The crypto market has seen one other rise at the moment, with almost all high 100 cash recording a worth improve over the previous 24 hours. The cryptocurrency market capitalization has decreased by 1% to $3.58 trillion. The full crypto buying and selling quantity is at $138 billion, the best we’ve seen in a number of days.

TLDR:

Crypto Winners & Losers

Like yesterday, all high 10 cash per market cap have seen their costs improve over the previous 24 hours.

The world’s high coin, Bitcoin (BTC) has risen by simply 0.3%, which means it’s unchanged on this timeframe, now buying and selling at $109,531. That is additionally the smallest improve on this class.

Ethereum (ETH) has recorded one other notable rise. It’s up 4.6% to the value of $2,798.

The class’s highest gainer is Dogecoin (DOGE), which is now up 5.4%, altering fingers at $0.2013.

Furthermore, wanting on the high 100 cash, we discover that solely seven are down. Bittensor (TAO) fell essentially the most amongst these: 3.1% to $421.

Uniswap (UNI) famous the best improve at the moment, because it appreciated 18.1% to $8.41.

Six different cash recorded double-digit will increase.

Buyers, each crypto and TradFi, had been centered on the US-China discussions in London for the previous two days, the place individuals addressed tariffs and restrictions on shipments of key merchandise, corresponding to uncommon earth minerals and chips. On Tuesday, the events stated they agreed on “a framework” on each points, although the specifics stay unclear.

Furthermore, Wednesday morning within the US will see the buyer worth index for Might, which is able to point out how tariffs are affecting inflation.

BREAKING: Citing commerce wars, the World Financial institution sharply downgrades the worldwide financial development forecast for this yr. https://t.co/PNmaVrcAMf

— The Related Press (@AP) June 10, 2025

In the meantime, Sean Dawson, Head of Analysis on the onchain choices AI-powered platform, Derive.xyz, argued that costs surged after the US Securities and Alternate Fee (SEC) introduced exemptions for DeFi tasks. ETH is “the massive winner because it paves the way in which for speedy enlargement.”

Sebastian Pfieffer, managing director of Unimaginable Cloud Community, famous that Ethereum works to adjust to European legal guidelines, however that “now it’s Europe’s flip to embrace decentralization, somewhat than placing pointless roadblocks in place.” This manner, “Europe will be freed from US political management over its cloud infrastructure,” he says.

All Eyes on US Inflation Report

Ruslan Lienkha, Chief of Markets at YouHodler, stated that there’s a robust risk for BTC to hit a brand new ATH quickly. The worth at present stands just some share factors under its earlier peak. “Broadly talking, monetary markets stay optimistic,” he says.

“Nevertheless, the chance of a reversal stays, notably if upcoming financial information disappoints. All eyes are actually on [today’s] US inflation report. Whereas markets are pricing in a reasonable uptick, a higher-than-expected studying may set off elevated volatility throughout threat property, together with cryptocurrencies.”

