YZi Labs has introduced a strategic funding in USD.AI, a stablecoin protocol designed to deliver infrastructure finance (InfraFi) on-chain by offering hardware-backed credit score to AI operators.

The transfer signifies YZi Labs’ rising dedication to supporting foundational infrastructure that addresses the large capital wants of the unreal intelligence sector.

https://t.co/1wPen1Ls15

— YZi Labs (@yzilabs) August 26, 2025

USD.AI Secures $62.7M TVL as Stablecoin Protocol Targets AI Financing Hole

USD.AI, constructed by Permian Labs, is a yield-bearing artificial greenback protocol that enables infrastructure suppliers and AI corporations to entry non-dilutive loans backed by bodily compute {hardware}.

In response to the announcement, depositors, in flip, will obtain a sustainable asset-backed yield. The protocol has already secured backing from top-tier buyers, together with Framework, Dragonfly, Digital Foreign money Group, Delphi, and Fintech Collective.

In contrast to conventional financing, which regularly hinges on lengthy money movement projections and prolonged approvals, USD.AI provides loans secured 1:1 by AI {hardware}. This enables loans to shut in below per week, in comparison with the 60–90 days typical of conventional funds. For capital-intensive sectors, that pace may imply the distinction between scaling and stagnation.

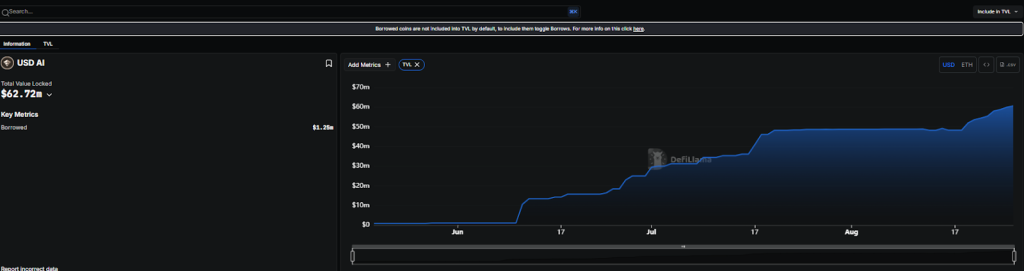

The protocol’s adoption curve has been steep. Since June, USD.AI has grown from just about zero to greater than $62.7 million in whole worth locked (TVL).

In response to knowledge from DeFiLlama, deposits surged previous $10 million by mid-June, climbed steadily into the $30–40 million vary in July, and accelerated once more in August to achieve their present all-time excessive.

Borrowing exercise, whereas nonetheless modest at $1.25 million, displays an early part of adoption, with most customers at the moment using USD.AI as a financial savings and yield platform.

Partnerships have additionally performed a central function in its rise. USD.AI has teamed up with K3 Capital, Concrete, Euler, and Pendle to launch its progressive “AutoVaults,” which permits depositors to earn optimized yields throughout DeFi markets.

Our @pendle_fi Enhance USDai and sUSDai Vaults at the moment are LIVE on USDAI

Right here's what meaning for the neighborhood ↓ pic.twitter.com/JCUmFa90fG— USD.AI | Public Launch is Stay (@USDai_Official) August 25, 2025

Pendle, specifically, has been a key supporter, not too long ago launching Enhance USDai and sUSDai vaults that combine with USD.AI’s ecosystem and provide enhanced incentives for liquidity suppliers.

On August 14, USD.AI raised $13 million in Collection A funding led by Framework Ventures. With $50 million already in deposits throughout non-public beta, USD.AI plans a public launch that includes an ICO and a game-based allocation mannequin.

We’ve raised a $13.4M in Collection A led by @hiFramework to construct USDAI, the greenback that scales AI infrastructure.

