The crypto market is down right now, with 92 of the highest 100 cash in pink over the previous 24 hours. General, the cryptocurrency market capitalization has decreased by 0.2%, now standing at $3.96 trillion. On the identical time, the full crypto buying and selling quantity is at $154 billion.

TLDR:

Crypto Winners & Losers

On the time of writing, three of the highest 10 cash per market capitalization have elevated over the previous 24 hours, whereas 5 are down (not taking the 2 stablecoins into consideration).

Bitcoin (BTC) is unchanged over the previous day, now buying and selling at $115,118. That is the smallest lower on this class, with 0.1%.

On the identical time, Ethereum (ETH) dropped 0.7%, now buying and selling at $4,237.

Binance Coin (BNB) is up probably the most right now: 1.3% to the value of $843. It’s adopted by XRP (XRP) and Cardano (ADA) with will increase of 1.3% and 0.9%, now buying and selling at $3 and $0.9223.

Solana (SOL) dropped probably the most on this class: 1.1% at the moment altering fingers at $179.

Trying on the prime 100 cash, eight recorded will increase. OKB (OKB) and Provenance Blockchain (HASH) are up probably the most, having appreciated 9.8% and 9.3% to $124 and $0.02913, respectively.

However, Arbitrum (ARB) fell probably the most: 6% to $0.4931. It’s adopted by Pi Community (PI), with a 5.9% drop, altering fingers at $0.3519.

Buyers are maintaining a tally of a number of key occasions coming this week. For the crypto market, a big one is the US Federal Reserve Chair Jerome Powell’s speech this Friday on the Jackson Gap Symposium, an annual gathering of the world’s central bankers.

The markets will search to be taught if the Fed is on its technique to lower the lending price on the subsequent coverage committee assembly in September, as many count on.

Final month, Powell stated the central financial institution wanted further information on the impression of tariffs on inflation earlier than making a choice.

‘Merchants are Bracing for a Risky Finish to August’

Nick Forster, founder at onchain choices platform Derive.xyz, commented that expectations for a Fed price lower in September have “dropped sharply.” Subsequently, merchants are actually re-positioning forward of Powell’s Friday speech.

“If Powell indicators a continued hawkish stance, we might see a fast correction in digital belongings, significantly for BTC and ETH,” Forster says.

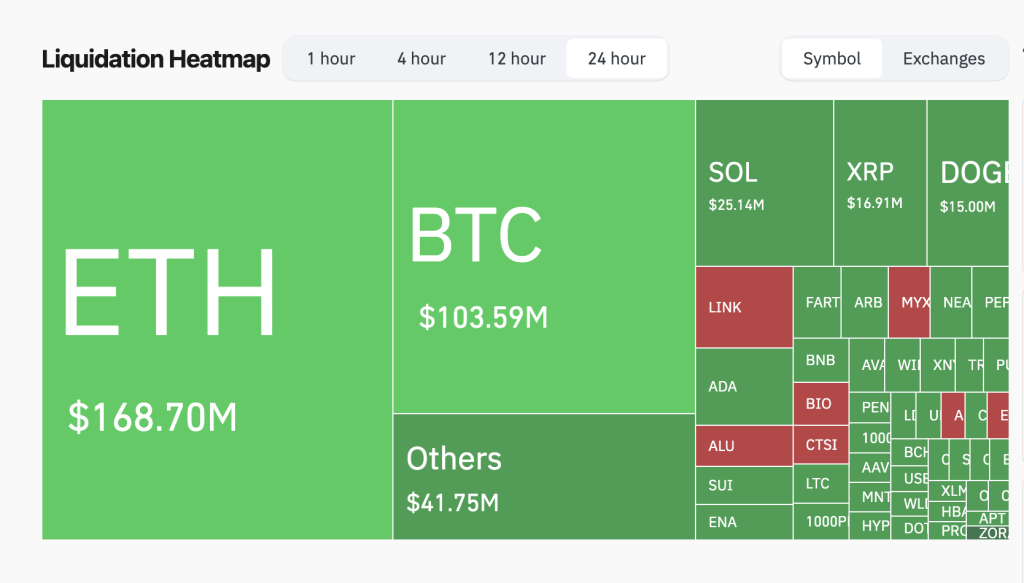

Furthermore, over the previous “turbulent” 24 hours, the crypto market noticed over $270 million in liquidations, led by $170 million in ETH and $104 million in BTC.

95% of those have been longs, triggered by reasonable pullbacks of three% for ETH and a couple of% for BTC, Forster stated.

Forster continued: “In response, short-dated (7-day) ETH implied volatility spiked from 68% to 73% within the final 24 hours, whereas 30-day IV stays secure – an indication that markets count on heightened volatility within the speedy time period.”

