MiCA is now reside throughout the European Union, marking a milestone for digital asset oversight. Business members now function underneath an EU-wide framework that covers stablecoins, token issuances, and providers similar to custody and trade.

Because the Bretton Woods Committee wrote, the method concerned years of session and negotiations, culminating in a rulebook that addresses oversight gaps and promotes transparency.

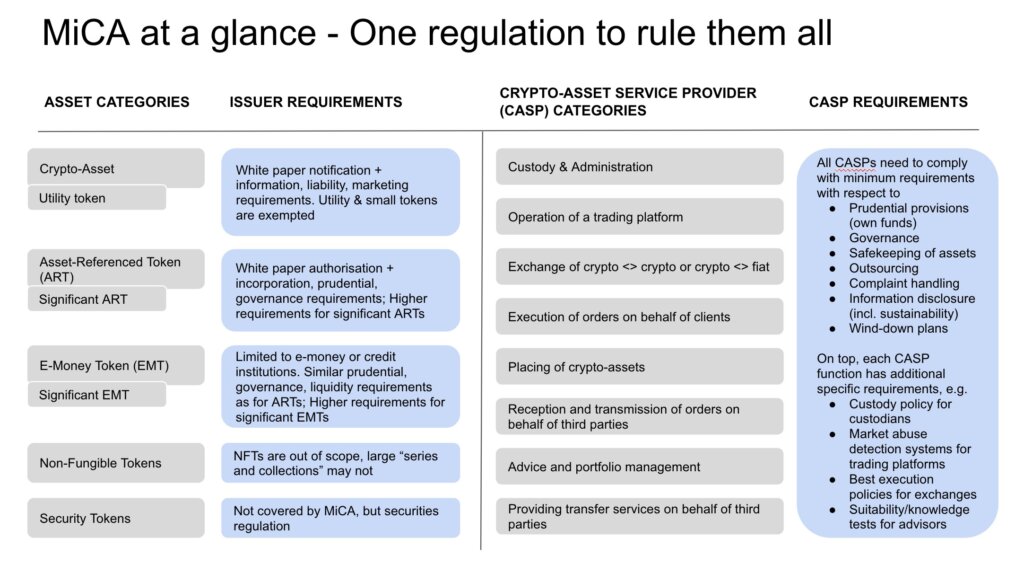

Corporations that difficulty e-money tokens (EMTs) have to be included within the EU or maintain related e-money licenses, whereas asset-referenced tokens face increased disclosures and governance necessities after they attain sure quantity or consumer thresholds. The measures additionally embrace stricter guidelines on reserve administration, redemption, and disclosure, signaling the bloc’s deal with monetary stability in digital asset markets.

Patrick Hansen, Coverage Director at Circle, wrote an intensive piece explaining how stablecoin issuers have little alternative however to conform or lose entry to all the EU market. Tether, the main stablecoin issuer on the planet, selected the latter choice, telling CryptoSlate that the competitors is pissed off by its differing method to stablecoins. He stated,

“Each day you get up, you scratch your head and also you don’t perceive why these couple of Italian guys are doing a significantly better job than you. After all you change into pissed off, proper?

So You recognize, if what you are promoting mannequin is known as Kill Tether, then you already know, it’s best to rethink about your product.”

Expectations for crypto firms within the EU

Crypto-asset service suppliers (CASPs) providing actions like brokerage, trade, or custody face licensing necessities that enable them to function throughout all member states as soon as approved in a single jurisdiction. That shift replaces the earlier patchwork of nationwide rules, decreasing obstacles for companies that search cross-border progress and offering a passport-like mechanism just like the method utilized in conventional EU monetary providers.

Some companies are anticipated to consolidate or forge partnerships as a result of compliance obligations could also be more durable to satisfy for smaller ventures. Buying and selling platforms should additionally set up controls towards market abuse and insider buying and selling. Authorities can prohibit token choices if disclosures or threat administration procedures seem incomplete.

MiCA formally excludes protocols working “in a totally decentralized method” from its scope, however many operations could fail to fulfill the brink for true decentralization.

The identical ambiguity seems round large-scale NFT collections, which the regulation may deal with as fungible, requiring compliance with white paper and issuer obligations. Uncertainty additionally surrounds “privateness cash,” which can face delisting if full holder identification proves not possible.

Total anticipated influence of MiCA

Business responses from Bretton Woods and Circle point out a shared view that MiCA’s sensible success depends on its technical requirements and enforcement practices. Corporations are adapting product choices, specializing in readability in disclosures and compliance with guidelines for token issuance and reserve administration. As Hansen noticed, the framework’s adoption could appeal to initiatives searching for certainty, particularly if considerations over enforcement actions elsewhere persist.

There are broader questions on world adoption. The U.S. has but to formalize stablecoin regulation, and enforcement patterns, whereas seemingly progressive, fluctuate extensively throughout Asia. The European mannequin might affect different jurisdictions, prompting a “race to the highest” in client safety and alignment with worldwide requirements.

In line with Bretton Woods, a coordinated method would foster passportability for stablecoins and mitigate dangers of regulatory arbitrage. Some lawmakers have mentioned a MiCA 2.0, indicating that non-fungible tokens, DeFi, or further technological options may finally be revisited underneath an up to date directive. Officers word that any new iteration will rely on the regulation’s preliminary outcomes.

Hansen factors to MiCA’s similarities with different EU tech initiatives, the place region-wide requirements in the end influenced industrial and authorized frameworks overseas. Whether or not MiCA turns into a default world reference will rely on its real-world implementation, the position of nationwide businesses, and the way successfully the measures safeguard markets whereas permitting companies to innovate. In the meantime, company strikes to safe a MiCA license proceed, with main banks and exchanges adjusting enterprise strains or buying smaller gamers.

Many count on MiCA to carry extra institutional involvement, aided by uniform licensing and client protections. The price of compliance, nonetheless, stays an element that would shift exercise towards well-capitalized platforms. Traders might even see a broader adoption of regulated providers, whereas smaller groups may think about specialised niches or relocate to areas the place obligations are much less strict. Policymakers have pledged to observe the end result, believing a unified EU stance on crypto can bolster capital formation and consumer safeguards.

Because the framework applies, stablecoin issuers and CASPs face earlier enforcement deadlines than different market members, whereas the rest of the foundations part in over the yr. Regulators may also difficulty binding implementation requirements that make clear timelines, technical disclosures, and working circumstances for token initiatives.

Hansen confirms that companies planning to navigate the European panorama are participating with authorities and making ready compliance methods accordingly. He believes MiCA has created an surroundings of clear tasks for members, and its potential to encourage accountable progress underneath constant guidelines will measure the way it shapes crypto markets.

Implementation continues in levels because the EU refines technical pointers and supervises licensed entities. The end result will reveal whether or not MiCA is a workable mannequin that balances innovation with oversight.

The put up MiCA goes reside in Europe because the crypto regulatory framework begins with stablecoins appeared first on CryptoSlate.