Key Takeaways:

- Botanix cofounder Alisia Painter says the stablecoin market will exceed $1 trillion in 2026.

- Progress to be pushed by institutional adoption, new yield-bearing tokens and cross-border funds.

- Over 20% of all lively stablecoins will supply embedded yield or programmability options subsequent 12 months.

The stablecoin market will greater than triple to succeed in $1 trillion in circulation subsequent 12 months, spurred by institutional adoption, new yield-bearing tokens and stronger cross-border funds, in keeping with one business govt.

“The largest shift will likely be from static stablecoins to yield-bearing stablecoins and artificial {dollars} backed by actual belongings,” Alisia Painter, co-founder and chief working officer of Bitcoin DeFi builder Botanix Labs, instructed Cryptonews.

“Greater than 20% of all lively stablecoins will supply embedded yield or programmability options [in 2026]. This development will speed up cross-chain settlement, payroll, and worldwide commerce.”

Painter customers will begin to “deal with digital {dollars} as financial savings devices relatively than static balances, particularly in ecosystems anchored to Bitcoin the place customers already view on-chain belongings as long-term shops of worth.”

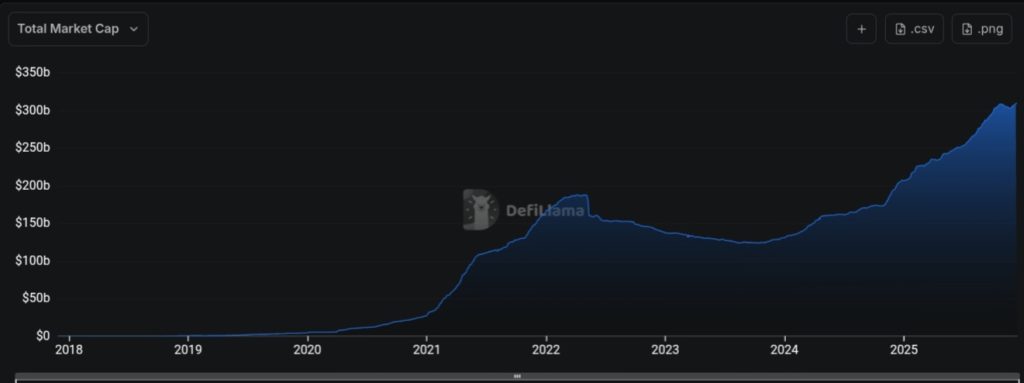

The stablecoin market is at the moment value $310 billion, an all-time excessive, in keeping with Defillama. Tether’s USDT dominates, accounting for 60%, or $186 billion, of market share, adopted by Circle’s USDC at $78.5 billion.

Ethena’s so-called “artificial greenback” USDe ($6.6 billion), Sky Greenback’s USDS ($6.4 billion), and MakerDAO’s DAI ($4.6 billion) spherical out the highest 5 largest dollar-pegged stablecoins.

Painter says whereas stablecoins will proceed to develop as a sub-sector, focus is shifting into programmable devices that may be embedded in cost methods, tokenized Treasury merchandise and fintech apps.

“Establishments will demand stablecoins that do greater than sit idle, and yield fashions anchored in Bitcoin-based collateral will grow to be extra in style,” she stated, including:

“Establishments and fintech platforms are integrating stablecoins as cost and settlement instruments. Circle processed greater than $12 trillion [in USDC] on-chain transaction quantity in 2023, demonstrating how rapidly stablecoins have gotten mainstream monetary infrastructure.”

From Static Stablecoins to Programmable {Dollars}

One other key driver is the rise of tokenized U.S. Treasuries, whose provide exceeded $3 billion this 12 months, a 10x enhance in about two years, exhibiting “vital institutional urge for food for yield-backed digital {dollars}.”

The demand for high-yield, blockchain-settled belongings is underpinned by artificial {dollars} resembling USDe and USDf – stablecoins that don’t depend on bodily {dollars} or authorities debt to take care of their greenback peg. As a substitute, they mix belongings like Ethereum or Bitcoin with derivatives positions.

Painter stated upgrades at main blockchains, together with new Bitcoin-based networks and Ethereum scaling methods, have lowered charges and boosted pace, “making stablecoins extra sensible for on a regular basis funds.”

She spoke about how development is not going to come merely from extra utilization, however newer stablecoin designs that put yield straight into balances.

“Customers will now not want to maneuver between a stablecoin and a separate yield product. The stablecoin performs each features [accruing return].”

Yield-bearing stablecoins are significantly enticing in rising markets battling excessive inflation — economies the place dollar-denominated financial savings already play an enormous position, stated Painter, who has been concerned with Bitcoin since 2015.

