The crypto market is up right this moment, for the third day in a row. 99 of the highest 100 cash per market cap have appreciated over the previous 24 hours. On the identical time, the cryptocurrency market capitalization has elevated by 1.3% to $3.73 trillion, which is a big improve from yesterday’s $3.45 trillion. The whole crypto buying and selling quantity is at $231 billion, up from $128 billion a day earlier than.

TLDR:

Crypto Winners & Losers

The crypto market has continued the inexperienced streak for the third day, as all high 10 cash per market cap rise as effectively.

Bitcoin (BTC) has achieved it – it broke its earlier all-time excessive. The coin jumped 5.6% in a day, presently buying and selling at $117,586.

Furthermore, Ethereum (ETH) is the class’s second-best performer. It appreciated by 6.5%, presently altering arms at $2,986.

Dogecoin (DOGE)’s 8.9% is the best improve among the many high 10. Its value is now $0.1965.

Furthermore, solely one of many high 100 cash is pink right this moment. Monero (XMR) fell 0.7% to $325.

On the opposite aspect, a dozen cash recorded double-digit rises. Two of those have will increase of over 20%.

Ethena (ENA) rose by 20.7% to the value of $0.347, whereas Sei (SEI) is up 20.6% to $0.3183.

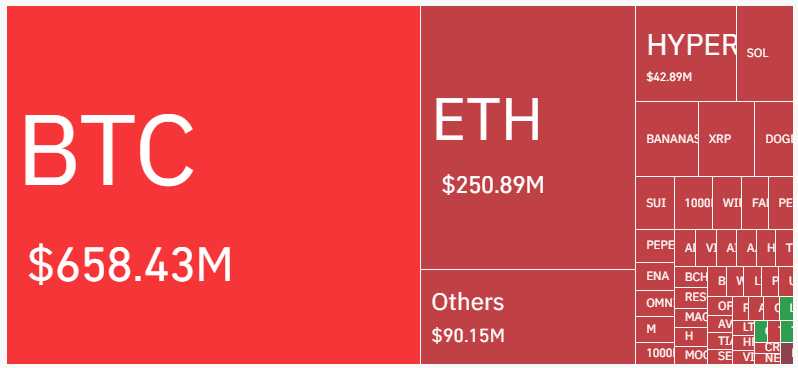

In the meantime, $1.25 billion in leveraged positions have been liquidated in 24 hours, in accordance with CoinGlass. Brief merchants account for $1.1 billion.

Furthermore, of the full quantity, Bitcoin accounted for $658.43 million and Ethereum for $250.89 million.

Notably, the greenback is seeing its worst efficiency since 1973. That is actively fueling danger belongings, together with crypto.

‘Outlook for Bitcoin Stays Overwhelmingly Optimistic’

Gadi Chait, Head of Funding at Xapo Financial institution, commented that since 8 Might, Bitcoin has ended day-after-day above $100,000. “That’s 62 days of value stability in six-figure territory,” Chait says. “For an asset as soon as outlined by volatility, this value consolidation over a big time frame exhibits that Bitcoin is maturing.”

And this week, BTC surged to an ATH, reflecting sturdy institutional demand and macroeconomic tailwinds, he provides. “Beneath the floor, institutional accumulation is at fever pitch.”

Additionally, the steadiness and institutional influx held agency via main macroeconomic uncertainty and world geopolitical tensions. That is “a take a look at that many different so-called ‘unstable belongings’ would battle to go,” Chait argues.

Furthermore, James Toledano, Chief Working Officer at Unity Pockets, provides that the value surge appears to be pushed by a confluence of macroeconomic optimism and important institutional exercise. The latter comes within the type of ETF inflows and sovereign and company steadiness sheet allocations. Moreover, there’s the discuss of an incoming US Federal Reserve fee cuts.

Moreover, Toledano argues that the state of affairs might flip dangerous for the standard economic system, benefiting digital belongings. “The US has a significant debt disaster, and the curiosity funds on this debt is the most important price range line-item,” he says. Additionally, the greenback is weakening, and bond markets are experiencing sell-offs.

“A reckoning is definitely coming, however this can be good for the strongest crypto belongings as capital takes flight in search of a brand new dwelling,” Toledano writes.

In the meantime, Ruslan Lienkha, chief of markets at YouHodler, argues {that a} decisive breakout and sustained transfer above $112,000 for BTC “might set off a pointy upward rally, doubtlessly concentrating on the $130,000 vary earlier than coming into a brand new consolidation part at traditionally unprecedented ranges.”

He provides that “the potential for such a transfer is underpinned by a broadly supportive macro backdrop,” in addition to tightening BTC provide dynamics.

