The crypto trade Upbit has launched a coin itemizing spree as a response to its South Korean rival Bithumb’s buying and selling quantity progress.

The South Korean newspaper Seoul Kyungjae reported that Upbit has listed seven tokens prior to now 10 days.

Upbit Itemizing Spree: Will It Cease Bithumb’s Surge?

The outlet wrote that on September 9, Bithumb’s home market share climbed to 46%, with Upbit’s share standing at 50.6%.

Upbit has dominated the South Korean market since round 2022, having fun with market share dominance above the 80% mark in some months.

This has led some lawmakers to complain that its operator, Dunmau, has change into the crypto trade sector’s de facto monopoly.

However Bithumb has been chipping away at Upbit’s market share in latest months. It has struck a partnership cope with Kookmin Financial institution, South Korea’s largest monetary participant.

And it has additionally launched a derivative agency because it seems to change into the primary home trade to debut on the NASDAQ inventory trade.

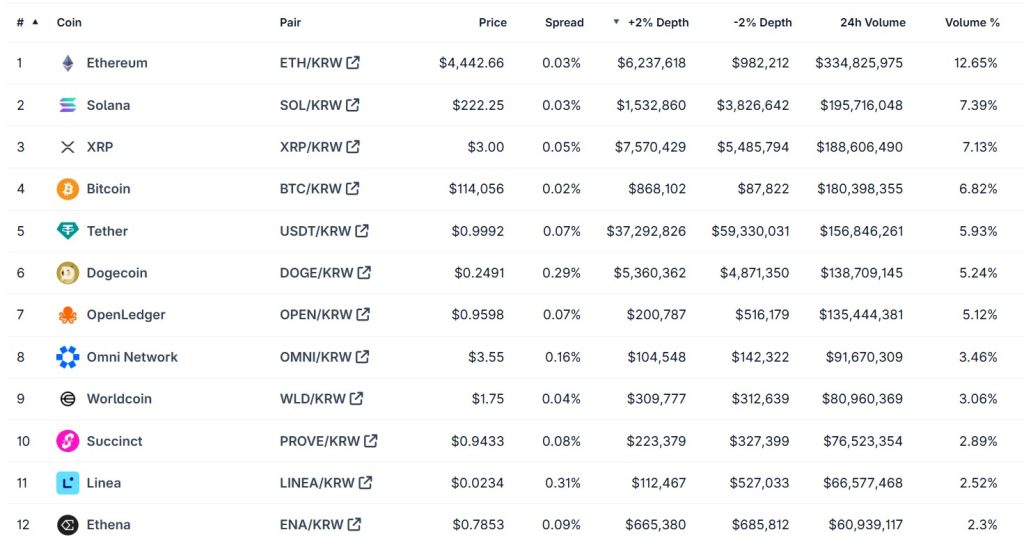

Upbit seems to have responded to Bithumb’s resurgence by launching new altcoin pairings and itemizing a wider vary of cash.

An unnamed South Korean trade official advised the media outlet that Upbit is anxious that Bithumb has narrowed the market share hole to lower than 5% with out resorting to novel promotions. The official opined:

“Upbit can’t assist however really feel a way of disaster.”

WLD Itemizing

The media outlet wrote that Upbit’s response to Worldcoin (WLD) commerce quantity progress in South Korea has been telling.

When WLD transaction volumes pushed Bithumb’s market share to 46% on September 9, Upbit responded quickly.

Upbit introduced it might be itemizing WLD at 7 pm KST the identical day and accomplished its itemizing simply two hours later, at 9 pm KST.

Upbit’s newest itemizing, at 1:30 am KST on September 11, was the Linea (LINEA). The trade’s September listings tally has already surpassed its complete variety of listings for the entire of August.

Prospects Might Undergo, Consultants Warn

The market chief has historically taken a way more conservative angle to coin itemizing than Bithumb, which additionally continues so as to add cash to its platform.

Ought to the 2 corporations change into embroiled in a listings warfare, critics warn, clients may undergo in the long term.

Consultants mentioned they have been “involved” that the “fierce competitors between exchanges” could lead on platform managers to make “hasty choices” that “compromise the evaluation course of.”

The consultants famous that whereas itemizing frenzies proceed, South Korean delisting occasions have gotten extra frequent.

A mixed complete of 25 altcoins have been delisted by Bithumb, Upbit, and their closest rivals, Korbit, Coinone, and GOPAX, since July this 12 months.

A number of of those cash had solely not too long ago been listed on the platforms. An unnamed crypto business govt prompt that Seoul’s efforts to police the sector could also be at fault.

The supply mentioned:

“Regulators solely enable home exchanges to supply spot buying and selling. That implies that the one method they will compete with each other is by increasing their listings. It’s ironic that regulators’ makes an attempt to police the business are literally spurring itemizing competitors and weakening investor safety.”

The publish Upbit Goes on Coin Itemizing Spree as Bithumb Claws Again Market Share appeared first on Cryptonews.