Bitcoin Mining Difficulty Reaches New Record at 103.92 Trillion

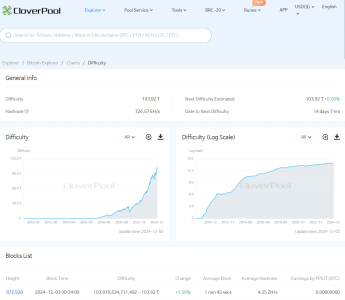

Bitcoin’s mining difficulty—a measure of how challenging it is to mine a new block—has reached an all-time high of 103.92 trillion (T) following a 1.59% adjustment at block height 872,928, according to CloverPool data. This increase marks a significant milestone for the Bitcoin network, underscoring its growing computational power and security.

Accompanying this rise, the network’s average computing power, or hash rate, now stands at an impressive 726.57 exahashes per second (EH/s), reflecting the escalating competition among miners to secure block rewards.

Understanding Bitcoin Mining Difficulty

1. What Is Mining Difficulty?

Bitcoin’s mining difficulty adjusts approximately every 2,016 blocks, or roughly every two weeks, to maintain a consistent block time of 10 minutes. The metric reflects the level of computational effort required to mine a block, directly correlating with the network’s hash rate.

2. Why Does It Increase?

The mining difficulty rises when:

- Hash Rate Surges: An influx of computational power increases competition among miners.

- Network Security Strengthens: A higher difficulty makes the network more secure by reducing vulnerabilities to attacks.

Current Mining Difficulty Milestone: Key Figures

- Record Difficulty: 103.92T, a 1.59% increase from the previous adjustment.

- Hash Rate: 726.57 EH/s, representing the network’s average computational power.

These figures highlight the robustness and growing decentralization of the Bitcoin network, as more miners join the ecosystem to compete for rewards.

Factors Driving the Difficulty Surge

1. Increased Mining Activity

- Global Expansion: Miners worldwide have ramped up operations, spurred by the recovering cryptocurrency market.

- New Hardware Adoption: Advances in mining technology, including energy-efficient ASICs (Application-Specific Integrated Circuits), have boosted overall network hash power.

2. Rising Bitcoin Prices

- Profitability for Miners: Bitcoin’s sustained price rally makes mining more lucrative, incentivizing more participants to enter the space.

- Post-Halving Impact: Following Bitcoin’s 2024 halving, competition for reduced block rewards (3.125 BTC) has intensified, driving up difficulty.

3. Institutional Investments in Mining

- Large-Scale Operations: Institutional players have invested heavily in mining farms, particularly in regions with affordable electricity.

- Sustainable Energy Trends: A shift toward renewable energy sources has made mining operations more scalable and socially acceptable.

Implications for Bitcoin Miners

1. Increased Competition

- Miners face heightened competition, with only the most efficient operations likely to remain profitable.

- Those using outdated or less efficient equipment may struggle to cover operational costs.

2. Rising Operational Costs

- Higher difficulty requires more energy and computational power, increasing expenses for mining operations.

- Miners in regions with high electricity costs may find profitability challenging.

3. Network Stability and Security

- The increased difficulty strengthens Bitcoin’s blockchain by making it more resistant to attacks, enhancing its long-term stability.

Impact on the Broader Cryptocurrency Market

1. Bitcoin Price Correlation

While mining difficulty does not directly influence Bitcoin’s price, it often reflects broader market confidence.

- Positive Sentiment: A record difficulty suggests strong participation and belief in Bitcoin’s long-term value.

- Potential Price Effects: Sustained mining activity may contribute to scarcity and, in turn, upward price momentum.

2. Decentralization

- The growth in hash rate and difficulty reflects the network’s increasing decentralization, reducing reliance on a few dominant miners.

3. Influence on Altcoins

- As Bitcoin mining becomes more competitive, smaller miners may pivot to altcoins, potentially boosting activity and value in alternative networks.

Technological Advances Supporting Mining Growth

1. Energy-Efficient Hardware

- The adoption of next-generation ASIC miners has significantly increased hash rates while reducing energy consumption.

2. Renewable Energy Integration

- Miners are leveraging solar, wind, and hydroelectric power to offset costs and improve sustainability.

3. Mining Pool Collaboration

- Collaborative mining pools allow smaller miners to participate effectively, contributing to overall network growth.

Historical Context: Difficulty Milestones

1. Early Days of Bitcoin

- In 2009, Bitcoin’s mining difficulty was set at 1, a stark contrast to today’s record 103.92T.

- Mining could be performed on standard CPUs, highlighting how far the network has come.

2. Major Difficulty Surges

- 2017 Bull Run: Difficulty rose significantly during Bitcoin’s first mainstream bull market.

- 2021 Peak: Another major increase accompanied Bitcoin’s rise to $69,000.

- 2024 Recovery: The current milestone reflects renewed growth and activity post-halving.

What’s Next for Bitcoin Mining?

1. Continued Hash Rate Growth

- As more miners join the network, the hash rate is expected to rise further, driving subsequent difficulty adjustments.

2. Geographic Shifts in Mining

- Regions with low-cost, renewable energy (e.g., Texas, Scandinavia) will likely attract more mining operations.

3. Long-Term Security

- Increased difficulty enhances Bitcoin’s resistance to attacks, cementing its reputation as the most secure blockchain.

Investor and Miner Strategies

1. Miners:

- Adopt Efficient Hardware: Invest in state-of-the-art mining rigs to stay competitive.

- Optimize Energy Costs: Explore renewable energy options to reduce expenses.

- Join Mining Pools: Participate in pools to share rewards and mitigate risks.

2. Investors:

- Monitor Difficulty Trends: Use mining difficulty as an indicator of network health and activity.

- Assess Mining Stocks: Companies involved in Bitcoin mining may offer indirect exposure to its growth.

- Diversify Portfolio: Consider altcoins benefiting from shifts in mining activity.

Conclusion: A Milestone for Bitcoin’s Resilience

The record-high Bitcoin mining difficulty of 103.92T underscores the network’s robustness, security, and growing global participation. While the milestone reflects increased competition and operational costs for miners, it also signals confidence in Bitcoin’s long-term value.

As the cryptocurrency market evolves, the rising difficulty serves as a testament to Bitcoin’s enduring strength as the world’s leading decentralized blockchain. For miners and investors, adapting to these changes will be key to navigating the ever-competitive Bitcoin ecosystem.

Stay informed about major developments in Bitcoin and cryptocurrency trends by exploring our article on latest news, where we analyze the factors shaping the digital asset landscape.