Nevertheless, there are some near-term dangers. This consists of an evolving political and financial backdrop, notably commerce tensions.

“That stated, the medium- and long-term outlook for Bitcoin stays overwhelmingly optimistic,” Lienkha continues. “Institutional adoption continues to deepen, the combination of crypto into conventional monetary techniques is accelerating, and the macro narrative of Bitcoin as a hedge in opposition to financial debasement stays intact. Moreover, regulatory readability is regularly bettering in key markets, additional legitimizing digital belongings as a core part of diversified portfolios.”

Ranges & Occasions to Watch Subsequent

On the time of writing, BTC trades at $117,586. The coin hit a brand new all-time excessive of $118,254 simply an hour previous to this writing. This was additionally a surge from the intraday low of $98,974. The worth is up 8.1% in per week, 7.6% in a month, and 103% in a 12 months.

Now, analysts and buyers alike are ready to see if BTC will surpass the $119,000 and $120,000 ranges.

Furthermore, Ethereum is presently buying and selling at $2,986. It managed to lastly surpass the $3,000 mark once more, reaching $3,019 earlier this morning (UTC). It pulled again barely, however analysts argue that it might rise additional. General, it’s up 17.1% in per week and seven.4% in a month. It fell 3.5% in a 12 months.

We’re now taking a look at $2,950-$3,050 as key assist ranges.

Furthermore, the crypto market sentiment additionally surged and entered greed territory. The Worry and Greed Index jumped from 58 yesterday to 67 right this moment. That is the best it’s been in a month.

It additionally alerts warning to buyers. Whereas this isn’t excessive inexperienced, the extent suggests potential overconfidence. It could lead to FOMO (worry of lacking out) and, subsequently, inflated costs.

Moreover, on 10 July, the US BTC spot exchange-traded funds (ETFs) recorded a large leap. They noticed inflows of $1.18 billion, in comparison with $218.04 million on 9 July. That is the second-highest quantity ever, the best being $1.38 billion in November 2024.

BlackRock’s share is $448.49 million. It’s adopted by Grayscale’s $324.34 million, in addition to Ark & 21Shares’ $268.7 million.

On the identical day, US ETH ETFs noticed important inflows of $383.1 million. That is the best quantity in six months. It’s second solely to the all-time excessive of $428.44 million seen in December 2024.

Of this quantity, BlackRock took in $300.93 million, whereas Constancy noticed $37.28 million.

In the meantime, establishments and firms are nonetheless coming into the crypto house, and more and more so.

One of many newest is NRW.BANK, a German state-owned growth financial institution. It has lately issued a €100 million ($116.7 million) blockchain-based bond on the Polygon community.

The financial institution used the infrastructure of Cashlink Applied sciences, a BaFin-licensed crypto securities registrar, to register the bond, whereas institutional buyers comparable to Deutsche Financial institution, DZ BANK, and DekaBank took half within the providing as joint lead managers.

NRWBANK, Germany’s largest regional growth financial institution, has tokenized its first totally digital bond, with assist from main monetary establishments like @DeutscheBank, @dzbank, and @DekaBank.

Polygon will function the rails for the EUR 100 million bond, registered through Cashlink as… pic.twitter.com/37jqqQpz8F— Polygon (@0xPolygon) July 10, 2025

Fast FAQ

- Why did crypto transfer with shares right this moment?

The crypto market surged over the previous 24 hours, whereas the US inventory market noticed a blended image on Thursday. regardless of enduring uncertainty about US commerce coverage. For instance, the S&P 500 rose by 0.27%, the Nasdaq-100 is down by 0.16%, and the Dow Jones Industrial Common is up by 0.43%. Issues coming from the US about tariffs, and subsequently inflation and world commerce wars, have been reignited once more. Buyers managed to largely brush them off.

- Is that this rally sustainable?

Analysts usually agree that the rally is sustainable. The market has extra room to develop this 12 months. Nevertheless, typical pullbacks and bigger corrections are doable and even possible.

You might also like: (LIVE) Crypto Information As we speak: Newest Updates for July 11, 2025 The crypto market is exhibiting extraordinarily bullish alerts right this moment, with the full crypto market cap rising 1.2%. Bitcoin is up over 5% over the previous 24 hours, presently buying and selling simply above $116,500 at an all-time excessive. Ethereum has continiued its optimistic momentum right this moment because it trades round $3,000, up 7%. However what else is going on in crypto information right this moment? Observe our up-to-date dwell protection…

The put up Why Is Crypto Up As we speak? – July 11, 2025 appeared first on Cryptonews.