On October 11, 2025, the crypto markets went right into a tailspin. Bitcoin, Ether, and an entire lineup of altcoins tanked arduous inside just some hours. Over $19 billion vanished in liquidations — abruptly and inexorably.

Merchants took large hits adopted by numerous stop-losses and margin calls, whereas exchanges struggled to maintain up, and social media was instantly flooded with hypothesis, finger-pointing, and wild theories. It was, with out exaggeration, one of the turbulent days the trade’s ever seen.

The Collateral Entice: Inner Pricing and Systemic Danger

The vulnerability crept out of Binance’s Unified Account system, which allowed customers to put up a big selection of property, together with collateralized derivatives like wBETH and BNSOL. The flaw wasn’t within the property themselves, however in how they have been valued. As a substitute of referencing exterior oracles or redemption costs, Binance relied by itself inside spot market costs. That meant if somebody may manipulate the order books, they might immediately devalue the posted collateral and set off mass liquidations throughout the platform.

The results have been instant and extreme. But, whereas the broader crypto market confronted important volatility, asset-backed stablecoins equivalent to USDC and Tether maintained their pegs and demonstrated resilience. In distinction, algorithmic stablecoins struggled to maintain up. Some deviated sharply from their greenback targets, others froze redemptions fully. So the occasions on October 11 actually shattered any lingering confidence within the supposed liquidity of stablecoins. It introduced again reminiscences of the Terra (LUNA) collapse in Could 2022, when UST misplaced its peg and $40 billion evaporated from the crypto market instantaneously. That incident uncovered severe weaknesses within the crypto structure, and someway these vulnerabilities are nonetheless in place.

Each occasions spotlight a vital actuality: whether or not we’re speaking a few token or a buying and selling platform, the steadiness of digital finance hinges on clear, dependable collateral and robust redemption mechanisms. With out these foundations, liquidity is only a fragile phantasm ready to break down.

Stablecoins Underneath Stress: A Story of Two Fashions

Stablecoins are sometimes dubbed as digital {dollars}, promising stability, quick transactions, and international attain. However when markets flip risky, issues get difficult. Liquidity, it seems, is not only about quantity or velocity. It’s about construction — how redemption works, what backs the token, and whether or not that backing can stand up to a shock.

The latest crash was a stress take a look at, and lots of stablecoins failed it. It turned clear that having tangible backing issues much more than intelligent programming when the stress’s on. This isn’t a brand new debate, however the scale and velocity of the October occasion amazed.

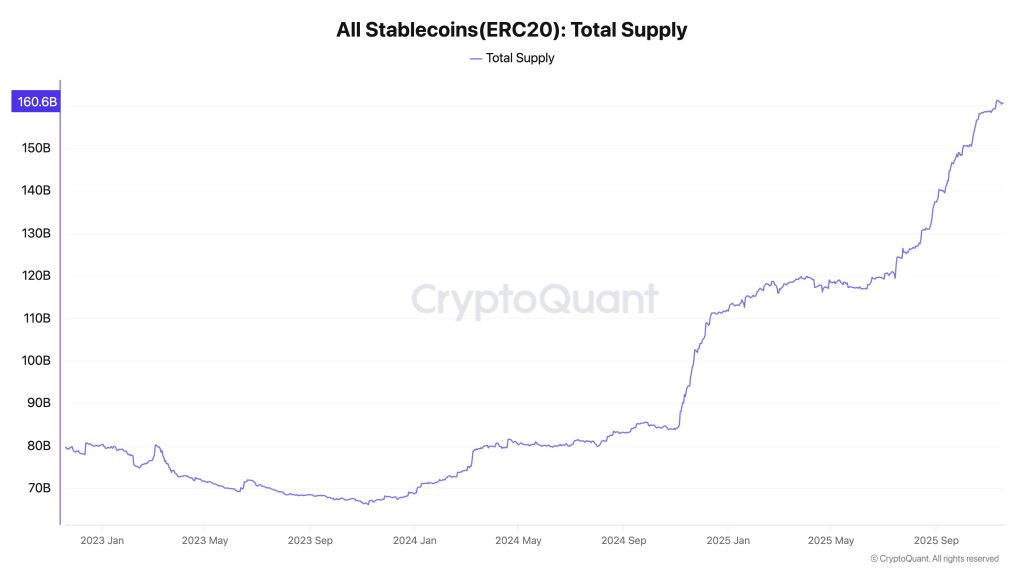

Some analysts predict that the worldwide stablecoin provide may surge to $1 trillion by the top of 2025. It displays the complete system’s scale and significance. Stablecoins are more and more utilized in cross-border funds, DeFi protocols, and even institutional settlement layers. Their liquidity profile issues not simply to merchants, however to central banks, regulators, and monetary establishments exploring digital greenback methods.

Nevertheless, liquidity in stablecoins might be each resilient and fragile. The phantasm of broad liquidity arises when redemption is promised however not assured, or when collateral is opaque, illiquid, or just restricted to unapparent inside pricing. In Binance’s case, the usage of inside spot costs created a suggestions loop permitting attackers to control collateral values and set off cascading liquidations. The lesson is obvious: pricing and redemption have to be anchored in exterior, verifiable information.

Why TradFi Requirements Nonetheless Matter in a Crypto World

This brings us to the following part of stablecoin evolution. It is going to not be outlined by only a slew of latest tokens or revolutionary algorithms. It will likely be formed by how liquidity is structured, monitored, and redeemed underneath stress. TradFi has spent many years constructing requirements for collateral, redemption, and danger administration. To keep away from contagion and earn institutional belief, stablecoins want to start out embracing ideas that mirror conventional finance, however be taught from it reasonably than blindly mimicking it.

Moreover, collateral transparency is not non-obligatory. This implies real-time audits, exterior pricing oracles, and redemption pathways securing unconditional performance even throughout market stress. It additionally means rethinking algorithmic fashions that promise stability with out substance.

Revealed systemic dangers sound an alarm. If a single trade’s pricing mechanism can set off billions in liquidations, what would occur when stablecoins are deeply built-in into international fee methods? What if an identical assault have been launched towards a stablecoin used for payroll, remittances, or central financial institution digital forex settlement?

Liquidity Isn’t Simply Quantity. It’s a Market Construction

Belief in digital greenback methods isn’t only a matter of strong code. Efficient governance, operational transparency, and general system resilience are essential on this context. The latest notorious occasion identified that even superior platforms have their Achilles heel.

Actual, unbiased teamwork between regulators and builders is vital. The goal shouldn’t simply be to imitate the standard finance playbook; as a substitute, we must always deal with creating frameworks to safeguard DeFi innovation by organising strong liquidity reserves, clear collateral necessities, and stress testing procedures that transcend principle. They should be examined and confirmed in real-world situations.

The crypto market will definitely recuperate. It at all times does. However the classes of October 2025 shouldn’t be forgotten. On this planet of crypto, this carcass construction begins with how we design, worth, and redeem our quantums of belief, our digital property.

Disclaimer: The views and opinions expressed on this article are these of the creator and don’t essentially mirror the views of Cryptonews.com. This text is for informational functions solely and shouldn’t be construed as funding or monetary recommendation.

The put up Stablecoins Underneath Hearth: Classes from the October 2025 Crypto Crash appeared first on Cryptonews.