Donald Trump is stepping up his assaults on Federal Reserve chairman Jerome Powell — and the turmoil may have important ramifications for crypto.

The U.S. president has repeatedly expressed frustration at Powell’s refusal to chop rates of interest, and desires the economist to step down earlier than his time period expires in Could 2026.

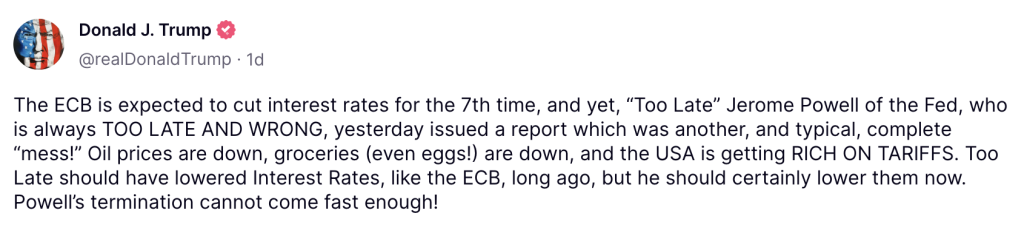

In a combative publish on Fact Social, Trump upped the ante by declaring: “Powell’s termination can not come quick sufficient!”

But a few of these inside the president’s internal circle, together with Treasury Secretary Scott Bessent, have warned firing him may destabilize monetary markets additional.

A standoff is rising. Whereas Trump has steered that Powell would go away his position if requested, the Fed chief has insisted that this isn’t the case.

At this level, it’s value taking a look at why the White Home doesn’t have the facility to dismiss the pinnacle of America’s central financial institution. A chair can solely be fired for trigger — and the Fed is supposed to be unbiased and freed from political interference.

But it surely’s clear that Trump is set to alter all this. After he dismissed senior officers at two unbiased companies, the Supreme Court docket is analyzing whether or not they need to be reinstated. Ought to the case go within the president’s favor, that would theoretically enable him to claim management over the Fed and present Powell the door.

Bessent isn’t the one one apprehensive about how this might affect the U.S. economic system. Senator Elizabeth Warren, a Trump critic and a deep crypto skeptic, has warned Wall Road will crash if presidents have this energy.

She instructed CNBC that handing very important financial levers “to a president who simply desires to wave his magic wand” would make it exhausting to distinguish America “from some other two-bit dictatorship around the globe.”

It’s honest to say that buyers are already panicked following the endless, will-he-won’t-he spherical of tariffs in opposition to main economies. Aggressive sell-offs have brought on the greenback to weaken considerably. Not solely does this eat into the income of international corporations promoting merchandise within the U.S., however it makes imported objects much more costly for home shoppers.

The Fed final minimize rates of interest again in December 2024, with Powell repeatedly saying that he desires compelling proof of cooling inflation earlier than doing so once more. By comparability, the European Central Financial institution has already slashed its foremost fee 3 times to this point in 2025 — and that is the supply of Trump’s frustration.

Regardless of all of this uncertainty, there are those that argue {that a} diminished greenback may very well be advantageous for Bitcoin within the medium to long-term. Actual Imaginative and prescient founder Raoul Pal has lengthy believed {that a} weaker buck encourages buyers to try to protect wealth via options like BTC.

24h7d30d1yAll time

But this hasn’t been mirrored in latest value motion. Till final 12 months, Bitcoin would typically rise at any time when the U.S. greenback index fell. However regardless of the DXY plunging by 8.5% within the 12 months up to now — its worst efficiency since 2005 — BTC can be nursing a lack of 9.5%.

Ought to Trump achieve his want to fireplace Powell, and may this transfer ship the inventory market into freefall, it’s extremely possible that Bitcoin would tank too — with equities and cryptocurrencies exhibiting a robust correlation of late.

Zooming out past BTC, a latest New York Instances opinion piece by Financial Safety Mission chair Chris Hughes warned that U.S. shoppers ought to pay very shut consideration to Trump’s assaults on the Fed. He wrote:

“The U.S. authorities would face considerably increased borrowing prices on the trillions it wants in coming years. Family budgets could be hit by increased borrowing prices, too, and by rising inflation.”

Hughes went on to warn that — even when Trump’s flip is over — shopper costs may spiral uncontrolled, with the greenback’s standing because the world’s reserve forex all however floor to mud.

At this stage, avid Bitcoiners would argue that this can be a good factor. They might level to how shoppers in Latin American nations ravaged by hyperinflation have already turned to BTC to protect their wealth. And they might insist that such a transfer may reinforce Bitcoin’s narrative as a hedge in opposition to inflation.

However let’s make one factor clear: it’s unimaginable to know precisely how Trump’s marketing campaign in opposition to Jerome Powell will finish — and the affect it’ll have on the crypto markets. Within the area of simply three brief months, merchants have already been caught without warning on a number of events… from the president’s refusal to purchase new BTC for a strategic reserve, and his worse-than-expected push for tariffs in opposition to China.

There aren’t any ensures that this might be a web optimistic for Bitcoin.

The publish What Trump’s Assaults on Jerome Powell Might Imply for Crypto appeared first on Cryptonews.