U.S.-focused digital asset funding funds recorded their first weekly withdrawals in a month, dropping $952 million after delays tied to the long-delayed CLARITY Act rattled traders and reignited worries about regulation.

In line with knowledge from CoinShares, digital asset funding merchandise noticed $952 million in internet outflows over the previous week, marking the primary adverse circulation since late November.

The retreat was largely pushed by delays linked to the Digital Asset Market Readability Act, extensively known as the CLARITY Act, which has prolonged regulatory uncertainty for crypto corporations working throughout America.

Fears of ongoing promoting from main holders additional dragged on sentiment.

Ether and Bitcoin Lead Crypto Fund Outflows Whereas SOL and XRP Survive

The outflows had been closely centered within the U.S., which made up $990 million of that complete.

This was solely partially offset by inflows from Canada and Germany, the place traders added $46.2 million and $15.6 million, respectively.

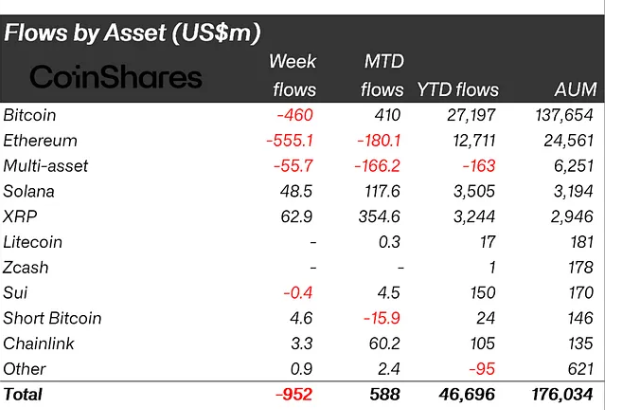

Ethereum bore the brunt of the promoting, recording $555 million in outflows.

Analysts famous that Ether’s sensitivity to regulatory developments is greater than most belongings, given its central function in decentralized finance and staking-related merchandise that could possibly be instantly affected by U.S. market construction guidelines.

Regardless of the current pullback, Ethereum funding merchandise have nonetheless attracted $12.7 billion in inflows thus far this 12 months, properly above the $5.3 billion recorded over the identical interval in 2024.

Bitcoin merchandise adopted intently behind, recording $460 million in outflows. Whereas Bitcoin nonetheless leads the market in absolute phrases, year-to-date inflows of $27.2 billion stay under final 12 months’s $41.6 billion.

Whole belongings beneath administration throughout all crypto exchange-traded merchandise now stand at $46.7 billion, down from $48.7 billion on the identical level in 2024, making it unlikely the sector will surpass final 12 months’s totals.

U.S. spot Bitcoin ETFs mirrored comparable strain, posting a weekly internet outflow of $497.05 million as of December 19, whilst cumulative inflows stay elevated at $57.41 billion.

In distinction, Solana and XRP continued to draw recent capital. Solana funding merchandise recorded $48.5 million in inflows, whereas XRP merchandise added $62.9 million.

The pattern was mirrored in U.S. spot ETFs, the place XRP funds posted $82.04 million in weekly inflows, and Solana ETFs added $66.55 million over the identical interval, extending a multi-month sample of regular accumulation.

Crypto Market Invoice Faces Contemporary Delay as Senate Kicks Vote to January

The market response unfolded as lawmakers confirmed additional delays to the CLARITY Act.

On Thursday, White Home AI and crypto czar David Sacks introduced that the Senate markup for the long-awaited Readability Act will happen in January 2026, delaying earlier expectations that the invoice would attain President Trump’s desk earlier than the top of 2025.

We had an excellent name as we speak with Chairmen @SenatorTimScott and @JohnBoozman who confirmed {that a} markup for Readability is coming in January. Because of their management, in addition to @RepFrenchHill and @CongressmanGT within the Home, we’re nearer than ever to passing the landmark crypto…

— David Sacks (@davidsacks47) December 18, 2025

The Home handed the laws in July, however the Senate has but to finish its evaluation, with the timeline disrupted by a document 43-day authorities shutdown in October and November.

GENIUS Act, Anti-CBDC Act, and CLARITY Act go essential procedural vote 215-211 in Congress after Trump's decisive Oval Workplace intervention rescues stalled crypto agenda.#GeniusAct #Trumphttps://t.co/Lm2tCBbimp

— Cryptonews.com (@cryptonews) July 16, 2025

The invoice is designed to make clear whether or not digital belongings fall beneath securities or commodities legislation and to outline the roles of the Securities and Change Fee and the Commodity Futures Buying and selling Fee.

Whereas supporters argue it will scale back uncertainty and set up clearer compliance pathways, progress has slowed amid political and procedural challenges.

Senate Banking Committee Chair Tim Scott and Agriculture Committee Chair John Boozman are anticipated to steer the markup, which might nonetheless face amendments earlier than reaching a full vote.

Senator Cynthia Lummis had beforehand recommended the invoice might attain President Donald Trump’s desk earlier than the top of 2025, however that outlook now seems much less sure as election-year pressures start to weigh on bipartisan negotiations.

The submit U.S. Crypto Funds Shed $952M as Readability Act Delay Sparks Panic – However These 2 Alts Survive appeared first on Cryptonews.