Bitmine, the crypto agency led by Wall Avenue veteran Tom Lee, has expanded its Ethereum treasury as soon as once more, buying one other $69 million value of ETH by Galaxy Digital’s over-the-counter (OTC) desk.

The newest acquisition brings Bitmine’s holdings to roughly 1.95 million ETH, valued at $8.66 billion, in response to Arkham information.

Blockchain transaction data present a sequence of enormous transfers carried out between Galaxy Digital and Bitmine in current hours.

TOM LEE IS BUYING EVEN MORE $ETH

Tom Lee’s Bitmine simply purchased one other $69M of ETH from Galaxy Digital. They now maintain $8.66 BILLION of ETH.$BMNR is bullish on $ETH. pic.twitter.com/t9BWh9btPR— Arkham (@arkham) September 19, 2025

The settlements included 3,247 ETH ($14.55 million), 3,258 ETH ($14.6 million), 4,494 ETH ($20.06 million), and 4,428 ETH ($19.77 million), totaling 15,427 ETH, about $69 million, in beneath an hour.

The structured timing suggests coordinated OTC settlements, which permit institutional patrons to build up massive quantities with out disrupting open market costs.

Bitmine Crosses 2M ETH, Controls Almost 2% of Ethereum’s Provide

The acquisition underlines Bitmine’s aggressive accumulation technique. Knowledge exhibits that Ethereum accounts for almost the whole thing of its $8.65 billion portfolio, positioning the agency as the biggest company ETH treasury holder.

Different tokens in its portfolio are negligible by comparability, together with minor holdings of MakerDAO’s MKR and a handful of experimental tokens with only some thousand {dollars} in worth.

Bitmine’s newest buy follows a sequence of considerable buys over current weeks. On September 11, the corporate obtained 46,255 ETH value $201 million from a BitGo pockets throughout three addresses. Every week earlier, on September 4, Bitmine acquired 80,325 ETH valued at $358 million from Galaxy Digital and FalconX.

These acquisitions have lifted its complete stash properly above 2 million ETH in circulation, equal to about 1.8% of Ethereum’s complete provide.

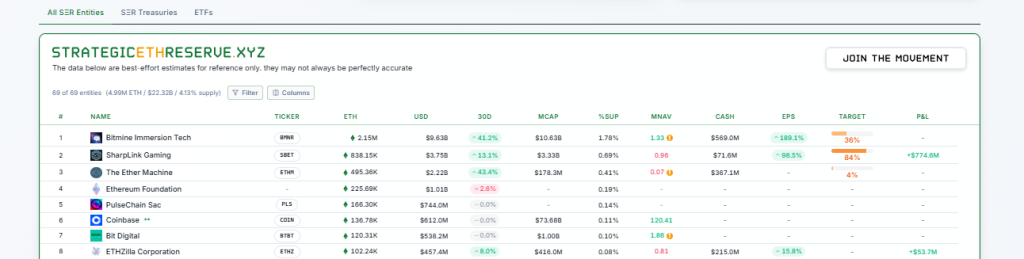

In keeping with treasury reserve information, company and institutional entities now collectively maintain about 4.99 million ETH value $22.2 billion, representing 4.13% of the token’s circulating provide.

Bitmine leads this group with 2.15 million ETH, valued at $9.59 billion at peak pricing, adopted by SharpLink Gaming with 838,000 ETH ($3.74 billion) and The Ether Machine with 495,000 ETH ($2.2 billion).

The Ethereum Basis, by comparability, holds about 225,000 ETH, whereas Coinbase’s treasury sits at 136,800 ETH.

The dimensions of Bitmine’s holdings has drawn comparisons to Technique’s long-standing bitcoin technique beneath Michael Saylor, the place massive company accumulation grew to become a cornerstone narrative for BTC’s institutional adoption.

Bitmine seems to be positioning itself as Ethereum’s equal, constructing a multi-billion-dollar ETH steadiness sheet as a long-term treasury reserve.

Ethereum itself has been buying and selling beneath stress regardless of the buildup. On the time of writing, ETH is altering palms at $4,465, down 2.8% previously 24 hours and 4.2% over the week.

Ethereum Treasury Corporations Broaden Holdings Amid SPAC Offers and Buybacks

The competitors amongst Ethereum treasuries is heating up as company methods evolve beneath market stress.

On September 17, The Ether Machine, an Ethereum-focused treasury agency, filed a draft registration assertion with the SEC to go public through a merger with Nasdaq-listed SPAC Dynamix Company.

@TheEtherMachine has filed a draft registration assertion with the SEC because it strikes ahead with plans to go public by a merger.#Ethereum #ETHhttps://t.co/vq7CHuD3Y7

— Cryptonews.com (@cryptonews) September 17, 2025

The deal, first introduced in July, is anticipated to shut within the fourth quarter, pending shareholder approval. The corporate has constructed a large place of 495,362 ETH after including 150,000 ETH in August.

In the meantime, SharpLink Gaming introduced the repurchase of 1 million shares at a median value of $16.67, a part of its ongoing buyback program.

Since late August, the agency has repurchased almost 1.94 million shares, citing undervaluation as the driving force. SharpLink reported a internet asset worth of $3.86 billion, or $18.55 per share, and confirmed it carries no excellent debt.

Analysts say Ethereum is rising as the important thing beneficiary of the digital asset treasury (DAT) increase.

In a report this week, Commonplace Chartered’s world head of digital property analysis, Geoffrey Kendrick, argued that ETH-focused treasuries are higher positioned than their Bitcoin and Solana counterparts.

Commonplace Chartered stated Ethereum has benefited greater than Bitcoin or Solana from digital asset treasury shopping for, citing stronger staking yields. #Ethereum #Bitcoin #treasurieshttps://t.co/p5yNkvvW87

— Cryptonews.com (@cryptonews) September 15, 2025

In contrast to Bitcoin, Ethereum and Solana generate staking yield, which helps greater valuations and long-term sustainability.

Since June, Ethereum treasuries have accrued about 3.1% of the token’s circulating provide. With valuations for a lot of DATs beneath stress, consolidation is anticipated, however Ethereum-focused companies look like gaining floor.

The publish Tom Lee’s Bitmine Buys One other $69M ETH, Holds Huge $8.66B Stack appeared first on Cryptonews.