US President Donald Trump’s declare {that a} “leaker on Venezuela” has been discovered and jailed after a gaggle of unusually well-timed bets on Polymarket following the arrest of Venezuelan President Nicolás Maduro.

Talking within the Oval Workplace this week, Trump stated the person chargeable for leaking delicate data associated to Venezuela was “in jail proper now” and will face a protracted jail sentence.

Whereas Trump didn’t title the particular person or reference betting markets immediately, his feedback instantly renewed scrutiny of a cluster of Polymarket accounts that positioned massive, extremely worthwhile wagers on Maduro’s elimination from energy shortly earlier than the information grew to become public.

Good Trades or Leaked Intelligence? Questions Develop as Polymarket Wallets Go Darkish

Blockchain analytics agency Lookonchain stated that two of the three wallets beforehand linked to these Venezuela-focused bets have grow to be inactive.

Donald Trump stated {that a} Venezuelan leaker is already in jail.

We seen that two of the three wallets that beforehand profited from betting on Venezuelan President Maduro being out of workplace have been inactive for 11 days.

The remaining pockets, "SBet365" positioned one other wager 2… https://t.co/GyZR4Lgd8i pic.twitter.com/fMP7QQ5tst— Lookonchain (@lookonchain) January 15, 2026

Lookonchain famous that these wallets stopped buying and selling across the similar interval Trump urged the leaker had been detained.

The agency highlighted that one account, recognized as 0xa72DB1, turned a $5,800 stake into roughly $75,000 by betting that Maduro could be out of workplace by January 31, 2026.

One other pockets, 0x31a56e, reportedly invested about $34,000 and walked away with greater than $400,000 earlier than disappearing from the platform round January 8.

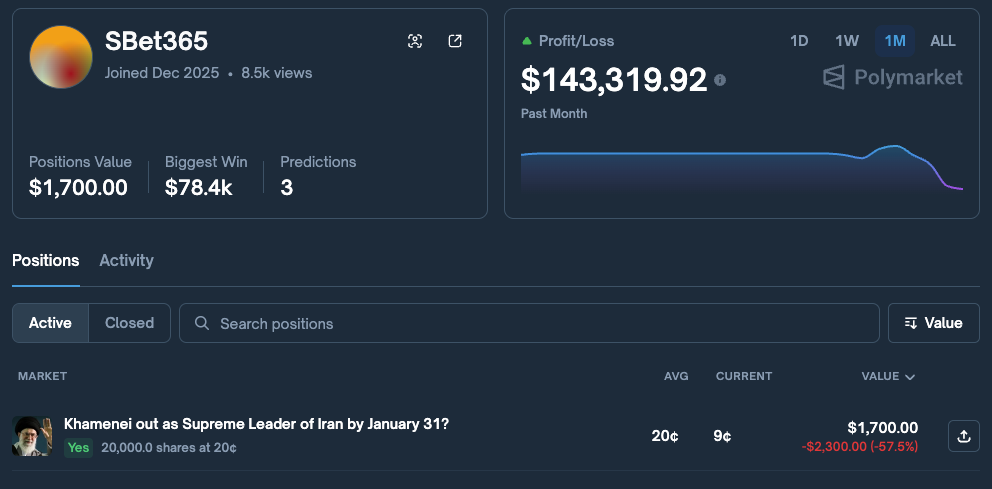

A 3rd pockets, often known as SBet365, stays energetic, as Lookonchain famous that this account positioned a brand new wager two days in the past predicting that Iran’s Supreme Chief Ayatollah Ali Khamenei could be faraway from workplace by the top of January.

The identical pockets had beforehand earned round $145,000 from Venezuela-related bets.

In early January, Lookonchain reported that the three wallets had been created and funded days prematurely, then out of the blue positioned massive bets simply hours earlier than Maduro’s arrest.

Three insider wallets on #Polymarket wager on Venezuelan President Maduro being out of workplace simply hours earlier than his arrest, netting a complete revenue of $630,484!

The three wallets had been created and pre-funded days prematurely.

Then, simply hours earlier than Maduro's arrest, they out of the blue… pic.twitter.com/VRAkQh8i9a— Lookonchain (@lookonchain) January 4, 2026

The timing of these trades has intensified issues about insider data flowing into prediction markets.

Authorized specialists be aware that leaking categorised or delicate authorities data can carry extreme penalties beneath U.S. regulation, significantly the Espionage Act.

Relying on the character of the knowledge, intent, and potential hurt, sentences can vary from a number of years in jail to a long time, alongside substantial fines and everlasting lack of safety clearance.

Current enforcement actions linked to Venezuela-related leaks recommend authorities are treating such circumstances aggressively.

Polymarket’s Rising Pains Spark Requires Prediction Market Reform

Whereas Polymarket markets are open to the general public, critics argue that entry to nonpublic authorities or army data undermines belief in platforms that mix components of finance, playing, and political forecasting.

Trump himself urged there might be multiple leaker, saying officers would “let you realize about that” if others are recognized.

The controversy comes as Polymarket faces separate backlash over its dealing with of Venezuela-related contracts.

On January 7, the platform stated it might not settle tens of millions of {dollars} in wagers tied as to whether america would invade Venezuela, regardless of Maduro’s seize throughout a U.S. operation.

Polymarket argued that the raid didn’t meet its contractual definition of an “invasion,” which it stated requires army motion meant to determine management over territory.

Over $10.5 million was wager on the outcome, and the ruling was not welcomed properly by many merchants, who accused the platform of fixing its understanding of the foundations retrospectively.

On January 6, Consultant Ritchie Torres additionally acknowledged he would introduce the Public Integrity in Monetary Prediction Markets Act of 2026.

The laws proposed would stop federal officers and political appointees from buying and selling prediction market contracts which can be primarily based on authorities actions or a political end result after they maintain materials nonpublic data or have entry to such nondisclosed data..

The put up Trump Jails ‘Venezuela Leaker’: Suspicious Polymarket Whales Go Silent After Correct Bets appeared first on Cryptonews.