Hyperliquid’s native stablecoin, USDH, launched on September 23 with $2.2 million in early buying and selling quantity.

The launch follows Native Markets’ victory in a aggressive governance vote that noticed the startup defeat established gamers, together with Paxos and Ethena Labs, for the suitable to problem USDH on the decentralized change.

Buying and selling commenced with a USDH/USDC spot pair on HyperCore, whereas Native Markets reported over $15 million in pre-minted tokens ready for preliminary distribution.

The stablecoin maintained its $1.00 peg throughout early buying and selling periods, fluctuating solely to $1.001 as market individuals examined the brand new asset’s liquidity and stability mechanisms.

USDH is now stay for all Hyperliquid customers!

The USDH / USDC spot order ebook is open on HyperCore, with over $15M USDH pre-minted within the final 24 hours.— Native Markets (@nativemarkets) September 24, 2025

Native Markets Begins Managed USDH Rollout

Native Markets structured the launch as a gradual growth, initially capping particular person transactions at $800 per person whereas core features endure real-world testing.

“USDH is now stay for all Hyperliquid customers,” the corporate introduced on social media, highlighting completion of each HIP-1 and ERC-20 token deployments.

A number of integration phases will unfold over the approaching months, starting with HyperEVM integrations, adopted by the growth of USDH’s position as a spot quote asset.

Future developments embrace native minting instantly on HyperCore and USDH-margined perpetual contracts by the proposed HIP-3 protocol improve.

The issuer structured USDH reserves utilizing money and short-term U.S. Treasury holdings managed off-chain by BlackRock, whereas on-chain tokenized property function by Superstate and Stripe’s Bridge infrastructure.

In the meantime, Native Markets can be dedicated to directing 50% of its reserve yield towards Hyperliquid’s Help Fund, with the remaining parts allotted for USDH ecosystem improvement.

This revenue-sharing mannequin emerged from the corporate’s aggressive proposal that secured validator approval towards better-known rivals throughout September’s governance course of.

Hyperliquid at the moment hosts over $5.5 billion in Circle’s USDC, representing roughly 8% of the token’s whole provide and producing an estimated $220 million yearly in treasury yield income for Circle.

Stablecoin Competitors Intensifies as Platforms Pursue Income Independence

The USDH launch contributes to a broader shift inside defi, as buying and selling platforms search to cut back their dependence on exterior stablecoin issuers and seize reserve yield income internally.

Tether’s USDT at the moment dominates the market, with $173.05 billion in circulation, processing over $24.6 billion each day on TRON alone by roughly 2.4 million transactions, in keeping with Coingecko’s information.

This infrastructure benefit extends to order backing, the place Tether claims 75.86% U.S. Treasury Payments and 12.09% in a single day repos throughout its reserve portfolio.

Native stablecoins like USDH are taking a special strategic method, concentrating on particular ecosystem integration fairly than the cross-chain ubiquity that characterizes established gamers.

Bloomberg characterised comparable governance contests as “bidding wars” spreading throughout DeFi platforms as establishments acknowledge substantial income potential from stablecoin reserves.

The USDH energy battle on @HyperliquidX has concluded, with Native Markets securing the stablecoin mandate. Analysts say competitors now hinges on branding and partnerships.#DeFi #Stablecoins https://t.co/vRvxxuLmEM

— Cryptonews.com (@cryptonews) September 17, 2025

The stablecoin panorama is exhibiting rising fragmentation, regardless of USDT’s dominance, with Chainalysis reporting $2.5 trillion in sector-wide transaction volumes that accommodate specialised gamers.

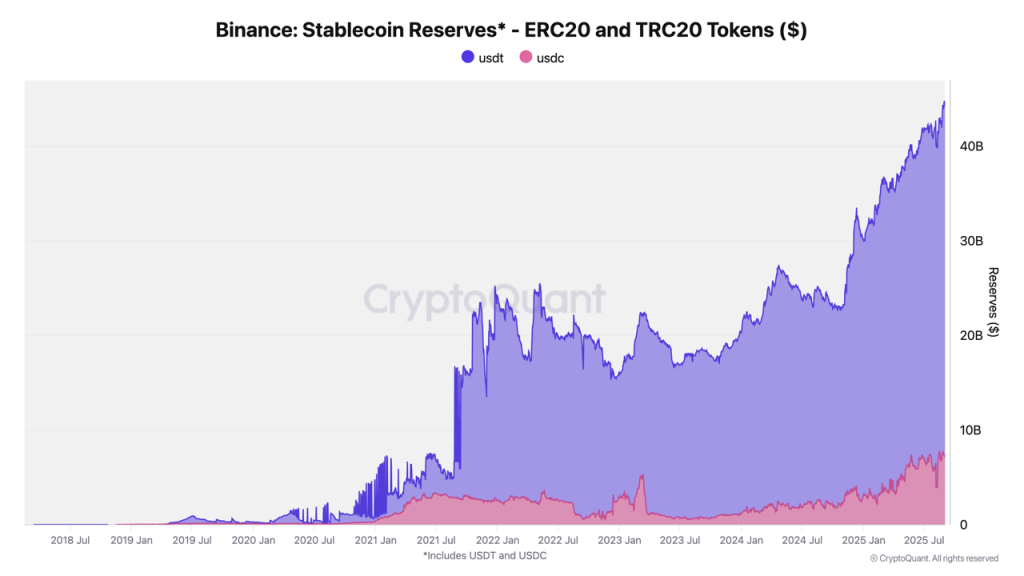

Binance at the moment holds 67% of all change stablecoin reserves, amounting to $44.2 billion, comprising $37.1 billion in USDT and $7.1 billion in USDC.

Smaller stablecoins have additionally proven speedy progress trajectories, with euro-denominated EURC increasing 89% month-over-month from $47 million to $7.5 billion in transactions throughout the previous 12 months.

Equally, PayPal’s PYUSD accelerated from $783 million to $3.95 billion over the identical interval.

These aggressive dynamics emerge as regulatory frameworks evolve, with the Trump-backed GENIUS Act and the EU’s MiCA creating alternatives for compliant options to seize market share.

Business projections from Citigroup counsel the sector might attain over $2 trillion market capitalization by 2030, which might probably create house for a number of gamers to coexist fairly than winner-take-all eventualities.

Trying ahead, the success of ecosystem-focused stablecoins will probably depend upon the expansion trajectories of their host platforms. As an illustration, Hyperliquid generated $106 million in income throughout August 2025 alone, whereas slashing spot buying and selling charges by 80% to bolster liquidity forward of the stablecoin launch.

The put up USDH Stablecoin Goes Reside on Hyperliquid with $2.2M Early Buying and selling Quantity – Can it Substitute Tether? appeared first on Cryptonews.