The crypto market information one other minor pullback, probably transitioning into consolidation. 80 of the highest 100 cash per market cap have decreased over the previous day. On the similar time, the cryptocurrency market capitalization has decreased 2.2%, presently standing at $3.55 trillion. The whole crypto buying and selling quantity is at $116 billion, again to the extent we usually see.

TLDR:

Crypto Winners & Losers

On the time of writing, six of the highest 10 cash per market capitalization are down over the previous day, one is up, and one is unchanged.

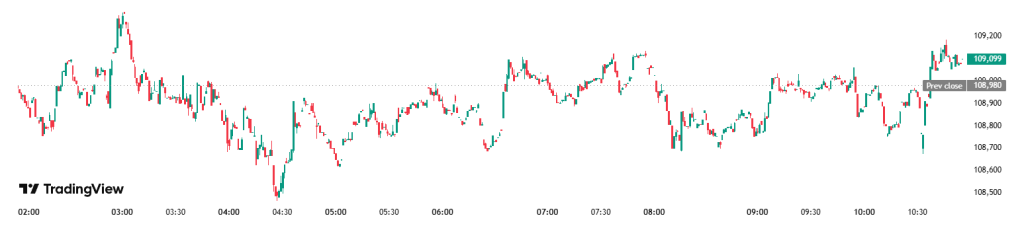

Bitcoin (BTC) hit an intraday excessive of $110,407, reducing to $108,897 by the point of writing. General, the value is down 0.7% in a day. The coin hit its all-time excessive of $111,814 on 22 Might, falling 2.6% since.

Ethereum (ETH) is the one coin on this class that elevated right now. It’s up 0.5%, now buying and selling at $2,639.

The largest lower is Dogecoin (DOGE)’s 2.5% to the value of $0.223.

Of the highest 100 cash, about 20 recorded worth will increase. The very best gainer is Quant (QNT). It’s up 8.9% to $115.

Monero (XMR) fell essentially the most on this class. It’s the one coin with a double-digit drop: 14.4% to the value of $334.

After the volatility shook the normal sector, traders are nonetheless (and more and more so) turning in the direction of crypto as a secure haven. Due to this fact, the present drop nonetheless suggests a typical post-rally short-term pullback. Nonetheless, a variety of optimistic information, together with Circle’s IPO, didn’t handle to push the costs greater, so this will likely recommend an extra downturn.

That mentioned, there are some fascinating developments to watch. Bitcoin 2025 has begun, with some high-profile figures in attendance. Buyers will regulate this.

Moreover, El Salvador is feeling the IMF heat. The latter acknowledged that it could work to “guarantee” that the full quantity of Bitcoin the federal government holds stays unchanged.

Thanks Coach / @SenTuberville! The pleasure was fully mine, and thanks in your continued advocacy of US spinoff markets. https://t.co/FrHNbuRJDj

— Brian Quintenz (@BrianQuintenz) April 9, 2025

Within the US, Brian Quintenz, US President Donald Trump’s choose for the Commodity Futures Buying and selling Fee (CFTC) chief, disclosed $3.4 million in property tied to crypto ventures.

Nonetheless, the outgoing CFTC Commissioner Christy Romero warned that the present pattern of “massive swings” between “regulation and deregulation” might hinder the success of the nation’s monetary markets.

‘Main Gamers Nonetheless Satisfied of BTC’s Lengthy-Time period Worth’

Blockchain information and intelligence supplier Glassnode discovered that spending by older BTC holders is on the rise, and older cash are on the transfer once more. “Combination quantity from the 1y–5y cohorts simply hit $4.02B – the very best since February,” it mentioned on Tuesday.

Right here's how the present spending of older $BTC stacks up in opposition to this cycle's peaks:

Oct 2024: $9.25B (led by 1-2y cohort)

Mar 2024: $6.11B (led by 2–3y)

Feb 2025: $5.42B (led by 2–3y)

Nov 2024: $4.39B (led by 3–5y)

Might 2025: $4.02B (led by 3–5y) pic.twitter.com/duhehwk6qp

— glassnode (@glassnode) Might 28, 2025

Moreover, Gadi Chait, Head of Funding at Xapo Financial institution, argues that BTC has “spent the previous week catching its breath slightly below its all-time excessive, buying and selling round $109,000 as highly effective forces pull the market in several instructions.”