Public launch on Monday. pic.twitter.com/85J2QX8LeD— USD.AI | Public Launch is Stay (@USDai_Official) August 14, 2025

YZi Labs, which manages over $10 billion in belongings globally and has backed greater than 300 initiatives throughout 25 nations, mentioned its choice to assist USD.AI displays a perception that new monetary primitives are wanted to scale AI infrastructure.

David Choi, co-founder of USD.AI, framed the undertaking as a lifeline for a brand new class of builders who’ve {hardware} however lack conventional financing channels.

“Not everybody has a CFO or a Wall Road connection. However they do have machines and a future to construct,” Choi mentioned. “It is a greenback that scales for the outsiders, and we’re excited to have YZi Labs’ assist in that mission.”

The backdrop for this innovation is a quickly escalating capital crunch within the AI business. Analysts estimate that over $6.7 trillion can be required for compute infrastructure within the subsequent 5 years, but a lot of that financing stays out of attain for all however the largest companies.

Reviews of OpenAI’s Sam Altman exploring new financing devices to lift trillions for infrastructure present simply how acute the funding hole has turn into.

USD.AI seeks to handle that hole by giving smaller gamers the identical monetary entry, with out diluting fairness or ready months for approvals.

YZi Labs Emerges as Power Behind Institutional Push Into BTC and BNB Ecosystems

YZi Labs, the rebranded funding arm previously often known as Binance Labs, has accelerated its shift towards institutional adoption and ecosystem growth.

@BinanceLabs has rebranded to YZi Labs, increasing its focus to incorporate AI and biotech investments.#CZ #AI #Binancehttps://t.co/Tb3FgMgnd4

— Cryptonews.com (@cryptonews) January 23, 2025

Since its relaunch in January, the agency has widened its scope to incorporate synthetic intelligence and biotechnology whereas reinforcing its dedication to blockchain.

Changpeng Zhao, Binance’s former CEO, has taken an energetic function as a mentor to startups throughout the program, whereas co-founder Ella Zhang has returned to guide operations.

In Might, the agency made a serious guess on Bitcoin’s DeFi ecosystem via an funding in Avalon Labs, a BTC-based platform growing capital markets round BTC-collateralized lending, stablecoin USDa, and credit score companies.

CZ YZi Labs Avalon has invested in @AvalonFinance, rising a BTC-collateralised market with USDa stablecoin, lending and credit score companies whereas focusing on world licenses. #Bitcoin #DeFi @yzilabs @cz_binance

https://t.co/EEO1ihE3hw

— Cryptonews.com (@cryptonews) Might 26, 2025

On the time, Avalon held greater than $500 million in whole worth locked, with over 20,000 BTC below administration, making USDa the second-largest CDP undertaking on DeFiLlama.

YZi Labs’ attain has since prolonged into treasury administration. In July, it backed the creation of the BNB Treasury Firm by 10X Capital.

The U.S.-based entity focuses completely on BNB Chain investments and is focusing on a list on a serious American trade to present institutional buyers direct publicity to BNB, Binance’s $92 billion native asset.

Momentum continued in August when China Renaissance (CR), a Hong Kong–listed monetary group, partnered with YZi Labs to accumulate $100 million value of BNB. CR will act as a champion for broader institutional adoption, changing into the primary HK-listed agency to carry BNB as a proprietary asset.

@BStrategyTech introduced a $1B crypto treasury to build up BNB with backing from @yzilabs#BNB #CryptoTreasury https://t.co/gvOZkWWKqf

— Cryptonews.com (@cryptonews) August 25, 2025

Yesterday, a brand new milestone adopted. B Technique, a digital asset funding agency led by former Bitmain executives, launched a $1 billion BNB-focused treasury automobile, with backing from YZi Labs.

The corporate, which goals to mannequin itself because the “Berkshire Hathaway of the BNB ecosystem,” plans a U.S. itemizing whereas reinvesting in core BNB initiatives and neighborhood initiatives.

The submit YZi Labs Backs USD.AI Stablecoin – Yield-Bearing, AI-Backed Play Raises Massive Questions appeared first on Cryptonews.