The future, the place you purchase shares in a non-public firm identical to you purchase a inventory on an app, is right here now. No piles of paperwork, no locked‐in minimums, no geography limiting your entry.

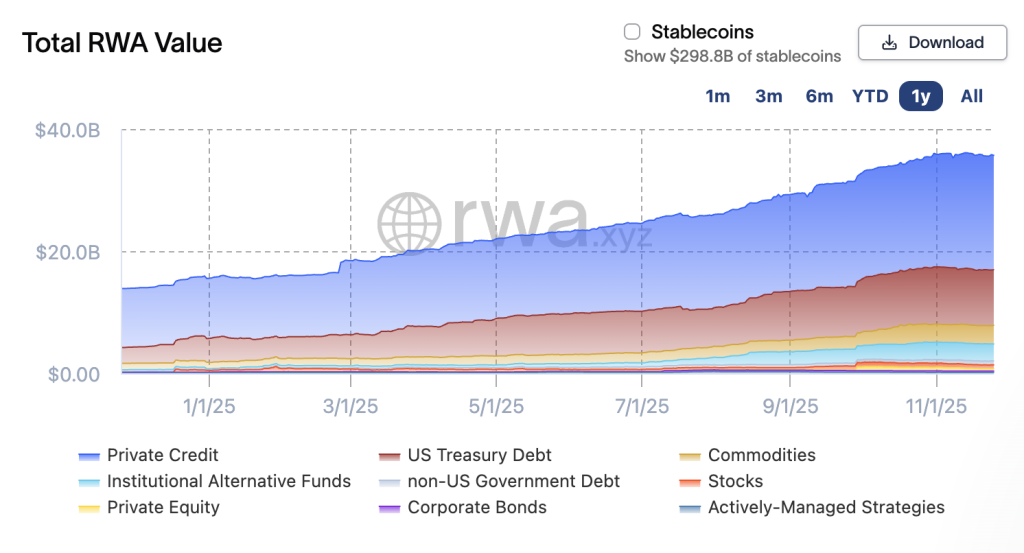

Main choices and real-world property (shares, bonds, actual property) are being tokenized and moved on-chain. Coinbase International just lately introduced a deal to accumulate the funding platform Echo (for almost $375 million in money and inventory) in a push towards blockchain-based capital formation.

But, that progress has a hidden downside: the programs beneath (those that monitor possession data, confirm identities, apply compliance guidelines, and handle investor onboarding) aren’t maintaining. Whereas buying and selling interfaces, platforms, and good contracts advance at a tempo, these programs are nonetheless fragmented and clunky.

The result’s that tokenized choices transfer slower, value extra, and stay largely sidelined slightly than going mainstream. The promise of really accessible tokenized markets will stay out of attain till this hidden bottleneck is addressed.

The Present Bottleneck

When an issuer decides to tokenize an asset, the headline second is commonly the good contract minting tokens, a market itemizing, or a fundraising cap being hit. However in actuality, the most important obstacles lie behind the scenes. Cap-table software program, id/KYC programs, compliance workflows, transfer-agent coordination – all that issuer‐aspect infrastructure – are incessantly separate, disconnected modules.

Put merely, one a part of the system handles who’s investing, one other handles what number of tokens every investor owns, whereas a 3rd handles who’s allowed to commerce or switch, and one more offers with audit and regulatory reporting. Many of those modules don’t combine, don’t share real-time knowledge, and sometimes require guide intervention. It’s as in case you tried to run a contemporary e-commerce enterprise with three totally different money registers that don’t speak to one another and no dashboard to see which register holds which buyer’s buy.

This fragmentation creates friction for everybody. Issuers face delays in launching choices, threat of errors when reconciling disparate data, and better compliance prices when guide checks dominate. Traders endure from gradual onboarding, confusion about rights and possession, and typically restricted secondary liquidity as a result of transfers need to navigate a number of disconnected programs.

Regulators face the next threat, too, with audit trails which can be inconsistent and laborious to supervise. Regardless of billions in tokenized property, buying and selling quantity stays low, and most tokens are held slightly than actively traded.

Briefly, the bottleneck isn’t the good contract or the itemizing. It’s the plumbing behind the issuance, possession monitoring, transfers, and audit. Till these programs function in a unified loop, tokenization will proceed to be an fascinating area of interest as an alternative of a mainstream infrastructure for markets.

How Subsequent-Technology Platforms Clear up It

The true worth in tokenized markets lies not within the second of issuance however within the lifecycle: issuance → investor onboarding → holding → secondary switch → audit/reporting → rotation. To make that lifecycle environment friendly, we want a platform the place onboarding, compliance, cap-table updates, switch rights, and audit reporting are linked seamlessly, slightly than patched collectively.

The repair isn’t one other change or token customary – it’s connecting programs that exist already.

That is the workflow an issuer makes use of after logging in: they full id verification for an investor, concern tokens that instantly replace the cap desk, embed compliance guidelines within the tokens in order that any switch routinely triggers overview, and have audit-ready data generated in actual time. From the investor aspect, they confirm as soon as, obtain a token, commerce it or maintain it, and know all of the rights are accurately embedded.

Distinction that with at this time’s norm: investor verifies through one system, issuer updates a separate cap-table, switch agent reconciles later, and audit stories are cobbled collectively manually.

Within the next-generation mannequin, issuers launch quicker, with fewer errors and decrease value; buyers expertise smoother onboarding and clearer possession; regulators achieve real-time visibility and stronger record-keeping. The tokenized asset is now not a standalone novelty, however a part of a market-ready infrastructure the place issuance, possession, transfers, and audit all stream in a single structure. That change transforms tokenization from a intelligent thought right into a scalable market layer.

Why This Issues to Markets and Traders

When the backend infrastructure works seamlessly, the implications are profound. Tokenized property can turn into genuinely liquid, regulated, accessible, and investable at scale. For buyers, meaning entry to beforehand illiquid asset courses (actual property, non-public credit score, infrastructure) with decrease minimums, clearer possession, and extra tradability. For issuers, in flip, it means quicker fundraising, international investor attain, and fewer operational bottlenecks.

It additionally issues for regulators and the ecosystem at giant. Tokens that embed possession, compliance, and audit within the infrastructure create transparency and belief. That is important if on-chain property are to take a seat alongside conventional monetary markets slightly than in remoted sandboxes. The worldwide scale potential is big: stories recommend tokenization might seize trillions of {dollars} of worth as these programs evolve.

But when infrastructure stays fragmented, tokenized property will stay caught – created, provided, and held, however not often traded or liquid. And meaning digital finance’s promise of quicker, fairer, and extra inclusive investing will stay partially fulfilled at greatest.

Closing Ideas

The way forward for investing could possibly be quicker, fairer, and extra accessible – however provided that we repair the plumbing. Tokens could be the entrance finish of innovation, however the true progress will occur behind the scenes, the place id, compliance, and possession converge. As soon as the infrastructure catches up, tokenized markets received’t simply be attainable – they’ll be unstoppable.

Disclaimer: The views and opinions expressed on this article are these of the creator and don’t essentially mirror the views of Cryptonews.com. This text is for informational functions solely and shouldn’t be construed as funding or monetary recommendation.

The submit Tokenized Markets Are Prepared, However Their Infrastructure Isn’t: The Hidden Bottleneck in On-Chain Actual-World Belongings appeared first on Cryptonews.