Solana co-founder and CEO Anatoly Yakovenko has unveiled a brand new decentralized perpetual change protocol, “Percolator,” designed to run natively on the Solana blockchain.

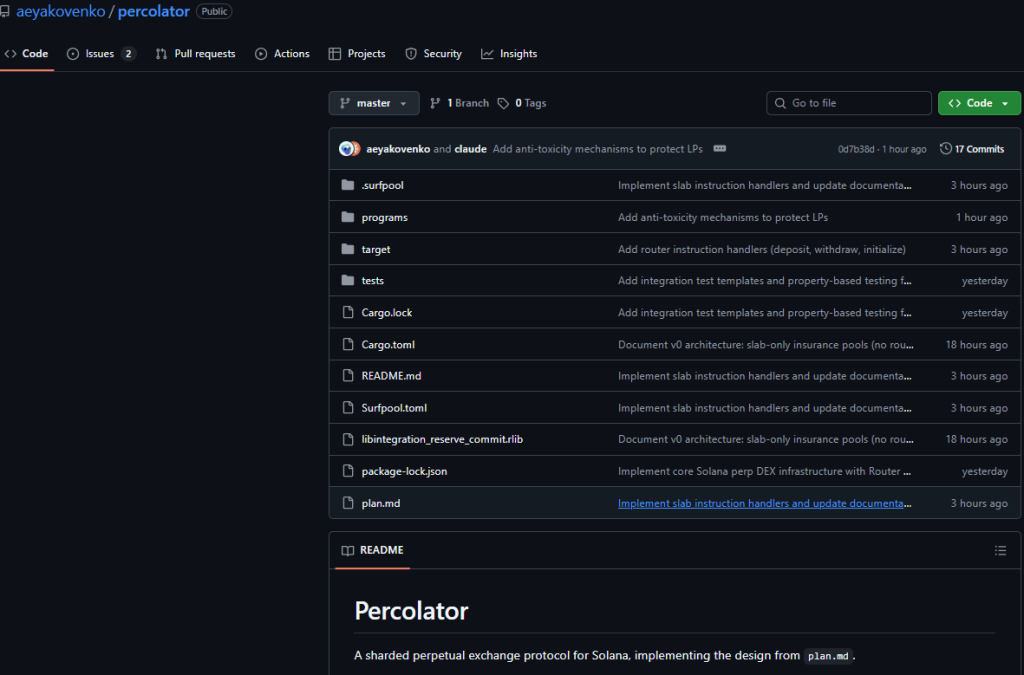

The GitHub repository for the undertaking was uploaded on October 19, outlining what Yakovenko described as an “implementation-ready” technical blueprint for a sharded perpetual futures decentralized change (DEX) that would problem main gamers like Aster and Hyperliquid.

Percolator’s emergence comes at an vital time for the Solana ecosystem. Though Solana’s DeFi ecosystem has seen constant progress, its perpetuals buying and selling sector has lagged behind rivals like Hyperliquid, which have captured a big market share in latest months.

Information reveals Solana-based perp DEX quantity fell by 24.19% week-on-week, with complete month-to-month quantity now round $63.24 billion, reflecting a gentle lack of market momentum.

Yakovenko’s transfer seems to be an effort to carry a brand new layer of infrastructure that would appeal to liquidity suppliers and high-frequency merchants looking for decentralized options to centralized exchanges.

Percolator May Reignite Solana DeFi as Meme Coin Exercise Cools

Percolator goals to introduce a two-program structure constructed for efficiency and adaptability by that includes a Router program that manages collateral, portfolio margining, and cross-slab routing, alongside modular “Slabs” that function self-contained buying and selling engines operated by liquidity suppliers.

In keeping with the documentation, Percolator seeks to ship CEX-level execution speeds with the multi-shard order books, permitting completely different buying and selling pairs or markets to run concurrently with out competing for a similar computational sources.

This method, Yakovenko argues, would forestall congestion during times of excessive buying and selling quantity, which is a identified ache level for a lot of present DEXs.

Toly constructing the Hyperliquid of Solana by himself??? pic.twitter.com/bVUtBifq8V

— fabiano.sol (@FabianoSolana) October 20, 2025

“The design retains every LP’s slab totally self-contained and innovable,” Yakovenko wrote in his technical abstract. “Combination capital effectivity matches a monolithic DEX, typically with higher execution high quality through selective routing.”

Though the codebase remains to be in improvement, with a number of processes similar to account validation and funding charge updates but to be finalized, lots of the core information constructions are already full.

The undertaking’s GitHub recordsdata recommend that the system is near stress-testing, marking a doubtlessly vital step for Solana’s DeFi sector.

