After a quick try and rise yesterday within the afternoon hours (UTC), the crypto market is down right this moment. 20 of the highest 100 cash have recorded will increase over the previous 24 hours, however most of them of lower than 1%. Furthermore, the cryptocurrency market capitalization has decreased by one other 2.3% over the previous day, now standing at $3.37 trillion. The entire crypto buying and selling quantity is at $66.6 billion, the bottom we’ve seen it in days.

TLDR:

Crypto Winners & Losers

All the highest 10 cash per market cap are down right this moment – however most of them with such a low share that they’re virtually unchanged.

Bitcoin (BTC) fell by 0.1%, which means it hasn’t actually modified in a day, now buying and selling at $104,705.

Additionally, Ethereum (ETH) too fell by simply 0.1%, due to this fact additionally standing unchanged at $2,521. Each BTC and ETH have barely moved over the previous two days.

Dogecoin (DOGE) noticed the very best lower on this class of 1.7% to the worth of $0.1679. It’s the one one with a change of greater than 1%. XRP (XRP) follows with a fall of 0.8% to $2.14.

As Cryptonews reported, crypto analyst ‘Crypto Beast’ not too long ago opined that XRP has vital upside potential, significantly now that its regulatory headwinds are gone.

XRP is about to blow up.

I’m eyeing at the very least $8, and the market nonetheless hasn’t caught as much as the truth that the SEC doesn’t think about it a safety.$XRP holders are about to PRINT.

I’ll drop the sign to exit proper right here when the second is true.

You’ll remorse not following. pic.twitter.com/oiE8INoy7F— Crypto Beast (@cryptobeastreal) June 16, 2025

Furthermore, 20 of the highest 100 cash noticed their costs rise in the identical interval. The class’s finest performer is Gate (GT), which is the one coin with a double-digit rise. It’s up 14.2% to $17.28. Kaia (KAIA) is subsequent, having elevated by 9.8% to $0.1958.

On the identical time, Fartcoin (FARTCOIN) fell probably the most: 7.4% to $1.01. It’s adopted by SPX6900 (SPX) with a 6.3% drop to $1.31.

In the meantime, Twitter CEO Linda Yaccarino not too long ago introduced that customers will quickly have the ability to commerce and make investments immediately on the platform. “And that’s whether or not I will pay you for the pizza that we shared final evening, or make an funding, or a commerce. In order that’s the long run,” she mentioned.

Bitcoin Holds Agency in Face of Geopolitical Chaos

James Toledano, Chief Working Officer at Unity Pockets, commented that “we have now seen over the previous week that even with geopolitical chaos—particularly within the Center-East, Bitcoin has confirmed its resilience—though this shall be examined if oil costs start to rise.”

Equally, Gadi Chait, Head of Funding at Xapo Financial institution, argues that BTC holds throughout the six-figure mark, “displaying its resilience even with main geopolitical tensions intensifying quickly.” These embody battle escalation within the Center East, ongoing commerce disputes, and world financial uncertainty.

“However amongst all of that, Bitcoin’s value stability exhibits simply how mature it’s amongst all of this exterior noise.”

The US Senate passing the GENIUS Act with bipartisan assist reinforces a way of legitimacy for crypto. “For the crypto business, this can be a key milestone, not simply in coverage however within the belief of the system,” Chait says.

In the meantime, Dom Harz, Co-Founding father of Layer-2 BOB, famous that ETH is consolidating above $2,400, up from a low of $1,400 in April, signaling the return of investor confidence “as many select to stake moderately than promote.”

Additionally, Bitcoin is consolidating above $104,000, says Harz, “nonetheless sitting on huge, untapped liquidity.”

“The true alternative lies within the convergence of those two ecosystems — connecting Bitcoin’s capital with Ethereum’s DeFi infrastructure to unlock the following wave of yield and innovation.”