Furthermore, the inspiration beneath BTC’s present worth level “seems broader than in previous cycles. What as soon as spiked on hype is now underpinned by coverage shifts, notably within the US, institutional flows which might be presently pouring cash into digital property, and a recalibrated investor mindset that favours alternate options.”

“If this momentum continues, discussions of Bitcoin’s future could lastly transfer past short-term concern over its inherent volatility, and as a substitute deal with its future as a foundational asset throughout the international financial system,” Chait says.

Institutional traders proceed investing in Bitcoin ETFs, however geopolitical tensions and coverage uncertainty “create important background noise, maintaining some traders cautious.” That mentioned, the “aggressive shopping for on any worth dip reveals that.”

That mentioned, right now, the Glassnode analysts famous that the BTC funding price turned damaging.

$BTC funding price simply flipped damaging. Shorts are quietly constructing throughout the highest 10, with $BNB and $ADA each exhibiting indicators of strain. Notably, #Solana now ranks because the sixth lowest funding price amongst all property you possibly can monitor on Glassnode Studio: https://t.co/xqigM0dgzP pic.twitter.com/CRZvfiGVkZ

— glassnode (@glassnode) Might 28, 2025

Ranges & Occasions to Watch Subsequent

After hitting the all-time excessive of $111,814 final Thursday, BTC briefly hit an intraday excessive of $110,407, which is sort of decrease than the near-ATH of $111,807 seen yesterday. Now standing at $108,897, the newest strikes recommend consolidation.

The important thing resistance degree stands at $109,653 and $111,935 earlier than it even makes an attempt to take the $113,000 zone. The primary assist degree is $108,731. Ought to it break that, we may even see it go right down to $107,078, and even $105,905. Quick-term, there doesn’t look like a menace of BTC dropping under $100,000.

In the meantime, the Concern and Greed Index stands at 68, unchanged from yesterday. Due to this fact, it nonetheless signifies optimistic market sentiment and ongoing bullishness. In comparison with final week, when the metric climbed to excessive greed, there may be now a considerably decrease likelihood of overconfidence that might result in bigger downward corrections.

Furthermore, on 27 Might, US BTC spot exchange-traded funds (ETFs) noticed a internet influx of $384.85 million, led by BlackRock’s $409.26 million. The whole internet influx now reached $44.91 billion. US ETH spot ETFs noticed $38.77 million in internet inflows, with BlackRock’s $32.48 million main the way in which. The cumulative influx is now $2.8 billion.

The continuous inflows sign sturdy assist by the institutional sector.

Digital asset firms are speeding to boost funds for large-scale BTC purchases, fueled by the latest rally. At present, 113 publicly listed firms maintain Bitcoin, up from 89 in April. They maintain a mixed stash of over 800,000 BTC. “Beneficial market situations are drawing capital,” Aaron Chan of Move Merchants advised the FT.

Trump Media is diving headfirst into crypto, elevating $2.5 billion to construct one of many greatest Bitcoin treasuries.#TrumpMedia #Bitcoin https://t.co/Fpfqth4KCA

— Cryptonews.com (@cryptonews) Might 27, 2025

Trump Media & Know-how Group, managed by Trump, is elevating $2.5 billion for one of many largest Bitcoin treasuries held by a public firm. Given the moral considerations and purple flags raised, market individuals ought to preserve an in depth eye on this.

Lastly, the traders shall be keeping track of the US Federal Reserve’s May meeting minutes. We’ll see whether or not these have an effect on the market.

Fast FAQ

- Why did crypto transfer in opposition to shares right now?

The crypto market has recorded a slight lower right now, whereas the inventory market noticed a notable uptick. The S&P 500 is up 2.05%, the Nasdaq-100 elevated by 2.39%, and the Dow Jones Industrial Common rose by 1.78%. The optimism rose on Wall Road as Donald Trump walked again tariff threats in opposition to the European Union and commerce tensions softened.

- Is that this dip sustainable?

The market could also be in a consolidation interval. The market capitalization and investor curiosity stay sturdy, so main bear motion appears unlikely short-term. Nonetheless, with all of the upcoming occasions, the market could also be spooked by damaging regulatory or macroeconomic developments.

The put up Why Is Crypto Down As we speak? – Might 28, 2025 appeared first on Cryptonews.