Key Takeaways:

- Massive Bitcoin transactions above $20 million more and more moved to alternate scorching wallets between October and mid-December.

- Round 65% of BTC throughout whales and institutional-linked flows was despatched to exchanges, usually seen as a preparatory step somewhat than rapid promoting.

- November marked the height in outflows throughout whales, BlackRock-linked wallets, and Wintermute, coinciding with Bitcoin value weak spot beneath $85,000.

- The timing of those peaks suggests a broad liquidity redistribution throughout the correction, not focused stress from a single market participant.

Desk of Contents

- In This Article

Sizzling Wallets Are the Essential Vacation spot for Massive BTC Transfers November Marked the Peak in Massive Outflows Throughout Bitcoin Worth Weak spot Why Are They Doing This? Conclusion

- In This Article

- Sizzling Wallets Are the Essential Vacation spot for Massive BTC Transfers

- November Marked the Peak in Massive Outflows Throughout Bitcoin Worth Weak spot

- Why Are They Doing This?

- Conclusion

Present Full Information

Bitcoin (BTC) costs proceed to pattern decrease. The market at the moment appears to be like like a ping-pong match between patrons and sellers. Costs fall, however and not using a sharp collapse. That is adopted by a rebound, however with out sturdy upside momentum. In opposition to this backdrop, hypothesis is rising that enormous gamers could also be placing stress in the marketplace and could possibly be concerned with pushing costs decrease. However does the information assist this concept?

On this analysis, Cryptonews analyzed giant Bitcoin transactions price greater than $20 million per switch between Oct. 10 and Dec. 15. This timeframe permits us to watch market conduct after the October sell-off. Transactions linked to BlackRock and Wintermute have been additionally reviewed, as each are among the many most seen institutional members.

Sizzling Wallets Are the Essential Vacation spot for Massive BTC Transfers

The evaluation exhibits that round 65% of BTC throughout these teams was transferred to scorching wallets, primarily exchanges. This was the most typical vacation spot.

Such transfers are normally seen as a preparatory step earlier than promoting. Nonetheless, they don’t indicate rapid liquidation. Gross sales might occur later or might not occur in any respect. Even so, such a exercise usually will increase warning available in the market and influences expectations.

The second most typical class was inside transfers. These embrace Bitcoin moved from one chilly pockets to a different or to unlabelled addresses. The aim of those transactions is tougher to interpret. In some circumstances, they could replicate rebalancing, adjustments in custody construction, or preparation for over-the-counter offers. In present market circumstances, these actions also can amplify uncertainty, particularly when giant BTC volumes commonly transfer between addresses and not using a clear rationalization.

November Marked the Peak in Massive Outflows Throughout Bitcoin Worth Weak spot

Throughout all three teams, Bitcoin whales in addition to flows linked to BlackRock and Wintermute, exercise peaked in November. This occurred after the October 10 sell-off and coincided with Bitcoin buying and selling beneath $85,000, a interval marked by elevated uncertainty.

