Key Takeaways:

- Company treasuries hit a report 1 million BTC in 2025, however corporations at the moment are extra cautious, shopping for BTC in smaller, measured allocations.

- MicroStrategy’s dominance is waning, with its share of company holdings falling from 76% to 64% as different public corporations stepped up.

- Analysts say macro uncertainty is driving warning, but establishments nonetheless added extra BTC this yr than all U.S. spot ETFs mixed, exhibiting long-term conviction.

Bitcoin treasury corporations — firms that maintain Bitcoin as a reserve asset on their stability sheet — now maintain a report 1,011,387 BTC in treasury, however demand has slowed sharply, in accordance with information from Bitcoin Treasuries Web.

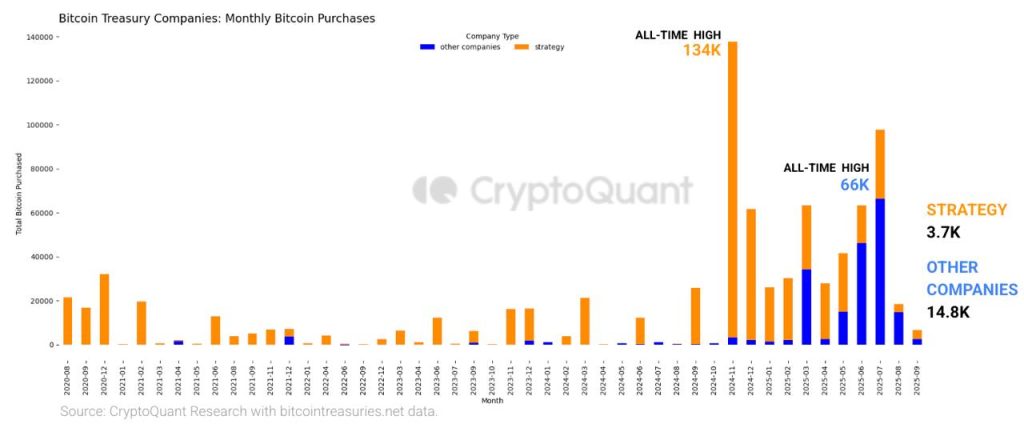

For instance, MicroStrategy’s month-to-month buys collapsed from 134,000 BTC in November 2024 to simply 3,700 BTC in August 2025, per an earlier CryptoQuant report. MicroStrategy, now often called Technique, is the most important company holder of Bitcoin.

The corporate is a bellwether of the company Bitcoin treasury rush. At a price foundation of $73,913 per coin, Technique now holds 638,985 BTC, translating to greater than $47 billion in belongings and about $27 billion in unrealized good points.

In its report, CryptoQuant mentioned whereas the quantity of holdings and the variety of buy transactions hit all-time highs in 2025, corporations purchased much less BTC, and month-to-month holdings development has “slowed sharply.”

The report, which put company treasuries at 840,000 BTC in early September, reveals that corporations at the moment are extra cautious, shopping for BTC in smaller tranches.

“Corporations are shopping for smaller quantities per transaction, signaling that institutional demand is weakening regardless of the headline record-high holdings,” it mentioned.

Slowing Company Demand: Outlier or Pattern?

Talking to Cryptonews, Illia Otychenko, lead analyst at crypto alternate CEX.io, warned towards studying the CryptoQuant information at face worth.

“November 2024 was by far the most important month of Bitcoin accumulation for Technique, making it an outlier,” he explains. “In lower than 10 days of September 2025, the corporate has already added 6,000 BTC — greater than your complete August determine highlighted by CryptoQuant.”

Otychenko says the context is necessary as a result of the headline slowdown dangers overstating the case. Whereas Technique’s accumulation has declined, different company consumers have stepped up, in some unspecified time in the future reducing the agency’s dominance in company Bitcoin treasuries from 76% in January to 64%.

The analyst mentioned public corporations added a mixed 415,000 BTC to their treasuries up to now in 2025, already surpassing the 325,000 BTC acquired all through the entire of final yr.

“The urge for food remains to be there,” Otychenko acknowledged. “It’s simply that Technique has been hit tougher, which makes the general image look weaker than it really is.”

A part of the rationale Technique’s exercise appears to be like muted lies in how the market now values its Bitcoin technique.

Since November 2024, says Otychenko, the agency’s modified Web Asset Worth (mNAV) — primarily the premium traders have been keen to pay for its Bitcoin publicity — collapsed from 3.89x to 1.44x.

“At 3.89x, the market was valuing the corporate nearly like a leveraged Bitcoin ETF,” Otychenko tells Cryptonews. “With 1.44x, traders at the moment are treating it a lot nearer to the precise worth of its Bitcoin holdings.”

