The crypto market cap slipped once more as we speak, down 4.1% to $3.33 trillion, whereas day by day buying and selling quantity reached $142.2 billion. The market stays unstable, although some main cash are exhibiting indicators of resilience.

TL;DR:

- The crypto market cap dropped 4.1% as we speak to $3.33T, volatility stays excessive;

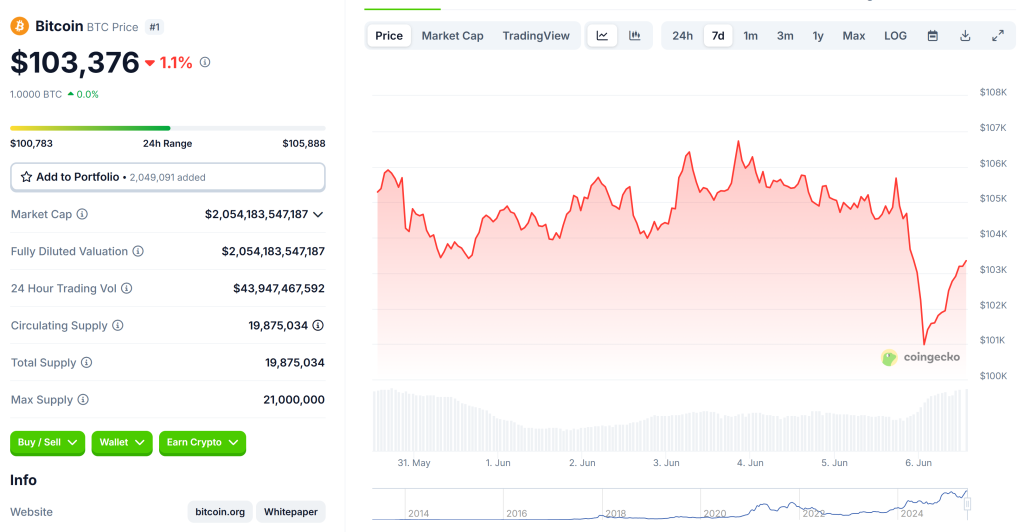

- BTC is holding above $103K after a pullback from $111.8K ATH;

- Revenue-taking by long-term holders is capping short-term good points;

- Small caps like KILL BIG BEAUTIFUL and VICE see sturdy speculative curiosity;

- Institutional demand and ETF inflows may drive BTC towards $115K by early July;

- The U.S. jobs report could affect BTC’s subsequent transfer, with $95K–$97K seen as key assist.

Crypto Winners & Losers

On the time of writing, Bitcoin (BTC) is altering arms at $103,188, largely unchanged on the day. Ethereum (ETH), nonetheless, fell one other 5.8% to $2,455.79.

XRP is secure at $2.13, up a slight 0.1% prior to now hour. Tether (USDT) and USD Coin (USDC) stay anchored at $1.

In the meantime, Solana (SOL) declined 3.5% to $147.26, persevering with its latest downtrend. Dogecoin (DOGE) took a heavier hit, down 7.2% to $0.175.

On the flip aspect, small-cap coin KILL BIG BEAUTIFUL surged 168.5%, adopted by VICE up 35%, and GIZA up 17.7%, reflecting rising speculative exercise in smaller tokens.

$BTC has damaged above the short-term holder realized worth.

If historical past repeats…

Bitcoin is about to blow up! pic.twitter.com/f5utqm1j1u— Mister Crypto (@misterrcrypto) June 5, 2025

Whereas high belongings stay range-bound, on-chain metrics recommend that the market could also be gearing up for a brand new transfer. BTC’s resilience above the $100K stage stays key for broader sentiment.

Macro components akin to ongoing U.S. debt issues and world liquidity developments may form the subsequent leg of the cycle. For now, crypto buyers are watching intently for affirmation of a breakout.

Bitcoin’s Rally Faces a Check as Lengthy-Time period Holders Lead Revenue-Taking

Bitcoin just lately surged to a brand new all-time excessive of $111.8k earlier than retreating to $103.2k, as long-term holders started realizing income, in line with a report by Glassnode.

The most recent rally was largely spot-driven, with key accumulation zones now serving as assist between $81k and $104k. Nonetheless, older cohorts are actually offloading, posing resistance to additional upside.

On-chain knowledge reveals that many earlier accumulation zones have flipped into distribution zones, notably these shaped between $25k–31k and $60k–73k. These seasoned holders are shaping the present market construction, making use of promoting strain that would cap Bitcoin’s short-term good points.

Value foundation fashions spotlight speedy assist close to $103.7k and $95.6k, with resistance sitting at $114.8k. The common entry worth for short-term holders is now round $97.1k, with wider bands defining the market’s present sentiment vary. A break of those ranges may sign whether or not momentum is fading or reigniting.

Revenue realization has intensified, with day by day income spiking to $1.47B, marking the fifth such occasion this cycle. Importantly, this promoting is being led by long-term holders—these holding for over a 12 months—indicating mature capital rotation reasonably than speculative churn.

Briefly, Bitcoin’s newest surge has entered a crucial part. Elevated profit-taking by veteran buyers, coupled with cooling momentum, means that the market could also be transitioning right into a consolidation or top-formation part. Whether or not assist zones maintain within the coming weeks will decide if the rally resumes or deeper corrections unfold.

Ranges & Occasions to Watch Subsequent

BTC is at the moment buying and selling at $103,450. It briefly touched an intraday excessive of $103,467 however couldn’t break larger. From its latest all-time excessive of $111,814, the coin is now down roughly 7.5%. Over the previous week, BTC has declined by round 3%, whereas nonetheless posting a month-to-month acquire of roughly 8%.

Bitcoin may climb to $115,000 or larger by early July, pushed by institutional demand, ETF inflows, and broader macro catalysts, in line with Bitfinex analysts.

Of their newest market outlook, they highlighted that Friday’s U.S. jobs report may additional affect expectations for Federal Reserve charge cuts, which might profit threat belongings like BTC.

Whereas the labor knowledge alone received’t dictate Bitcoin’s subsequent transfer, weaker-than-expected figures may reinforce disinflation developments and assist a dovish Fed stance. On this state of affairs, BTC may check the $120K–$125K vary in June. On the draw back, the $95K–$97K zone is seen as key for accumulation.

SCENARIO FRAMEWORK: June 2025 BTC Forecast

Bullish Breakout (Chance: 79%)

•Vary: $112K → $126K

•Triggers:

•Trump–Musk détente formalized as strategic alliance

•U.S. jobs report confirms soft-landing phantasm breaking

•ETF inflows resume post-volatility flush…— SightBringer (@_The_Prophet__) June 6, 2025

At the moment buying and selling close to $105,000, Bitcoin faces short-term dangers if the roles report surprises to the upside, which may push BTC again towards $102K or decrease.

Nonetheless, Bitfinex analysts emphasize that Bitcoin’s trajectory stays formed by a fancy mixture of institutional flows, macro components, and evolving market sentiment.

The put up Why Is Crypto Down Right this moment? – June 6, 2025 appeared first on Cryptonews.