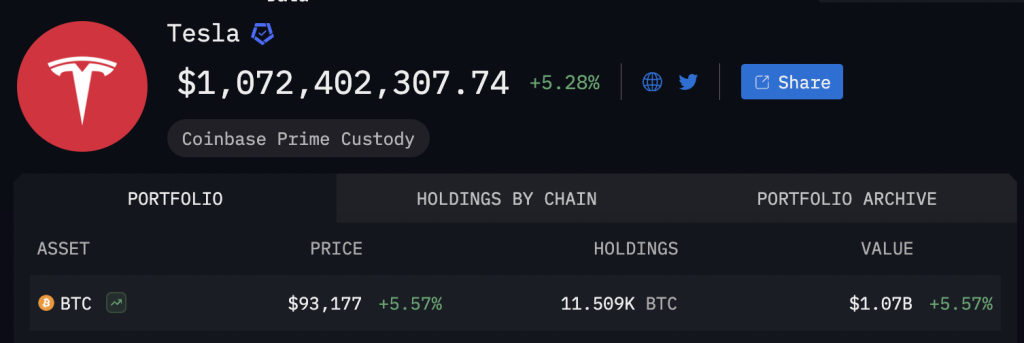

Tesla reported holding $951m in Bitcoin on the finish of the primary quarter, sustaining its place as one of many largest company holders of the cryptocurrency.

The determine, disclosed in its earnings launch on Tuesday, is down from $1.076b on the shut of December, reflecting the dip in Bitcoin’s value throughout the quarter. Tesla didn’t promote any of its holdings, based on on-chain information from Arkham Intelligence.

Tesla continues to carry 11,509 Bitcoin, a place it started accumulating in early 2021 when it grew to become the primary main automaker so as to add the digital asset to its steadiness sheet.

FASB Rule Change Lifts the Lid on Unrealized Bitcoin Good points

This isn’t the primary time Tesla’s financials have mirrored the influence of latest accounting requirements for digital property. The newest determine comes underneath the Monetary Accounting Requirements Board’s up to date rule requiring firms to mark crypto holdings to market every quarter.

Beforehand, firms needed to document the bottom worth of the asset throughout the reporting interval, typically obscuring unrealised positive factors. The change now permits companies like Tesla to current a extra correct view of their digital asset positions.

It additionally comes at a time when institutional confidence in Bitcoin is strengthening, regardless of ongoing macroeconomic uncertainty.

Q1 Earnings Fall Quick as Tesla Battles Price Pressures and Slowing Demand

Whole income declined 9% to $19.3b, down from $21.3 billion a 12 months in the past. Automotive income fell 20%, dropping to $14b from $17.4b in the identical quarter final 12 months.

Web revenue plunged to $409m, or 12 cents per share, down sharply from $1.39b, or 41 cents, a 12 months earlier. The corporate didn’t difficulty new development steering for the 12 months and stated it could revisit its 2025 outlook within the subsequent quarter.

CEO Elon Musk has been spending important time in Washington, working with the Trump administration on a broad plan to cut back the dimensions of the federal authorities. The White Home’s sweeping tariff coverage has raised issues for EV producers, as larger import prices for key inputs corresponding to battery elements, circuit boards and specialty glass threaten to erode margins.

The submit Tesla Posts $951M in Bitcoin Holdings Regardless of 20% Drop in Q1 Auto Income appeared first on Cryptonews.