Key Takeaways:

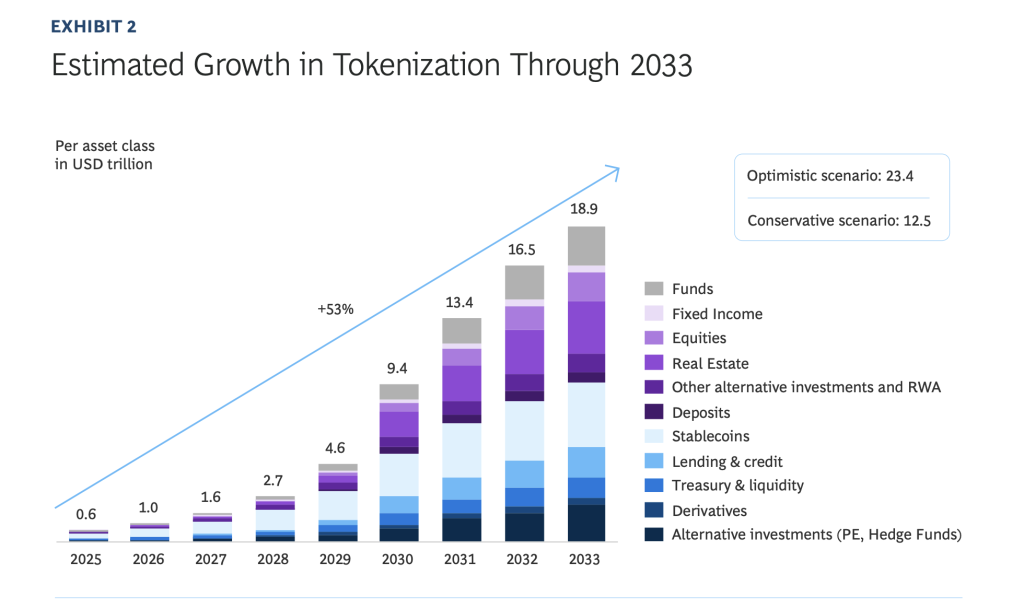

- Tokenized real-world property are projected to surge from $0.6 trillion to $18.9 trillion by 2033.

- The report was a collaboration between Ripple and Boston Consulting Group (BCG).

- This surge displays a elementary transformation of worldwide monetary infrastructure.

- Progress is pushed by regulatory readability, mature know-how, and institutional momentum.

A Ripple report launched on April 7 exhibits that tokenized real-world property are projected to soar from $0.6 trillion in 2024 to $18.9 trillion by 2033.

By 2033, a $0.6T → $18.9T shift is coming as tokenization reshapes international finance.

Why?Regulation & institutional adoption

Actual-world property like bonds & actual property

Sooner, interoperable monetary infrastructure

The establishments that act now will lead the subsequent… pic.twitter.com/RjJcACzWm2— Ripple (@Ripple) April 7, 2025

This progress exhibits a compound annual progress price of 53% and marks a brand new interval the place monetary property are now not static devices however dynamic, programmable instruments that function on shared digital ledgers.

he report, which was performed in collaboration with Boston Consulting Group (BCG) and shared with Cryptonews, outlines a three-phase evolution of tokenization that’s already underway.

The monetary business is experiencing a interval of low-risk adoption, throughout which establishments are tokenizing acquainted monetary devices reminiscent of cash market funds and bonds.

As confidence within the know-how grows, the second section is anticipated to see the enlargement into extra advanced asset courses together with personal credit score and actual property.

Tokenization will culminate in a market transformation the place the know-how turns into totally built-in into each monetary and non-financial merchandise. This push is being pushed by a mixture of regulatory readability, maturing technological infrastructure, and the momentum of institutional investments.

Tokenized Property Adoption Led by BlackRock, Constancy, and JPMorgan

Key gamers within the monetary sector are already embracing this shift. Main establishments reminiscent of BlackRock, Constancy, and JPMorgan have begun to operationalize tokenization.

Tibor Merey, Managing Director and Accomplice at BCG, explains that tokenization transforms monetary property into programmable, interoperable instruments that allow 24/7 transactions, fractional possession, and automatic compliance.

Regulatory readability is rising as a vital issue for this transition, with markets within the European Union, the United Arab Emirates, and Switzerland largely establishing clear tips.

Related progress is anticipated in america, pushing institutional momentum.

Alongside regulatory developments, the maturation of know-how—evidenced by refined wallets and custody platforms—and strategic investments by means of bank-fintech mergers and acquisitions are making a reinforcing “flywheel impact.”

This impact is shaped by a self-reinforcing cycle by which institutional provide and investor demand constantly push the adoption of tokenized property.

Markus Infanger, Senior Vice President of RippleX, says the market is shifting from tokenized property merely present on a blockchain to being totally built-in into actual financial exercise.

This integration guarantees to streamline processes, cut back reliance on intermediaries, and unlock new income streams.

By permitting prompt 24/7 transactions and fractional possession of property, tokenization is anticipated to interrupt down obstacles which have slowed down entry to international capital markets.

Nevertheless, the journey is just not with out its challenges. Fragmented infrastructure and regulatory divergences stay notable hurdles

But, business stakeholders are collaborating on frequent requirements and infrastructures to beat these obstacles.

Tokenization No Longer a Speculative Idea

As Bernhard Kronfellner, Accomplice & Affiliate Director at BCG, notes, tokenization is now not a speculative idea however the cornerstone of the way forward for international finance.

The Ripple report makes it clear that establishments will transition from pilot tasks to totally scaled operations.

The publish Tokenized Property to Surge to $19 Trillion by 2033: Ripple Report appeared first on Cryptonews.