Zcash is buying and selling at $460-472 following wild volatility that noticed the token surge to $723 earlier than plunging 37% to present ranges.

Earlier in the present day, the Winklevoss twins launched the world’s first Digital Asset Treasury centered on ZEC by newly rebranded Cypherpunk Applied sciences, previously Nasdaq-listed Leap Therapeutics.

The Cambridge biotechnology agency secured a $58.88 million non-public placement led by Winklevoss Capital, instantly deploying $50 million to buy 203,775 ZEC at a mean value of $245.

wow, the winklevoss twins have began the primary ZEC DAT!

id anticipate a better mnav and purchase stress for a privateness coin DAT since not authorized to carry in lots of areas

would anticipate an ETF as nicely

shielded/unshielded will act as a malicious program for privateness at planetary scale pic.twitter.com/EA4XkMOQWF— mert | helius.dev (@0xMert_) November 12, 2025

Cypherpunk joins company treasury methods by following Technique’s Bitcoin playbook, however focuses on Zcash’s zero-knowledge proofs, which confirm transactions with out revealing pockets addresses or quantities.

Privateness Demand Accelerates Institutional Adoption

Management adjustments come together with this rebrand, with Khing Oei appointed Chairman and Will McEvoy from Winklevoss Capital turning into Chief Funding Officer.

Oei based Treasury, a Netherlands Bitcoin firm that raised $147 million in September by Winklevoss Capital and Nakamoto Holdings.

McEvoy famous different crypto treasuries faltered below “short-term, mercenary capital,” whereas Cypherpunk constructed a “value-aligned” investor base centered on long-term privateness significance for america and world.

Galaxy Digital analyst Will Owens just lately identified that Zcash is gaining traction as a Bitcoin different amid considerations about on-chain surveillance.

Owens described ZEC as “encrypted Bitcoin,” representing a return to cypherpunk rules that resonate throughout widespread surveillance.

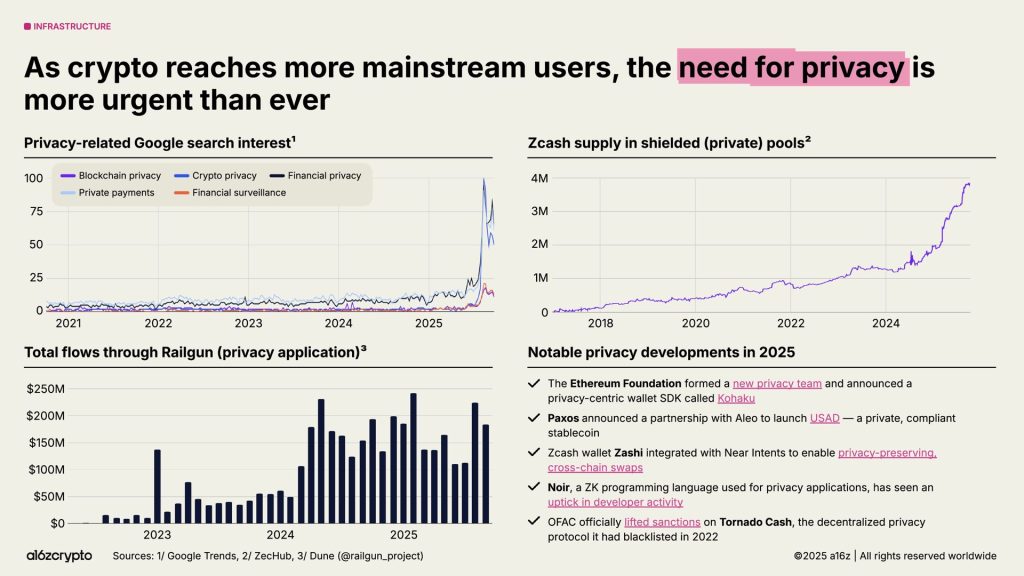

Amidst this booming adoption of privateness cash, A16z’s report just lately documented a return to mainstream privateness adoption, with Google searches for crypto privateness surging in 2025.

Zcash’s shielded pool provide has grown to almost 4 million ZEC, whereas Railgun’s transaction flows have surpassed $200 million per thirty days.

Earlier in the present day, BitMEX co-founder Arthur Hayes additionally warned ZEC holders to withdraw tokens from centralized exchanges or danger shedding privateness protections.

Hayes emphasised that shielded addresses allow transaction obscurity that centralized custody undermines.

If you happen to maintain $ZEC on a CEX, withdraw it to a self-custodial pockets and protect it.

— Arthur Hayes (@CryptoHayes) November 12, 2025

Zcash surged practically tenfold in two months earlier than peaking close to $735 on Friday, triggering $51 million brief liquidations.

The token stays 85% under the 2016 excessive of $3,191 regardless of a latest explosive rally.

Analysts beforehand cautioned about overheating, with the RSI reaching overbought ranges following a 1,700% rally since September.

Elliott Wave Construction Exams Assist – What Occurs to ZEC Subsequent?

On the technical degree, two-hour charts show a accomplished five-wave impulse from $300 to $750, adopted by a three-wave ABC correction all the way down to $429.

The construction suggests a possible new five-wave impulse, starting with the present value sitting between 0.618 and 0.5 Fibonacci retracement ranges at $483-$524, frequent areas for wave transitions.

RSI at 39.07 signifies oversold situations following a correction, doubtlessly supporting a bullish wave depend if ZEC has accomplished its corrective construction.

At the moment, Elliott Wave projection targets $1,000, representing a 112% acquire from present ranges if the depend validates.

Zooming in nearer, the one-hour charts reveal a descending trendline resistance converging with an ascending help, making a compression apex across the present value.

Quantity profile exhibits focus round $480-520, suggesting a high-conviction zone.

The latest spike to $440, adopted by an instantaneous restoration, may signify a capitulation wick earlier than a reversal or a short lived bounce.

A breakout above descending resistance at $480-$500 with quantity will validate Elliott Wave construction and will set off brief overlaying towards $520-$550.

Failure to breakout will preserve a corrective construction towards the $440-$420 help degree, with a deeper correction towards the $342-369 vary doable if promoting stress persists.

Digital Mining Meets Meme Tradition

Privateness cash are main the altcoin alternatives, however this coin dominates the mining coin area of interest.

PepeNode integrates digital mining with gamified mechanics the place customers deploy Miner Nodes in customizable server rooms.

Gamers improve setups to maximise $PEPENODE rewards, which have PEPE and Fartcoin payouts.

The ecosystem burns 70% of tokens spent on upgrades, lowering provide by deflationary mechanics.

The presale has already surpassed $2 million, having handed good contract audits.

The Token Technology Occasion and DEX listings are approaching subsequent, with NFT upgrades and cross-chain rewards additionally set to launch quickly.

The platform combines technique, gaming, and DeFi, which is well-positioned for an altseason.

To affix PepeNode, go to the official web site and join your pockets. Take part utilizing crypto or a financial institution card.

Go to the Official Web site Right here

The submit ZEC Worth Prediction: Winklevoss Twins Launch World’s First Zcash DAT as Privateness Demand Hits Report Highs appeared first on Cryptonews.