In full distinction to yesterday’s image, the crypto market is down right now, with almost the entire prime 100 cash per market cap seeing their costs fall over the previous 24 hours. On the identical time, the cryptocurrency market capitalization has dropped 4.2% to $3.43 trillion. The entire crypto buying and selling quantity is at $97.3 billion, notably down in comparison with yesterday’s $120 billion.

TLDR:

Crypto Winners & Losers

On the time of writing, solely one of many prime 10 cash per market cap is inexperienced.

Bitcoin (BTC) is down 0.4%, which means it’s largely unchanged, at the moment buying and selling at $108,836.

Ethereum (ETH) has seen a drop of two.1%, at the moment altering palms at $2,547.

Dogecoin (DOGE) noticed the best lower on this class: 4.4% to the worth of $0.1673.

On the identical time, Tron (TRX) is the one inexperienced coin, however with an increase of 0.4%, which means it’s virtually unchanged over the previous day at $0.2856.

Furthermore, 5 of the highest 100 cash noticed will increase, however solely one in all them was excessive sufficient to maneuver the worth. Pudgy Penguins (PENGU) is up 1.8% to $0.01576.

Alternatively, Pepe (PEPE) noticed the best lower of 8.3% to $0.000009791.

The Pudgy Penguins staff lately summarized their accomplishments over the previous few months, together with a partnership with NASCAR, going stay on Upbit and Revolut, CBOE submitting for the CANARY PENGU ETF, and extra.

It looks like @pudgypenguins are taking up the world this yr…

Nascar partnership

Stay on @Official_Upbit

Stay on @RevolutApp

Collab with @PEZCandyUSA

CBOE $PENGU ETF submitting

Guide partnership with @randomhousekids

@PenguClash recreation

Partnership with… pic.twitter.com/cmZncjqFdZ

— Cryptotwits (Stocktwits) (@CryptotwitsHQ) July 2, 2025

In the meantime, shares of DeFi Growth Corp. jumped 17% on Thursday after the corporate revealed it had acquired $2.7 million value of Solana as a part of its crypto treasury technique. Earlier this week, it mentioned it deliberate to lift $112.5 million via non-public placements, anticipated to shut Monday.

Information: DeFi Growth Corp (Nasdaq: $DFDV) has bought 17,760 Solana cash for $2.72 million.

This brings the corporate’s whole Solana holdings to 640,585 $SOL, at the moment value round $98.1 million—making it one of many largest public holders of Solana.

The newly acquired… pic.twitter.com/bDftGzhBH4— Crypto Coin Present (@CryptoCoinShow) July 4, 2025

‘Merchants are Betting on a Large July’

Sean Dawson, Head of Analysis at decentralized onchain choices platform, Derive.xyz, commented that “June’s largest value swings have been geopolitical.” We noticed main drawdowns throughout key escalation factors within the Center East on June 13 and 22.

That mentioned, “restricted volatility spikes inform us markets have been betting on restricted fallout. That’s precisely what performed out,” Dawson says. “The muted response in month-to-month volatility suggests merchants accurately anticipated that hostilities can be contained.”

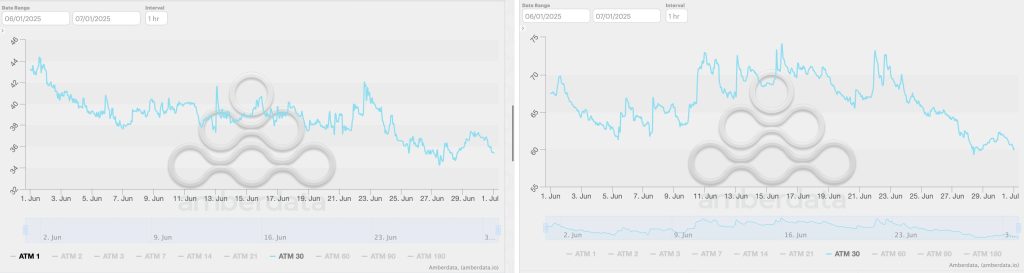

Furthermore, volatility trended decrease throughout each ETH and BTC. The previous’s 30-day implied volatility fell from 44% to 36% and the latter’s from 68% to 60%.

BTC and ETH 30-day volatility

Dawson continues: “Merchants are betting on an enormous July, with volatility suppressed and positioning break up, all eyes at the moment are on the Fed, macro knowledge, and additional geopolitical developments. ETH has the stronger momentum narrative, however BTC’s choices market is coiled for a decisive transfer.”

