The tokenized real-world belongings market has surged to $26.5 billion following 70% progress in 2025, but new analysis warns that fast enlargement may set off an “on-chain subprime disaster” by means of what analysts name the “RWA Liquidity Paradox.“

Tristero Analysis launched a complete examine warning that tokenization creates harmful mismatches between slow-moving bodily belongings and the hyper-fast blockchain market.

The analysis argues that wrapping illiquid belongings, resembling buildings, loans, and commodities, in liquid digital shells amplifies systemic danger relatively than lowering it.

Market Development and Trillion-Greenback Projections Defies Structural Considerations

The warning comes because the sector experiences large progress. RWA tokenization has expanded 245 instances since 2020, rising from $85 million to the present $26.5 billion market valuation.

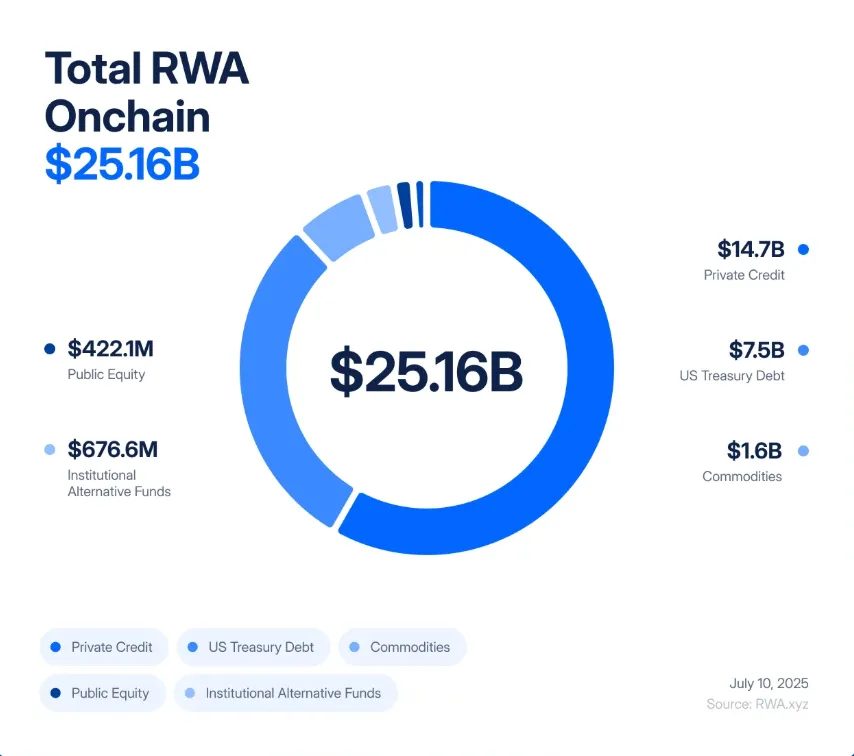

Personal credit score and U.S. Treasuries dominate almost 90% of tokenized worth, whereas Ethereum maintains 55% market share.

Trade projections stay bullish regardless of the warnings. Animoca Manufacturers’ analysis suggests the sector may faucet right into a $400 trillion conventional finance market, whereas Skynet’s 2025 RWA Safety Report forecasts progress to $16 trillion by 2030.

Tokenized U.S. Treasuries alone are projected to succeed in $4.2 billion this yr.

The regulatory local weather has improved considerably with the passage of the GENIUS Act, the primary main crypto laws authorised by Congress.

The invoice supplies regulatory readability for stablecoins and tokenization corporations, permitting establishments and expertise corporations to function beneath established frameworks.

Main gamers have positioned themselves strategically. BlackRock points tokenized Treasuries, Determine Applied sciences has billions in personal credit score on-chain, and actual property offers from New Jersey to Dubai commerce on decentralized exchanges.

Tokenization of RWAs may unlock a $400 trillion conventional finance market, in accordance with new analysis from @animocaresearch.#Tokenization #RWAhttps://t.co/Flp1yvBP3Y

— Cryptonews.com (@cryptonews) August 25, 2025

The Liquidity Paradox Warning: 2008 Monetary Disaster Would possibly Repeat Itself

Tristero Analysis’s evaluation facilities on basic structural flaws in present tokenization approaches.

The agency argues that tokenization doesn’t change asset traits. Workplace buildings, personal loans, and gold bars stay gradual and illiquid, regardless of digital wrappers that facilitate on the spot buying and selling.

The analysis in contrast this to the 2008 monetary disaster, when subprime mortgages had been remodeled into advanced securities by means of Mortgage-Backed Securities and Collateralized Debt Obligations, creating obvious liquidity from illiquid foundations.

The mismatch between gradual mortgage defaults and fast-moving derivatives amplified native issues into world shocks.

RWA tokenization dangers repeating this sample at blockchain pace. The analysis cited a business property token in New Jersey the place the constructing’s authorized switch requires weeks of title checks and county filings. Nonetheless, its digital illustration trades 24/7 on decentralized exchanges.

The analysis outlines potential disaster eventualities. In a single instance, a personal credit score protocol with $5 billion in tokenized SME loans faces real-world defaults whereas oracles replace month-to-month.

Market costs fall earlier than official valuations regulate, triggering automated liquidations that create suggestions loops, crashing all the system inside minutes.

A second state of affairs entails tokenized business properties the place custodian hacks or pure disasters compromise authorized claims.

On-chain tokens collapse instantly whereas underlying belongings stay intact, creating dangerous debt throughout DeFi protocols that used the tokens as collateral.

Moreover, the evaluation warns of “RWA-squared” derivatives, that are second-layer merchandise that bundle tokenized belongings into indices and structured merchandise.

These devices promise diversification however share correlation by means of DeFi infrastructure, that means oracle failures or protocol governance issues may crash all RWA derivatives concurrently.

Regulatory Progress and Market Growth

The GENIUS Act’s passage created speedy alternatives for compliant expertise corporations.

Talking with Cryptonews, Dave Hendricks, Vertalo’s CEO, mentioned the laws advantages builders greater than banks, as establishments searching for pace to market will probably purchase relatively than develop blockchain capabilities internally.

Equally, Walter Hessert from Paxos shared with Cryptonews that the Act validates years of compliant infrastructure growth alongside enterprises like Stripe, Mastercard, and PayPal.

The regulated digital greenback infrastructure now permits large-scale RWA tokenization with stablecoins serving as important on-chain settlement mechanisms.

In consequence, partnership alternatives emerged between conventional monetary establishments and blockchain expertise corporations.

Banks deliver shopper relationships and regulatory experience whereas tech corporations present infrastructure and compliance frameworks.

As an illustration, IBM is growing tokenization frameworks for enterprise belongings and financial institution cash to handle technical and governance challenges.

Nonetheless, challenges persist past regulatory readability. Whereas talking with Cryptonews, Ryan Zega from Aptos Labs recognized integration gaps between on-chain networks and off-chain monetary techniques as major obstacles.

Due to this, he advised that “there’s a unbroken want to teach policymakers, monetary establishments, and the general public on the sensible advantages of this expertise past headlines and hypothesis. That understanding will likely be key to long-term adoption.”

The put up Tristero Analysis Warns RWA Tokenization May Set off ‘On-Chain Subprime Disaster’ appeared first on Cryptonews.