Fireblocks, the $8 billion crypto infrastructure supplier, has launched a stablecoin fee community with over 40 institutional individuals.

In keeping with a Fortune report, the Fireblocks Community for Funds contains members similar to Bridge (lately acquired by Stripe), stablecoin firms Zerohash and Yellow Card, and issuer Circle.

This community plans to streamline how monetary establishments and crypto corporations transfer stablecoins between one another whereas constructing new stablecoin merchandise, addressing what CEO Michael Shaulov describes as pricey infrastructure challenges.

Not like Circle’s current funds community, which focuses completely on USDC, Fireblocks’ platform helps a number of stablecoins, giving individuals higher operational flexibility.

The community gives customers entry to banking relationships and regulatory licenses from a broader vary of firms than prospects would usually attain independently.

Multi-Stablecoin Infrastructure Addresses Enterprise Ache Factors

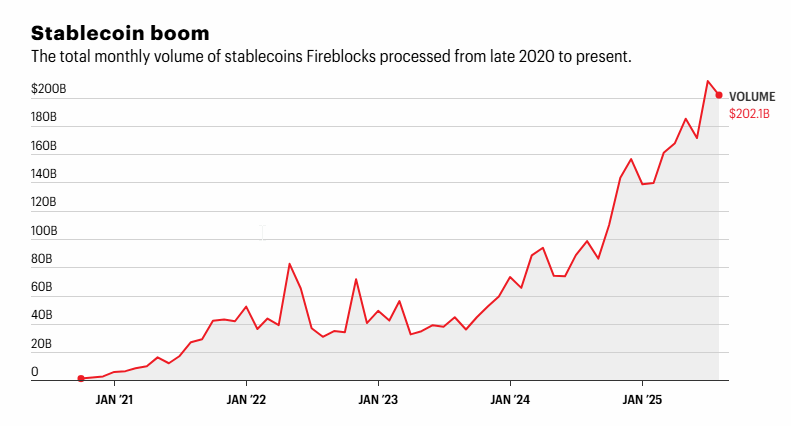

Fireblocks already processes billions of {dollars} in stablecoin quantity every day, attaining a file $212 billion in July alone throughout its current infrastructure.

Nonetheless, Shaulov famous that the corporate’s authentic community was constructed primarily for crypto buying and selling relatively than specialised stablecoin operations.

The brand new community fills this operational hole by permitting seamless conversion between completely different stablecoins and facilitating cross-border transfers.

This launch builds on Fireblocks’ latest growth into stablecoin-focused infrastructure, together with its June integration with Codex, a purpose-built blockchain for stablecoin finance.

Codex presents on the spot settlement capabilities and permits establishments to create wallets with zero extra integration work.

The corporate has additionally partnered with Japan’s SMBC (via mother or father Sumitomo Mitsui Monetary Group) and Ava Labs to pilot stablecoin launches, with trials anticipated to start within the second half of 2025.

SMFG, the mother or father firm of Japan’s second-largest financial institution SMBC, is getting ready to launch a stablecoin in partnership with @avax

and @FireblocksHQ.#SMBC #Avalabshttps://t.co/rLwHg1TNUi— Cryptonews.com (@cryptonews) April 2, 2025

If profitable, SMBC might launch its stablecoin as early as subsequent 12 months, probably decreasing cross-border fee prices by bypassing conventional SWIFT intermediaries.

Institutional Adoption Accelerates Throughout Stablecoin Ecosystem

The Fireblocks launch coincides with quickly accelerating institutional adoption, as revealed within the firm’s Could survey of 295 executives throughout banks, fintech corporations, and fee processors.

Analysis has proven that 90% of economic establishments are both actively utilizing or exploring stablecoin integration into their operations.

In the meantime, company giants are transferring past exploration towards lively growth, with Amazon and Walmart reportedly contemplating their very own USD-backed stablecoins to scale back transaction charges.

Cost processor Stripe can be growing a dollar-backed stablecoin for markets exterior the U.S., UK, and Europe, constructing on its October 2024 launch of stablecoin fee choices.

In keeping with DefiLlama knowledge, the whole stablecoin market capitalization now stands at roughly $285 billion, reflecting 56% year-over-year development.

Business projections counsel the sector might attain $1 trillion in annual fee quantity by 2028, with Citigroup forecasting much more dramatic growth to a market cap of over $2 trillion by 2030.

Banking Business Raises Systemic Danger Considerations

Nonetheless, this speedy development has seen pushback from conventional banking establishments, with Citigroup govt Ronit Ghose warning that stablecoin curiosity funds might set off a deposit flight just like the Nineteen Eighties disaster, when cash market funds drained $32 billion from banks in two years.

Citi govt warns stablecoin curiosity funds might drain financial institution deposits just like the Nineteen Eighties disaster amid GENIUS Act loophole considerations.#Stablecoin #Bankshttps://t.co/aaHxz9bXHM

— Cryptonews.com (@cryptonews) August 25, 2025

Main banking teams, together with the American Bankers Affiliation, are lobbying Congress to shut what they name a “loophole” within the GENIUS Act that enables crypto exchanges to supply yields on third-party stablecoins.

Former Individuals’s Financial institution of China Governor Zhou Xiaochuan has individually warned that stablecoin issuers might pursue aggressive growth with out understanding systemic dangers.

Zhou cited amplification results that may create redemption strain past preliminary reserves, referencing the Could 2022 TerraUSD collapse, the place arbitrage mechanisms accelerated relatively than contained the disaster.

Latest analysis means that main stablecoins face a roughly one-in-three likelihood of a disaster over the subsequent decade resulting from design vulnerabilities in how they deal with excessive market stress.

Regardless of these considerations, Treasury Secretary Scott Bessent has expressed help for stablecoin adoption, arguing that digital {dollars} will “develop greenback entry for billions throughout the globe and result in a surge in demand for U.S. Treasuries” as backing belongings.

The submit Stablecoin Adoption Explodes: Fireblocks Unveils Cost Community With Stripe Bridge, Circle, 40+ Companies appeared first on Cryptonews.