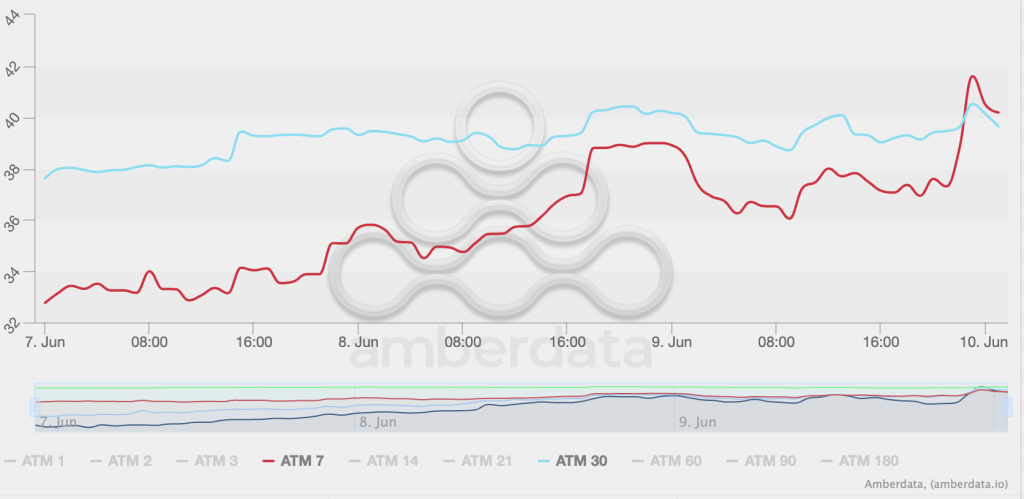

Derive.xyz’s Sean Dawson commented that, regardless of the latest uptick in worth, BTC implied volatility nonetheless hovers round its lowest ranges this yr. He explains that this might point out “vital mispricing, providing merchants alternatives to entry low-cost upside leverage or draw back safety.”

BTC 7-day (purple) and 30-day (cyan) implied volatility.

Dawson says that the muted response of implied BTC volatility regardless of the value rise suggests “a possible disconnect between market pricing and underlying threat. This presents a strategic window for merchants to capitalize on comparatively low-cost choices, enabling environment friendly positioning for both additional upside or potential draw back in BTC.”

Ranges & Occasions to Watch Subsequent

On the time of writing, BTC trades at $109,531, nonetheless nearing the all-time excessive of $111,814, which it hit on 22 Might. The coin examined the $110,200 but once more at the moment, reaching the intraday excessive of $110,237, however failed to take care of it. That stated, ought to it break the ATH once more, it would proceed to check the important thing resistance ranges of $115,103 and $118,358.

In the identical interval, Ethereum hit an intraday excessive of $2,821, seeing a minor pullback since, however steadily climbing each day. The coin broke the resistance degree of $2,720, suggesting further will increase to observe.

Sean Dawson commented that ETH volatility has jumped almost 5% to 70% for 7-day volatility. It’s additionally holding at 66% for 30-day volatility. Because of this every day ETH worth strikes “might be roughly twice as giant as BTC’s,” he argued.

ETH 7-day (purple) and 30-day (cyan) implied volatility

Furthermore, the crypto market sentiment retains climbing after getting into the greed zone yesterday. Crypto Worry and Greed Index stands at 65 at the moment, indicating more and more bullish sentiment and traders persevering with to purchase in.

In the meantime, US BTC spot exchange-traded funds (ETFs) noticed a internet influx of $431.12 million on Tuesday. BlackRock’s $336.74 million contributed essentially the most to this quantity. The full internet influx up to now stands at $45.06 billion.

On the similar time, US ETH spot ETFs have recorded seventeen consecutive days of inflows, including one other $124.93 million. BlackRock leads this listing once more with $80.59 million on 10 June. General, Ethereum funding merchandise have seen a cumulative whole internet influx of $3.5 billion.

In the meantime, Bitcoin is regularly seeing a rising investor curiosity, with over 80 publicly traded corporations now holding BTC. Nevertheless, some have raised purple flags.

In accordance with the newest report by the worldwide digital asset financial institution Sygnum, “giant concentrated holdings are a threat for any asset.” At this level, Technique’s holdings are “approaching a degree the place they develop into problematic, with the corporate holding shut 3% of the full Bitcoin ever issued, however a a lot greater share of the particular liquid provide.”

The corporate goals to amass 5% of the full issued BTC. This “raises considerations.” Firstly, these automobiles amassing an excessive amount of of the availability undermine Bitcoin’s secure haven properties. Secondly, personal companies controlling a big portion of the prevailing provide would make BTC inappropriate for central banks to carry as a reserve asset, Sygnum warns. Lastly, a plunge within the liquid provide will even deter giant establishments.

Fast FAQ

- Why did crypto transfer with shares at the moment?

Each the crypto and inventory markets have elevated within the final day, although crypto’s improve is notably greater. For instance, the S&P 500 has elevated by 0.55%, the Nasdaq-100 is up 0.66%, and the Dow Jones Industrial Common rose by 0.25%. Shares are up for 3 days straight, and at the moment, they’re anticipated to react to the settlement reached through the US-China commerce talks.

- Is that this rally sustainable?

The constructive market sentiment retains powering the present two-day rally. Analysts see the market shifting greater, however they do warn merchants and traders to control macroeconomic and geopolitical occasions.

The submit Why Is Crypto Up At present? – June 11, 2025 appeared first on Cryptonews.