In the meantime, the possibility of BTC hitting $100,000 earlier than the tip of September rose from 15% to 21%.

Additionally, the possibility of ETH hitting $4,000 in the identical interval rose from 45% to 60%.

“Merchants are bracing for a risky finish to August, with all eyes on Jackson Gap,” Forster concluded.

Ranges & Occasions to Watch” Subsequent

On the time of writing on Thursday morning, BTC trades at $115,118. Earlier within the day, it fell to the week’s low of $114,740. It recuperated to $116,996, aiming for the $117,000 mark, earlier than returning to the present stage.

It’s at the moment down 7.3% from its all-time excessive of $124,128 hit 5 days in the past. The charts sign uncertainty, with attainable swings both manner.

Ethereum additionally noticed fairly a uneven day of buying and selling. It’s at the moment buying and selling at $4,237. Its intra-day was $4,204, whereas the day’s excessive stands at $4,382.

That is in comparison with the 7-day vary of $4,180 on the lowest level and the intraweek excessive of $4,776.

Moreover, the best level reached over the previous week is $4,776. The value will try and rise again to this stage, per analysts. Ought to it maintain it, it could lastly match a brand new ATH quickly.

Moreover, the crypto market sentiment continues dropping, but it surely nonetheless stays within the impartial zone. The crypto worry and greed index fell from 56 yesterday to 53 right now.

This indicators that the chance urge for food is lowering in the mean time. That stated, whereas the dealer confidence is down, it’s nonetheless current, and the bullish sentiment persists.

In the meantime, the US BTC spot exchange-traded funds (ETFs) continued with outflows on Monday. By the tip of the buying and selling day, one other $121.81 million bled out of the funds.

Whereas Bitwise recorded inflows of $12.66 million, BlackRock and Ark&21Shares misplaced $68.72 million and $65.75 million, respectively.

On the identical day, the US ETH ETFs additionally misplaced $196.62 million. The cumulative complete web influx now stands at $12.47 billion, as of 18 August.

Six of the 9 funds recorded flows, all of them detrimental. The very best amongst these is BlackRock’s $87.16 million, adopted by Constancy’s $78.4 million.

In the meantime, US (Illinois) Governor JB Pritzker signed two new payments to manage crypto exercise within the state and criticised US President Donald Trump’s strategy to digital belongings.

“Whereas the Trump Administration is letting crypto bros write federal coverage, Illinois is implementing commonsense protections for traders and customers,” Pritzker stated.

Whereas Trump lets crypto bros write federal coverage, Illinois is implementing commonsense protections for traders and customers.

As we speak, I've signed into legislation first-of-their-kind safeguards within the Midwest for cryptocurrency and different digital belongings.

We gained't tolerate fraudsters.— Governor JB Pritzker (@GovPritzker) August 18, 2025

Talking of the US and regulation, the US Treasury has referred to as on the general public to offer suggestions required by the GENIUS Act on how the federal government might assist stop “illicit finance dangers” tied to digital belongings.

As we speak, Treasury issued a Request for Remark required by the GENIUS Act, which furthers the Administration’s coverage of supporting the accountable progress and use of digital belongings, as outlined in President Trump’s Government Order on “Strengthening American Management in Digital…

— Treasury Division (@USTreasury) August 18, 2025

“This request for remark gives the chance for people and organizations to offer suggestions on progressive or novel strategies, methods, or methods that regulated monetary establishments use, or might probably use, to detect illicit exercise involving digital belongings,” the U.S. Treasury states.

Fast FAQ

- Why did crypto transfer with shares right now?

Each the crypto and the inventory markets have largely decreased over the previous day. By Monday’s closing time, the S&P 500 was down by 0.010%, the Nasdaq-100 elevated by 0.0071%, and the Dow Jones Industrial Common fell by 0.076%. Buyers are getting ready for the Fed Chair speech this week, in addition to a sequence of retail sector earnings studies that can present tariff impacts and shopper spending.

- Is that this dip sustainable?

The present dip continues to be throughout the vary predicted by analysts as attainable earlier than the following leg up within the mid- to long-term. That stated, the markets are paying shut consideration to the incoming macroeconomic indicators.

You may additionally like: (LIVE) Crypto Information As we speak: Newest Updates for August 19, 2025 The crypto market continues to be in slight bearish mode as Bitcoin slipped under $115,000 and Ethereum fell below $4,200, contributing to over $400 million in liquidations previously 24 hours. Most sectors noticed declines, with DeFi and Meme tokens dropping greater than 2%, whereas the PayFi sector remained comparatively resilient. Regardless of the broader downturn, OKB and POL bucked the development with notable positive factors. However what else is occurring in crypto information right now? Observe our up-to-date dwell protection…

The put up Why Is Crypto Down As we speak? – August 19, 2025 appeared first on Cryptonews.