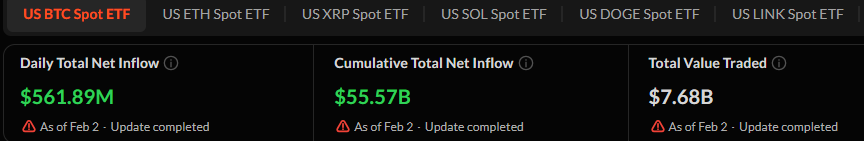

U.S. spot Bitcoin exchange-traded funds skilled a major turnaround in investor flows on February 2, as nearly $562 million in web each day flows had been attracted after weeks of steep web outflows, in keeping with information compiled by SoSoValue.

The rebound was one of many largest single-day inflows for the reason that starting of January and drove cumulative web inflows in all U.S. Bitcoin spot ETFs to 55.57 billion.

This influx has raised issues about whether or not institutional demand is coming again or it’s simply short-term positioning in a weak market background.

After January Redemptions, Bitcoin ETF Flows Present Indicators of Life

The influx restoration got here after a difficult interval of Bitcoin-linked funding merchandise.

Over the past two weeks of January, spot ETFs have been hit with successive heavy redemptions, with web outflows of $817.87 million on January 29 and 509.70 million on January 30.

These sell-offs had been accompanied by declining crypto costs, declining alternate volumes, and a extra risk-off sentiment that additionally burdened equities.

Main inventory indexes have been shifting down since October, and the buying and selling in each standard and crypto markets has been very skinny with diminished publicity.

Crypto alternate shares have dropped almost 60% for the reason that $19B October liquidation as #Bitcoin costs fell and buying and selling volumes collapsed, hitting $COIN, $BLSH, and $GEMI.#Coinbase #CryptoStockshttps://t.co/LZAiFSYVRf

— Cryptonews.com (@cryptonews) February 2, 2026

Regardless of Monday’s influx surge, whole web property held by the U.S. Bitcoin spot ETFs fell to $100.38 billion, down sharply from highs above $125 billion seen in mid-January.

The decline displays Bitcoin’s worth drawdown relatively than a collapse in ETF participation.

Buying and selling exercise rebounded alongside inflows as the full each day traded worth throughout spot Bitcoin ETFs reached $7.68 billion, up from subdued ranges earlier within the week, suggesting lively repositioning relatively than passive inflows.

Bitcoin ETF Demand Persists By Market Pullback

BlackRock’s iShares Bitcoin Belief remained the dominant fund by measurement, holding $60.17 billion in web property.

IBIT recorded $141.99 million in each day inflows, equal to roughly 1,810 BTC, at the same time as its shares closed down almost 7% and traded at a slight low cost to web asset worth.

Constancy’s FBTC led the day in inflows, attracting $153.35 million, or about 1,960 BTC. The fund’s cumulative inflows climbed to $11.43 billion, with whole web property of $15.18 billion.

Grayscale’s legacy Bitcoin Belief, GBTC, noticed no new inflows and remained burdened by cumulative web outflows of $25.70 billion.

Different issuers additionally posted constructive flows as Bitwise’s BITB added $96.5 million, ARK Make investments and 21Shares’ ARKB introduced in $65.07 million, and VanEck’s HODL gained $24.34 million. Smaller funds largely reported flat exercise.

Modest Bitcoin Bounce Fails to Ease Bearish On-Chain Information

The rebound got here as Bitcoin costs stabilized modestly after weeks of declines. Bitcoin traded round $78,900, up roughly 2.5% on the day, whereas Ethereum rose about 3% to $2,314.

Even so, Bitcoin remained greater than 37% under its all-time excessive of $126,080 and down over 13% for the previous month.

On-chain information has added to the cautious tone, with a CryptoQuant analyst reporting that the share of Bitcoin provide held at a loss has risen to round 44%, a stage that traditionally appeared throughout early bear market phases relatively than routine pullbacks.

Further information confirmed Bitcoin buying and selling under the realized worth of medium-term holders, a sample that in previous cycles aligned with prolonged durations of consolidation and draw back threat.

Analysts at Galaxy Digital echoed these issues, because the analysis lead, Alex Thorn, stated Bitcoin might nonetheless take a look at decrease ranges close to $70,000 and even its realized worth round $56,000 if catalysts stay scarce.

Thorn famous that Bitcoin has misplaced key moving-average assist and that accumulation by giant consumers seems restricted, at the same time as long-term holder promoting has slowed.

The put up Spot Bitcoin ETFs Ingest $562M in Each day Inflows—Is This a Bullish Rebound or Only a Blip? appeared first on Cryptonews.