The timing of the announcement is especially related. Solana has lately misplaced floor in one among its strongest fits, the meme coin market. As soon as Solana’s strongest space of consumer exercise, retail curiosity has waned sharply from the broader meme coin sector following a significant crypto sell-off throughout October.

Over $28 billion in meme token worth was worn out in mid-October, in accordance with a Cryptonews report. The overall market capitalization of meme tokens fell from $72 billion to $44 billion, erasing months of beneficial properties largely pushed by Solana and BNB Chain buying and selling exercise.

The meme coin market crash erased $28 billion in worth, dropping complete capitalization to $44 billion as $DOGE, $SHIB, and $BONK shed double-digit percentages.#memecoin #dip #BONKhttps://t.co/VSD0QwZORc

— Cryptonews.com (@cryptonews) October 16, 2025

This downturn has left Solana in want of latest progress drivers. Exercise on Solana launchpads has additionally slowed, with weekly buying and selling volumes declining from $1.5 billion in July to round $600 million by late September.

In opposition to this backdrop, Percolator represents a possible shift, an effort to reassert Solana’s technological edge in decentralized finance by getting into the aggressive perpetual buying and selling enviornment.

Moreover, Solana has been bettering its new community efficiency. The blockchain lately achieved 623 consecutive days with out an outage, its longest operational streak since its launch in 2020, displaying the community’s technical maturity.

BREAKING: @Solana has reached 623 days with out an outage, its longest streak since launch in 2020. The earlier document was 347 days, and post-2024 upgrades have strengthened community stability, with Solana remaining totally operational throughout main market occasions just like the Trump… pic.twitter.com/AyXr5QdRf7

— SolanaFloor (@SolanaFloor) October 20, 2025

This enhanced stability might assist restore developer and dealer confidence as Solana makes an attempt to reestablish its presence within the DeFi ecosystem, one thing that Percolator can leverage.

Perpetual DEX Quantity Tops $1.15 Trillion as Solana’s DEX Enters the Enviornment

Perpetual futures exchanges have turn out to be one of many fastest-growing areas in decentralized buying and selling. These platforms enable customers to invest on crypto costs with out expiration dates, with on-chain settlement and 24/7 market entry.

The sector’s mixed 30-day buying and selling quantity lately topped $1.15 trillion, in accordance with DeFiLlama, reflecting a speedy migration from centralized exchanges to decentralized derivatives platforms.

Presently, Hyperliquid and Aster dominate the sphere. Hyperliquid, working by itself Layer 1 blockchain, instructions the deepest liquidity with $7.59 billion in open curiosity and $309 billion in 30-day buying and selling quantity.

The change has turn out to be a benchmark for velocity and execution high quality, dealing with as a lot as $17 billion in each day buying and selling at its peak this yr. Its token, HYPE, carries a market capitalization of roughly $10.2 billion, supported by over $1.19 billion in annualized income.

Aster, in the meantime, has emerged as a formidable challenger. Constructed on BNB Good Chain with backing linked to Binance co-founder Changpeng “CZ” Zhao, the change has leveraged multi-chain help and aggressive incentives to seize new customers.

Aster lately generated $2.97 billion in annualized charges, greater than twice Hyperliquid’s determine, and logged $145 billion in 30-day perpetual quantity. It briefly overtook Hyperliquid in each day buying and selling exercise earlier this month.

Each platforms now lead decentralized derivatives buying and selling, however Percolator’s design might introduce a brand new variable.

By leveraging Solana’s low-cost, high-throughput infrastructure, it seeks to supply the effectivity of Hyperliquid with the modular flexibility of Aster, however in a totally on-chain, native Solana surroundings.

Yakovenko’s determination to launch the design as open-source code suggests a dedication to transparency and neighborhood collaboration.

The documentation consists of danger controls similar to capability-scoped escrow and atomic routing, designed to forestall over-debiting throughout a number of liquidity suppliers inside a single transaction.

The transfer additionally comes amid shifting consumer flows between blockchains. A July report by VanEck famous that Hyperliquid had been “poaching high-value customers from Solana,” as merchants sought less complicated, quicker options for perpetual markets.

If Percolator succeeds, it might assist reverse that pattern and appeal to superior merchants again to the Solana ecosystem.

Nonetheless, competitors is intense. Aster and Hyperliquid stay entrenched with massive liquidity swimming pools and institutional participation.

The publish Solana Founder Unveils ‘Percolator’ Perp DEX – A Direct Shot at Aster and Hyperliquid appeared first on Cryptonews.