrency market. It goals to quantify the emotional state of market individuals, which frequently drives worth motion. The index operates on a easy precept: excessive worry can sign a possible shopping for alternative (as costs could also be artificially low resulting from panic promoting), whereas excessive greed can recommend the market is due for a correction (as costs could also be inflated by FOMO – Worry Of Lacking Out).

The index is offered as a single quantity starting from 0 to 100:

- 0-24: Excessive Worry

- 25-49: Worry

- 50-50: Impartial

- 51-74: Greed

- 75-100: Excessive Greed

The Current Shift: From Worry to Impartial Territory

As of June 7, the Crypto Worry and Greed Index registered a worth of 52. This marks a notable enhance of seven factors from yesterday. Extra importantly, this motion signifies a transition out of the ‘Worry’ zone and into the ‘Impartial’ zone. For a interval, the market had been characterised by larger ranges of worry, typically related to worth downturns or uncertainty. The transfer to 52 means that whereas outright ‘Greed’ shouldn’t be but dominant, the extraordinary worry has subsided, changed by a extra balanced, albeit doubtlessly indecisive, market temper.

This shift in crypto market sentiment doesn’t essentially predict the long run, nevertheless it displays the present psychological state of market individuals primarily based on varied information factors.

Understanding the Components Behind the Index Rating

The index shouldn’t be primarily based on a single metric however aggregates information from six totally different sources. Every issue contributes a selected weighting to the ultimate rating:

1. Volatility (25%)

This part measures the present volatility and most drawdowns of Bitcoin in comparison with its common values during the last 30 and 90 days. Increased volatility, particularly downwards, tends to extend worry, whereas decrease volatility or upward worth swings can contribute to a extra impartial or grasping rating.

2. Market Momentum / Quantity (25%)

This issue seems on the present market quantity and momentum in comparison with common values during the last 30 and 90 days. Excessive shopping for quantity and robust upward momentum point out a bullish sentiment, pushing the index in direction of greed. Low quantity or promoting strain suggests worry or lack of curiosity.

3. Social Media (15%)

This analyzes key phrases associated to cryptocurrency on platforms like Twitter. A better charge of particular posts and hashtags, mixed with how shortly they’re receiving interactions, can point out heightened market curiosity or potential FOMO, contributing to a better rating.

4. Surveys (15%)

Though at present paused by Different, this issue traditionally concerned weekly polls asking individuals how they see the market. These surveys aimed to seize direct investor sentiment.

5. Bitcoin Dominance (10%)

Bitcoin dominance measures Bitcoin’s share of the overall cryptocurrency market capitalization. A rise in Bitcoin dominance typically means that buyers are shifting away from altcoins and into Bitcoin, which will be seen as a safer haven throughout occasions of uncertainty (worry). Conversely, lowering Bitcoin dominance may point out elevated threat urge for food as funds movement into altcoins (greed), although this issue’s interpretation will be nuanced.

6. Google Developments (10%)

This issue analyzes search queries associated to Bitcoin on Google Developments. For instance, a sudden surge in searches for phrases like “Bitcoin worth manipulation” may point out worry, whereas phrases like “purchase Bitcoin” may recommend growing curiosity and potential greed. This supplies perception into retail investor curiosity and panic ranges.

What Does ‘Impartial’ Sentiment Suggest for Crypto Developments?

Transferring into the ‘Impartial’ zone (50-50 vary, with 52 being simply above the midpoint) is commonly interpreted as a interval of indecision or equilibrium out there. It means that neither excessive worry nor excessive greed is at present dominating participant conduct. Listed below are some potential implications for crypto tendencies:

- Lack of Clear Route: The market may commerce sideways or exhibit uneven worth motion as bulls and bears are comparatively balanced.

- Potential Turning Level: Neutrality can precede a big transfer in both route. It’s like a coiled spring, ready for a catalyst.

- Elevated Sensitivity to Information: In a impartial state, the market could be extra reactive to exterior information occasions, rules, or macroeconomic information.

- Give attention to Fundamentals: With emotional extremes subdued, market individuals may pay nearer consideration to challenge developments, adoption charges, and technological developments.

For these monitoring crypto tendencies, a impartial studying means relying solely on the index is inadequate. It’s a sign to look deeper into different technical and basic indicators.

How Can Traders Use the Crypto Worry and Greed Index?

The index is a sentiment instrument, not a buying and selling sign in isolation. Nevertheless, it may be a beneficial addition to an investor’s toolkit:

- Contrarian Indicator: Some buyers use the index as a contrarian sign. Excessive worry (low index worth) could be seen as a time to think about shopping for, whereas excessive greed (excessive index worth) may recommend warning or a time to think about promoting. The transfer to impartial could be seen as exiting a possible shopping for zone (worry) or approaching a possible promoting zone (greed), relying on one’s technique.

- Market Affirmation: It will possibly assist affirm or query alerts from different indicators. If technical evaluation suggests an oversold market, a excessive ‘Worry’ studying on the index would assist that view.

- Emotional Examine: It will possibly assist buyers examine their very own feelings towards the prevailing market sentiment. If the index exhibits excessive greed however you are feeling fearful, or vice versa, it’d immediate you to re-evaluate your place or technique.

- Historic Context: Monitoring the index over time supplies context on market cycles and the way sentiment has traditionally correlated with worth actions.

Keep in mind, the index is only one information level amongst many. It’s essential to mix sentiment evaluation with technical evaluation, basic evaluation, and a stable understanding of your individual threat tolerance and funding objectives.

Contemplating Crypto Volatility within the Impartial Zone

Even in a ‘Impartial’ sentiment section, crypto volatility stays a basic attribute of the market. The index’s volatility part contributes 25% to the rating, reflecting how vital worth swings affect total sentiment. A impartial index doesn’t imply volatility disappears; it merely means the market isn’t at present pushed by panic promoting or manic shopping for primarily based on current worth actions to the intense diploma seen in periods of ‘Excessive Worry’ or ‘Excessive Greed’. Traders ought to all the time be ready for potential worth swings, whatever the index’s present studying.

Wanting Forward: What Would possibly Push the Index Additional?

The index’s subsequent transfer will rely upon shifts within the underlying components. Constructive information concerning regulation, institutional adoption, or vital technological upgrades inside main initiatives may push sentiment in direction of ‘Greed’. Conversely, detrimental information, regulatory crackdowns, or vital worth drops may shortly ship the index again into ‘Worry’. Modifications in Bitcoin dominance and broader financial circumstances will even play a job in shaping future crypto tendencies and the corresponding sentiment.

Conclusion: A Balanced Pause

The Crypto Worry and Greed Index shifting to 52, getting into the ‘Impartial’ zone, signifies a pause within the beforehand fearful market sentiment. It suggests a extra balanced atmosphere the place neither excessive panic nor rampant hypothesis is at present in management. Whereas this doesn’t present a transparent directional sign, it highlights a possible interval of indecision or transition for crypto tendencies. Understanding the components influencing the index, from crypto volatility and market momentum to social media buzz and Bitcoin dominance, supplies beneficial context for buyers. Use this index as one instrument amongst many to gauge the market’s emotional temperature, however all the time mix it with diligent analysis and evaluation earlier than making funding choices.

To study extra in regards to the newest crypto market tendencies, discover our articles on key developments shaping Bitcoin and different cryptocurrencies’ future worth motion.

This put up Essential Shift: Crypto Worry and Greed Index Enters Impartial Zone first appeared on BitcoinWorld and is written by Editorial Staff