The South Korean inventory change, the Korea Change (KOSDAQ), says it’s “exploring” the concept of approving crypto spot ETFs in 2025.

Per the South Korean media outlet The Reality, the claims got here from KOSDAQ Chairman Jeong Eun-bo on the 2025 Securities and Derivatives Market Opening Ceremony.

Monetary Providers Fee (FSC) Chairman Kim Byung-hwan was additionally in attendance. Kim advised an viewers on the Korea Change in Yeouido, Seoul, that the regulator hopes to grant firms permission to launch safety token choices (STOs) in 2025.

Is the South Korean Inventory Change Rising Crypto Eager?

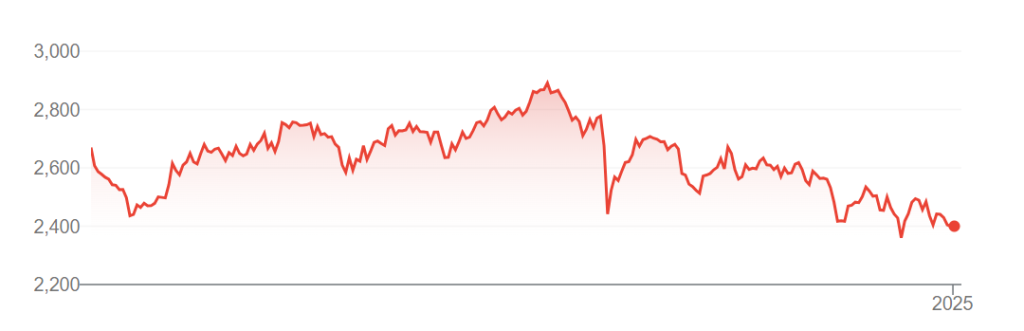

The duo spoke within the wake of a tumultuous finish to 2024 in South Korea. President Yoon Suk-yeol’s unsuccessful try and declare martial regulation in early December 2024 threw an already-sluggish KOSDAQ into chaos.

This led many South Korean and abroad shareholders to dump their holdings amid discuss of a inventory market exodus. Kim stated:

“Let’s make 2025 the 12 months when the overseas and home traders who left the market return.”

Jeong said that the inventory market wanted to look into new enterprise avenues together with “crypto exchange-traded funds (ETFs).”

“We’ll benchmark abroad instances for brand spanking new enterprise avenues comparable to crypto ETFs and discover new territory within the capital market.”

Korea Change Chairman Jeong Eun-bo

South Korea sharply reduce its financial development forecasts for this 12 months because it reels from the fallout from impeached President Yoon Suk Yeol’s martial regulation debacle https://t.co/n4eBzlz7EZ

— Bloomberg Markets (@markets) January 2, 2025

STO Hope

Kim, in the meantime, delivered a well timed increase for South Korean firms who’ve been ready for the inexperienced mild to subject safety tokens for years.

Yoon promised to prioritize STO regulation modifications in his election manifesto. However he has since didn’t ship.

Stress is rising as CIO strikes to detain President Yoon Suk Yeol. Protests and authorized battles intensify round this historic arrest. https://t.co/3JlQTN1AZQ#SouthKorea #Politics #YoonSukYeol #CIO

— The Korea Herald 코리아헤럴드 (@TheKoreaHerald) January 2, 2025

Conventional monetary firms and tech companies are desperate to launch STOs. Many have already developed STO platforms in anticipation of imminent approval.

However they’ve discovered themselves annoyed as Yoon’s authorities bumped into bother with a disastrous displaying in final 12 months’s midterm elections and corruption allegations.

The FSC seems able to take up the mantle, nevertheless, with lawmakers “pausing” crypto laws talks till the political turmoil abates.

“We’ll institutionalize STOs […] to diversify the securities issuance and distribution system. […] We’ll reorganize the complete system. That may let complete monetary funding companies carry out their unique function of offering company finance and enterprise capital.”

Monetary Providers Fee Chairman Kim Byung-hwan

“Final 12 months, our capital market skilled appreciable difficulties. The expansion potential of our firms weakened as a result of contraction of the home economic system and an export slowdown. The market confirmed significantly sluggishness in comparison with main international locations attributable to international conflicts and home political occasions.”

Korea Change Chairman Jeong Eun-bo

The FSC chief appealed to lawmakers, the ruling Folks’s Energy Occasion, and company inventory market traders to work collectively towards a standard aim. He urged:

“Though we’re beginning this 12 months in troublesome circumstances, the federal government, the Nationwide Meeting, and company traders ought to all work collectively. As one, we will make 2025 the 12 months when each the abroad and South Korean traders who’ve exited our market make their return.”

Late final 12 months, Jeong stated it was time for regulators to take away obstacles to adoption and known as for South Korea to “institutionalize” crypto.

The put up South Korean Inventory Change ‘Exploring’ Crypto Spot ETF Approvals appeared first on Cryptonews.