“In markets the place annual inflation exceeds 20%, a yield-bearing greenback turns into a pure default for each private financial savings and small enterprise treasury administration, and it typically acts as an entry level into Bitcoin.”

Stablecoins are a lifeline for folks in Nigeria who ship cash throughout borders and commerce. Conventional remittance channels cost as much as 7% in charges, however crypto cuts these prices in an enormous manner, in keeping with a Chainalysis adoption report.

Crypto adoption can be rising in Southeast Asia. The Philippines, the place remittances account for about 9% of GDP, has seen greater than 1,000,000 retailers settle for stablecoins by way of cell wallet-linked platforms.

It’s a change that’s affecting Bitcoin-based decentralized finance (DeFi), Painter tells Cryptonews. Lending markets might want to alter for the truth that their baseline collateral, the stablecoin itself, earns yield, she acknowledged.

Automated market makers will want new pricing fashions that account for steady stablecoin curiosity accrual, the Botanix COO added.

“New primitives designed particularly for Bitcoin-based monetary methods will emerge, together with merchandise that separate principal and yield streams or mix steady yield with native Bitcoin incentives.”

Nonetheless, new stablecoin features additionally include technical and regulatory challenges.

Regulatory and Technical Challenges

“Yield-bearing merchandise require extra granular and extra frequent reporting, together with period of belongings, counterparty publicity, and proof that person belongings are segregated,” Painter detailed.

Draft U.S. laws could limit sure types of curiosity distribution to retail customers, she stated. On the technical aspect, questions stay about how yield is delivered on-chain, how rates of interest are up to date, and the way the belongings work together with DeFi lending and automatic market methods.

“Poorly designed yield logic might create accounting points throughout DeFi.”

Didier Lavallée is the founder and CEO of Canadian crypto firm Tetra Digital Group. Tetra is creating CADD, a fully-regulated stablecoin, with backing from the Nationwide Financial institution of Canada, Shopify and Wealthsimple.

Talking to Cryptonews, Lavallée stated 2026 would be the 12 months when non-USD stablecoins develop in adoption and quantity, pushed by elevated regulatory readability internationally.

“An increasing number of international locations are adopting frameworks and laws to permit for innovation. It’s solely a matter of time earlier than stablecoin ecosystems fragment into regional and native markets.”

Stablecoin oversight superior sharply in 2025, with frameworks resembling Europe’s MiCA, the U.S. GENIUS regulatory blueprint and up to date steerage from the U.S. Workplace of the Comptroller of the Forex (OCC).

“Banks now have a clearer framework for a way they’ll maintain stablecoins for community charges, supply custody, and take part straight in blockchain networks,” stated Kevin Lehtiniitty, CEO of stablecoin funds community Borderless.xyz, in an interview with Cryptonews.

“World wide, regulators are publishing related roadmaps centered on funds innovation and stablecoin integration,” he added. Lehtiniitty expects the development to proceed in 2026, as extra establishments enter the market.

2025: A Breakout Yr for Stablecoins

Borderless has began to combine straight with banks and stablecoin issuers, the CEO stated, increasing its protection throughout new corridors, to align with the altering regulatory atmosphere.

The corporate additionally launched a public benchmark, which exhibits stablecoin-to-fiat international forex (FX) charges to extend transparency in a market lengthy criticized for opaque buying and selling. Borderless tracks real-time FX spreads throughout stablecoin venues.

“Our purpose is to make sure companions can entry protected and controlled liquidity as stablecoins grow to be extra embedded in international cross-border funds,” Lehtiniitty stated.

He predicts a bifurcated FX market subsequent 12 months as liquidity deepens.

“We usually see two sorts of liquidity suppliers,” he famous. “‘Naked-metal’ venues competing [on the narrowest possible spreads], and ‘orchestrator or aggregator’ venues that concentrate on premium options and performance.”

As liquidity grows, spreads in low-cost venues are tightening, making stablecoin FX more and more aggressive with conventional fiat funds.

Lehtiniitty stated the quantity of unfold charged will proceed to fragment as firms discover completely different methods.

“For cost firms and fintechs, it is going to be more and more necessary to have multi-venue connectivity and execution capabilities.”

In the meantime, 2025 was a breakout 12 months for stablecoins, consultants say. Key milestones included:

- Regulatory readability throughout the U.S., Europe, and rising markets.

- Stablecoin issuers going public, signaling market maturity.

- A surge in institutional adoption, from banks to international fintechs. Greater than 80% of banks have a digital asset technique in place.

- Document utilization in cross-border funds and buying and selling.

“We consider that these developments are setting the stage for stablecoins to grow to be an important monetary instrument in 2026 in addition to extra use instances for it,” stated Borderless’ Lehtiniitty.

The publish Stablecoins to Attain $1 Trillion in 2026 Spurred by Yield Tokens: Skilled appeared first on Cryptonews.