Upside catalysts for BTC to hit $130,000 embody the US Federal Reserve charge cuts on the 29 July assembly (25% probability) and de-escalation in Israel’s battle towards Iran and Palestine.

Draw back catalysts that might consequence within the value retreating to $90,000 embody a hawkish Fed tone, sizzling inflation print, elevated tensions within the Center East, ETF outflows, and miner capitulation.

Lastly, per Dawson, there’s a ten% probability that BTC will surpass $130,000 by the tip of August, and a 15% probability ETH will surpass $3,300 in that very same interval.

ETH sentiment is considerably extra bullish than BTC’s, he says. “Robinhood’s announcement of an L2 on Arbitrum for tokenized shares within the EU may reignite the real-world asset (RWA) narrative round Ethereum.”

Ranges & Occasions to Watch Subsequent

On the time of writing, BTC trades at $108,836. It has seen fairly uneven buying and selling over the previous day. The value fell to the $180,830 stage twice, and its present value is its intraday low. This follows a drop from a day by day excessive of $110,386.

On the identical time, Ethereum is at the moment buying and selling at $2,547. Because the chart exhibits, the coin went on a continuous drop from the day by day excessive of $2,630 to the bottom day by day level to date of $2,532, earlier than rising barely to the present value.

In the meantime, the crypto market sentiment stays largely unchanged inside impartial territory. The Worry and Greed Index elevated from 55 yesterday to 55 right now. Buyers proceed to attend for added information and alerts that might immediate an extra rise to greed or a drop to concern.

Notably, on 3 July, US BTC spot exchange-traded funds (ETFs) recorded inflows of a whopping $601.94 million. This marks the best optimistic day by day move in six weeks, since 22 Might. Of the overall quantity, Constancy accounts for $237.13 million, BlackRock $224.04 million, and Ark & 21 Shares $114.25 million.

Additionally, on 3 July, US ETH ETFs recorded inflows of $148.57 million, considerably larger than the two July outflow of $1.82 million. BlackRock and Constancy noticed the best optimistic flows of $85.38 million and $64.65 million, respectively.

In the meantime, Singapore-based crypto agency Amber Worldwide accomplished a $25.5 million non-public placement for its $100 million crypto ecosystem reserve fund. The Nasdaq-listed firm introduced its crypto reserve technique early this yr diversifying allocations in Bitcoin, Ethereum, and Solana. It’s now increasing to Binance Coin, XRP, and SUI.

Amber Worldwide is aiming to progress its $100 million crypto reserve technique with a $25.5 million non-public placement.#AmberInternational #Cryptostrategyhttps://t.co/hKCJsVwdHl

— Cryptonews.com (@cryptonews) July 4, 2025

Fast FAQ

- Why did crypto transfer towards shares right now?

The crypto market has dropped over the previous 24 hours, whereas the US inventory market noticed one other day of blended efficiency on Wednesday. For instance, the S&P 500 elevated by 0.83%, the Nasdaq-100 went up by 0.99%, and the Dow Jones Industrial Common rose by 0.77%.

Nevertheless, Ruslan Lienkha, Chief of Markets at YouHodler, argues that Bitcoin “stands poised to comply with equities to new highs.” This week noticed a surge in optimism throughout US fairness markets, with the S&P 500 hitting a brand new ATH. “If the S&P 500 holds above its earlier February peak following the discharge of the Non-Farm Payrolls knowledge within the coming weeks, it may function a powerful technical and psychological catalyst not only for equities but additionally for the cryptocurrency market.”

- Is that this dip sustainable?

This seems to be one other short-term dip available in the market, marking minor decreases earlier than further pushes larger. Within the medium time period, analysts anticipate the costs to proceed growing general, no matter unavoidable drops.

You might also like: (LIVE) Crypto Information At this time: Newest Updates for July 4, 2025 The crypto market is displaying blended alerts right now, with the overall crypto market cap falling 2.9%. Bitcoin is up 0.5% over the previous 24 hours, at the moment buying and selling simply above $109,000 after briefly crossing $110,300. Ethereum has held sturdy place, rising over 0.7% and buying and selling above $2,570. However what else is occurring in crypto information right now? Comply with our up-to-date stay protection…

The submit Why Is Crypto Down At this time? – July 4, 2025 appeared first on Cryptonews.