The Central Financial institution of the UAE is ready to challenge its Digital Dirham, a blockchain-based model of the nation’s nationwide foreign money AED, for retail use by the final quarter of 2025.

In line with experiences from the Khaleej Instances, the CBDC will function excessive safety, tokenization, and good contract integration, enabling instantaneous settlements and multi-party transactions.

A New Period for the #UAE #Dirham

Central Financial institution of UAE Unveils the New Dirham Image.In a historic transfer, the Central Financial institution of the UAE (CBUAE) has launched a contemporary image for the UAE Dirham (AED) – now represented globally with a smooth, daring id.

The up to date Dirham… pic.twitter.com/kQ3QxqpSz5

— Ghazanfar (@GhazanfarTweets) March 27, 2025

The CBDC might be a universally accepted cost methodology, made accessible by way of licensed monetary establishments—banks, change homes, and fintech companies.

Moreover, the Central Financial institution of the UAE (CBUAE) has developed an built-in Digital Dirham platform and pockets, enabling retail, wholesale, and cross-border transactions.

Stablecoin Adoption within the UAE

The UAE’s journey towards a digital foreign money started in June 2024 with the rollout of a stablecoin regulatory framework, establishing licensing pointers for Dirham-backed stablecoins.

This triggered a number of main initiatives, together with a push from Tether to challenge an AED-backed stablecoin on the TON blockchain.

On February 24, Circle acquired official authorization from the Dubai Monetary Companies Authority (DFSA) to acknowledge and function stablecoins, USDC and EURC, inside the Dubai Worldwide Monetary Centre (DIFC).

Nevertheless, as a sovereign-backed digital foreign money, the Digital Dirham stands to offer the next stage of safety, regulatory oversight, and financial authority than privately issued tokens.

CBUAE governor Khaled Mohamed Balama claims the initiative will “considerably improve monetary stability, inclusion, resilience, and combatting monetary crime”

Long run, Blamam anticipates that Digital Dirham will “allow the event of modern digital merchandise, providers, and new enterprise fashions whereas decreasing price and growing entry to worldwide markets.”

A CBDC stands to see appreciable adoption within the UAE, rating first among the many world’s “most crypto-obsessed nations” in 2025, with a crypto possession price of 25.3%.

World Push for CBDCs

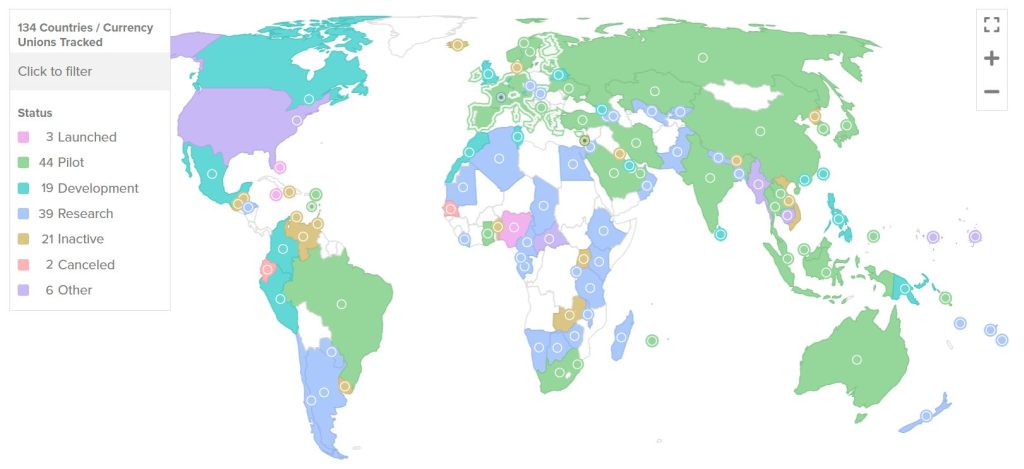

The UAE is presently within the testing section of its Digital Dirham, becoming a member of 43 different nations operating pilot applications for their very own Central Financial institution Digital Currencies (CBDCs).

Most notably, the European Central Financial institution is conducting a multi-year trial of the Digital Euro.

The UK is on observe to ascertain its personal regulatory framework for stablecoins by 2026, as outlined in a crypto roadmap revealed by the Monetary Conduct Authority (FCA).

Most just lately, US lawmakers proposed the Stablecoin Transparency and Accountability for a Higher Ledger Financial system (STABLE) Act on March 26 to advance stablecoin regulation.

The publish UAE Eyes This autumn 2025 for Digital Dirham Rollout appeared first on Cryptonews.