XRP could also be gearing up for a serious transfer, as long-term holders start stockpiling the token once more after weeks of profit-taking and selloffs.

This shift in investor conduct arrives simply as XRP posts a ten% weekend rebound from a month-to-month low of $2.05, flipping bearish sentiment and reigniting bullish XRP worth prediction debates.

Whereas macro situations—starting from U.S. commerce tensions to labor market weak spot—nonetheless weigh available on the market, XRP’s renewed accumulation development may trace at a breakout brewing beneath the floor.

Lengthy-Time period Holders Present Indicators Of Accumulation

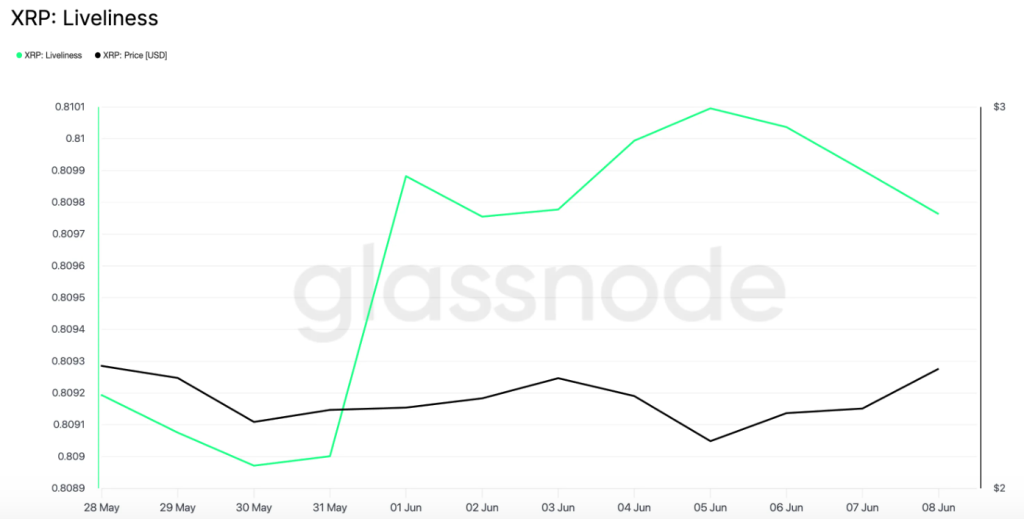

In line with Glassnode information, XRP liveliness—the ratio of coin days destroyed to the overall coin days amassed—slipped from 1% on June 5 to 0.809 by the top of the weekend on June 8.

This decline factors to a rising development of HODLing and potential accumulation, as long-term holders choose to not transfer or spend their XRP.

That conviction is echoed within the derivatives market. Coinglass studies that XRP has maintained a constant constructive funding price since June 6, at the moment sitting at 0.0106%.

A constructive funding price displays lengthy dominance out there, the place quick sellers are paying to carry their positions—one other robust indicator of bullish sentiment constructing behind XRP.

XRP Value Evaluation: What do Lengthy-Time period Holders Know?

The late week rally affirms the breakout path of a bullish 6-month pennant sample, narrowly avoiding invalidation with a bounce from its higher boundary as assist.

Whereas post-breakout momentum had waned, slipping right into a falling wedge over the previous month, the latest bounce has cleanly damaged that consolidation vary.

This comes because the RSI breaks again above the impartial line at 51 after a stint in bearish territory, an indication that sellside stress has cooled.

The three-day MACD line tells an analogous story, on observe to surpass the sign line in a golden cross. This formation means that consumers are beginning to overwhelm sellers.

Notably, this crossover has already performed out on the 1-day chart. The truth that it’s now showing on larger timeframes lends credibility to a extra sustained uptrend.

XRP additionally at the moment sits on the 0.5 Fibonacci retracement stage—a zone sometimes considered as a chief accumulation vary, particularly in an uptrend.

If momentum holds, the pennant breakout units up a possible transfer towards $4.38 earlier than year-end, representing a possible 90% surge from present costs.

HODLers are Opting For This New Self-Custody Resolution – Right here’s Why

With shifts in the direction of accumulation, HODLers are taking their baggage off exchanges to self-custody options like MetaMask, Exodus, and more and more Finest Pockets ($BEST).

This non-custodial crypto pockets introduces instruments like “Upcoming Tokens”—a crypto screener that enables customers to determine and make investments new tokens whereas they’re nonetheless flying underneath the radar.

The upcoming Finest Card—taking the place of the normal debit card—permits seamless real-world transactions utilizing stablecoins wherever that Mastercard is accepted.

This Web3 storage resolution helps belongings in additional than 50 blockchains and gives low charges for swaps.

With SEC Chair Paul Atkins advocating for crypto self-custody as a “foundational American worth,” the over $13 million raised within the $BEST utility token presale may simply be the beginning.

To be taught extra about Finest Pockets, observe its official X, Telegram, or go to the Finest Pockets web site.

The publish XRP Value Prediction: Golden Cross and Lengthy-Time period Holder Information Trace at Explosive Pump appeared first on Cryptonews.