The premium disappeared with the launch of IBIT ETF choices earlier this yr, which provided traders an easier solution to achieve Bitcoin publicity. Because of this, enthusiasm for Technique’s aggressive Bitcoin shopping for mannequin cooled.

“The market is not rewarding the corporate for outsized accumulation in the identical means it as soon as did,” Otychenko says. “This may need contributed to Technique’s weaker BTC accumulation.”

Macro Headwinds

Since CryptoQuant’s report earlier this month, the overall variety of Bitcoin held by publicly traded Bitcoin treasury companies alone has risen to 1,011,387 BTC valued at over $118 billion, in accordance with information from Bitcoin Treasuries Web.

That’s about 5% of all of the Bitcoin in circulation. Led by Technique, different key holders embody Mara Holdings, Metaplanet, and Riot Platforms. Personal corporations personal 299,207 BTC price $35 billion at current costs, the web site says.

“The focus of BTC in company treasuries and institutional funds can minimize each methods,” says Otychenko. “On one hand, it displays long-term conviction and removes provide from circulation, which helps value stability.”

“On the opposite, it makes the market extra delicate to shifts in institutional sentiment. If these gamers gradual accumulation or determine to promote, the affect on liquidity and value could be outsized.”

Shawn Younger, chief analyst at MEXC crypto alternate, described the report company Bitcoin treasuries as “an amazing structural milestone for the maturity of Bitcoin.” He believes it could possibly be wholesome for different public corporations to purchase Bitcoin.

Younger famous that 28 new Bitcoin treasury companies have been created in July and August alone, boosting combination company holdings by 140,000 BTC.

Nonetheless, if the structural pattern is undamaged, what explains the slower tempo in company accumulation over the previous couple of months? Analysts who spoke to Cryptonews blamed the decline on poor macroeconomic situations.

“Establishments and firms at the moment are constrained by larger international rates of interest, stricter regulatory oversight, and the necessity to present shareholders monetary self-discipline and threat administration,” Younger mentioned.

Uncertainty round U.S. jobs and inflation information, and altering expectations for Federal Reserve coverage, have additionally dampened threat urge for food. “The market is leaning towards warning, favoring smaller, extra measured purchases,” added Otychenko.

Farzam Ehsani, CEO of VALR crypto alternate, put it extra bluntly, saying unsure macroeconomic situations are “recognized to be very unkind to threat belongings” like BTC and different crypto belongings, together with ETH, SOL, and XRP.

“Establishments are merely being restricted by company insurance policies, capital reserve necessities, and shareholder expectations. This doesn’t suggest that there’s something essentially unsuitable with Bitcoin itself.”

Is Company Bitcoin Focus Dangerous?

As corporations stack extra Bitcoin, questions on market dynamics are additionally beginning to pop up. Analysts are frightened that concentrating an excessive amount of BTC in company palms may result in centralization and even fragility.

MEXC analyst Younger thinks institutional adoption has a “double-edged impact”. Whereas anchored provide strengthens the shortage narrative, heavy treasury management can dampen liquidity and worsen volatility. He explains:

“While focus gives stability towards market selloffs, it may additionally increase systemic threat and affect if firms determine to pursue a distinct path and alter their funding methods.”

Ehsani, the VALR cofounder and CEO, is extra crucial:

“Bitcoin focus in a couple of company wallets might look spectacular on a stability sheet, but it surely doesn’t strengthen the well being of the community. It makes it brittle and prone to declining when key gamers determine to unwind their positions…”

Regardless of institutional dominance, retail curiosity has remained sturdy, in accordance with Otychenko, the CEX.io analyst. Round 75% of Bitcoin ETF shares are held by non-13F filers, which is usually retail, he says.

Funding advisers, who purchase Bitcoin on behalf of particular person purchasers, add one other layer of oblique retail participation. It signifies that the share of retail traders is probably going larger than what’s publicly reported.

“Retail contains each speculative merchants and people seeing it [Bitcoin] as a retailer of worth,” mentioned Otychenko, including:

“During times of macro uncertainty, the speculative cohort might quickly act like weak palms, making general exercise more and more resemble institutional patterns.”

In 2025, retail traders have stepped in at crucial moments. As institutional demand softened mid-year and whales offered extra BTC, retail flows helped defend key assist ranges, stopping a broader collapse.

“These complementary market dynamics … are wholesome,” Younger mentioned, noting that as company inflows offered the onerous flooring for BTC costs earlier within the yr, retail inflows offered resilience.

The put up Why Company Bitcoin Treasuries Demand Is Slowing in 2025 appeared first on Cryptonews.