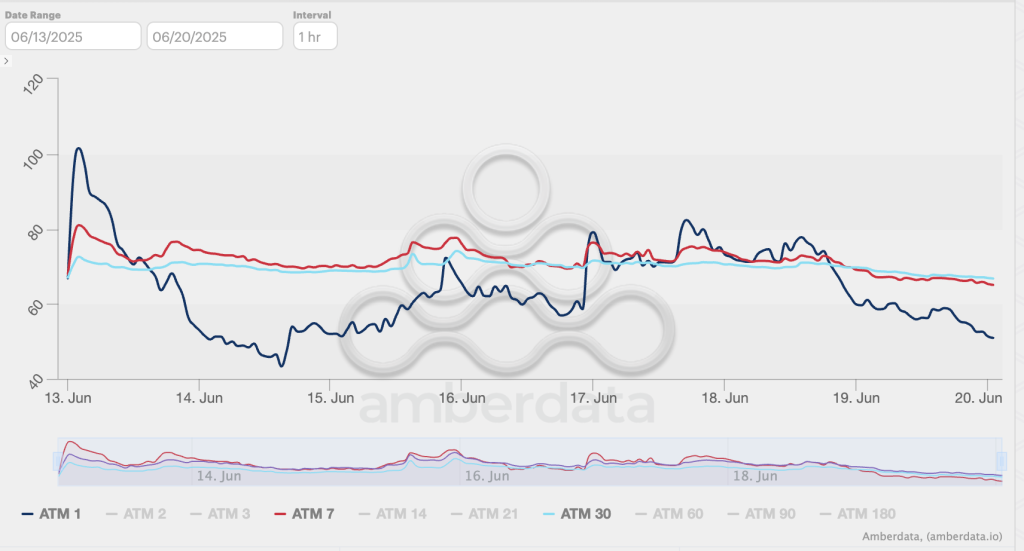

Lastly, Nick Forster, Founding father of decentralized onchain choices AI-powered platform Derive.xyz, argues that within the close to time period, “the dramatic drop in ETH volatility [from around 100% to 60%] might create situations for a breakout, particularly if Center East tensions ease additional.”

Within the medium time period, buyers ought to keep watch over the 26 September expiry buildup in BTC. It might set off volatility because it approaches.

Per Forster, “BTC volatility remained a lot calmer general, peaking close to 50% (ATM 1 day) earlier than trending down towards 30%. Each ETH and BTC present a typical contango construction, with short-term vols extra delicate to speedy occasions.”

Ranges & Occasions to Watch Subsequent

On the time of writing, BTC trades at $104,705, unchanged since this time yesterday. It has been buying and selling on this zone for the previous two days, unable to carry the $105,000 degree. It tried to surpass it once more throughout the previous 24 hours, briefly hitting the very best intraday excessive of $105,036.

It additionally practically fell under the $104,000 mark, reaching the each day low of $104,004, surging up quickly after.

On the identical time, Ethereum is at the moment buying and selling at $2,521. Like BTC, it has maintained this degree for the previous two days. It dropped from its intraday excessive of $2,541 to the intraday low of $2,488, earlier than recovering to the present value.

Furthermore, the crypto market sentiment continues unchanged for 2 days in a row as properly. The Worry and Greed Index nonetheless stands at 48. The buyers are ready for additional alerts to make their subsequent transfer. Standing in impartial, the sentiment can simply transfer to greed or concern.

In the meantime, US markets had been closed on 19 June for Juneteenth Nationwide Independence Day, a financial institution vacation in that nation. Subsequently, there shall be no info on the efficiency of US BTC and ETH spot exchange-traded funds (ETFs) till later right this moment.

On 18 June, US BTC ETFs marked eight consecutive days of inflows, with $389.57 million. US ETH spot ETFs recorded internet inflows of $19.1 million in that very same interval.

In South Korea, the Monetary Companies Fee (FSC) has submitted a roadmap to the Presidential Committee on Coverage Planning, outlining a possible framework to approve spot crypto exchange-traded funds (ETFs) within the second half of 2025.

It is a notable shift from the FSC’s long-standing place that these merchandise are dangers to monetary stability.

MASSIVE BREAKING: South Korean presidential election received by Lee Jae-myung who dedicated to permit South Korea’s $884 billion nationwide pension fund to spend money on Bitcoin and cryptocurrency — additionally guarantees to launch Bitcoin ETF.

Wild this occurred the 2nd day I’m in South Korea. pic.twitter.com/NkXfe0AaIy— Dennis Porter (@Dennis_Porter_) June 3, 2025

Healthcare infrastructure agency Semler Scientific is planning to build up 10,000 Bitcoin this yr, in addition to 105,000 BTC by 2027. The corporate has appointed BTC skilled Joe Burnett as Director of Bitcoin Technique. Burnett recently told Cryptonews that BTC is “extra scarce and transportable than gold.”

$SMLR appoints Joe Burnett @IIICapital as Director of Bitcoin Technique. Broadcasts three-year plan to personal 105,000 #Bitcoins by Yr-Finish 2027. So fired as much as have Joe on board to assist with this thrilling new chapter in Semler's $BTC mission.

— Eric Semler (@SemlerEric) June 19, 2025

Fast FAQ

- Why did crypto transfer with shares right this moment?

The crypto market has been purple during the last day. The US inventory market was closed on Thursday, 19 June, in observance of Juneteenth Nationwide Independence Day. Subsequently, no new info shall be out there until the market closes right this moment (US time).

- Is that this dip sustainable?

The consolidation could proceed within the brief time period, because the market makes an attempt to search out footing for the following leg up. Relying on additional geopolitical and financial developments, the costs could lower additional.

The publish Why Is Crypto Down At this time? – June 20, 2025 appeared first on Cryptonews.