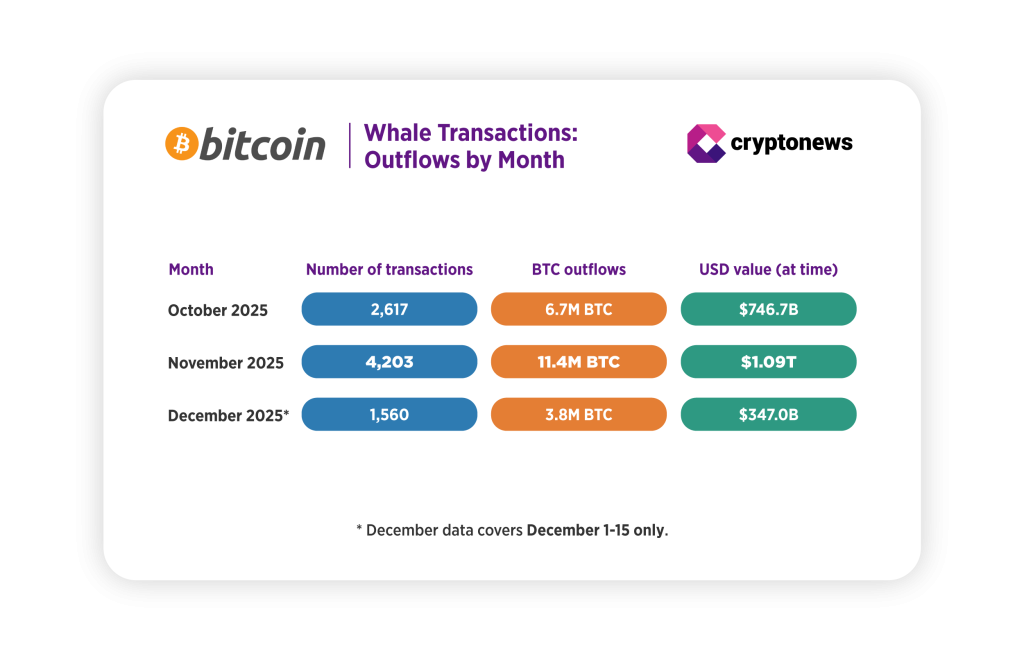

The pattern was most pronounced amongst Bitcoin whales. In November, their transaction volumes reached the very best ranges each within the variety of transfers and complete BTC moved. Round 11.4 million BTC in outgoing transfers have been recorded throughout the month. At prevailing costs, this represented greater than $1 trillion in worth. These figures have been nicely above October ranges and better than exercise seen in early December, when volumes started to say no.

Institutional flows confirmed an identical sample. Bitcoin outflows linked to BlackRock additionally peaked in November. Estimates recommend round $1.3 billion price of BTC was moved throughout the month, making it probably the most energetic interval for this group within the analyzed timeframe.

Wintermute, one of many largest crypto market makers, additionally recorded its highest month-to-month quantity of outgoing transfers throughout November. Given Wintermute’s function in offering liquidity, this enhance possible displays intensified buying and selling exercise and fund reallocation amid heightened volatility.

The truth that all three teams peaked at roughly the identical time factors to a broader redistribution of liquidity throughout a value correction somewhat than coordinated motion by a single market participant.

Why Are They Doing This?

The rising share of BTC transfers to alternate wallets naturally raises questions. Whereas these strikes are sometimes interpreted as preparation for promoting, they don’t robotically imply giant gamers are able to exit their positions.

Through the correction, some market members have steered that falling costs could possibly be used to check the resilience of main Bitcoin holders and even to set off redistribution between them.

When Bitcoin value comes below extended stress, giant and extremely seen company holders like Technique inevitably draw nearer scrutiny. The corporate is among the many largest company Bitcoin holders and is carefully related to a powerful long-term BTC thesis. This raises a logical query: might value stress be a strategy to check how resilient such positions actually are, and what would occur if one of many largest public holders modified its stance?

In response to consultants, drawing direct conclusions is untimely. David Dobrovitsky, CEO of Wowduck, says Cryptonews that it could be an oversimplification to single out one firm as a key driver of Bitcoin value actions:

It’s arduous to single out a non-public entity as a motive why BTC goes up or down. BlackRock, for instance, holds extra Bitcoin than Technique, to not point out varied governments. Technique is a really seen holder, however total BTC possession stays sufficiently distributed, which means one non-public firm shouldn’t be in a position to transfer the market by itself.

Even so, the thought of a “stress check” for company holders is more and more mentioned within the context of present market dynamics.

Dobrovitsky argues the market is just not there but:

Not but. There’s nonetheless sufficient distribution in Bitcoin holdings for value strikes to be absolutely indicative of stress on a particular company holder. What we’re seeing as a substitute is a broader downturn throughout tech markets. Jobs are scarcer, enterprise capital funding has declined, and there are fewer sectors delivering outsized returns, each for retail and institutional buyers.

From this angle, Bitcoin value decline seems extra like a part of a wider cooling in threat belongings than focused stress on particular gamers.

That mentioned, Michael Saylor’s function stays an vital a part of the market narrative, even when it’s not decisive. “Optimistic sentiment round Saylor and Technique actually helps Bitcoin,” Dobrovitsky provides. “But it surely shouldn’t be seen because the be-all and end-all with regards to BTC value dynamics.”

Conclusion

Relying on interpretation, this exercise could be defined in several methods. On one hand, the rise in BTC transfers to exchanges and the rise in inside actions might replicate a broader market cooldown and commonplace threat reallocation throughout a value correction and weaker macro circumstances. However, some members consider falling costs might act as a stress check for the most important Bitcoin holders, together with company gamers like Technique, whose dedication to BTC has turn into a part of the market narrative.

On the similar time, on-chain knowledge doesn’t level to focused stress on any single participant. Each explanations stay throughout the realm of market expectations somewhat than confirmed situations.

Disclaimer: Crypto is a high-risk asset class. This text is offered for informational functions and doesn’t represent funding recommendation. You could possibly lose your whole capital.

The publish Weekly Crypto Regulation Roundup: Staking Taxes Underneath Fireplace as Fed Hints at New Crypto Banking Mannequin appeared first on Cryptonews.