Singapore has taken the highest place in Bybit’s World Crypto Rankings 2025, strengthening its standing as some of the energetic and structured digital-asset markets.

The brand new index, produced at the side of DL Analysis, evaluates nations throughout person exercise, institutional readiness, and cultural engagement.

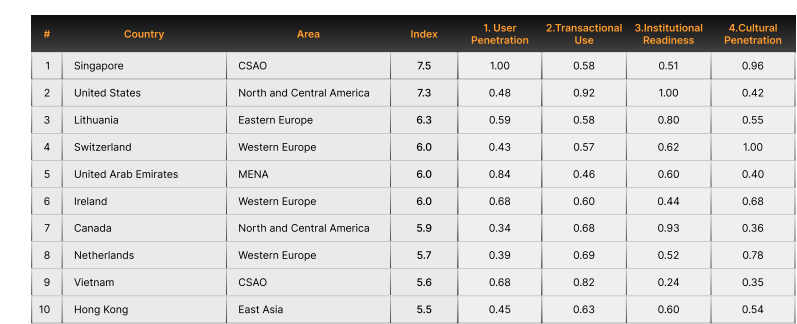

It positions Singapore forward of america and Lithuania, two nations that proceed to form the route of world crypto markets in distinct methods.

Report Reveals Two Distinct International Crypto Adoption Fashions

The report reveals how Singapore reached a rating of seven.5 out of 10, pushed by excessive person penetration and powerful cultural engagement round digital property.

Its licensing regime, excessive digital literacy, and energetic institutional sector have helped create one of many strongest pipelines between retail customers and controlled monetary entities.

The USA follows intently with a rating of seven.3. Its rating is supported by buying and selling volumes, custody exercise, and a rising base of tokenization tasks involving main banks and asset managers.

Lithuania, which secured third place with a rating of 6.3, continues to be a most well-liked regulatory base for fintech and change corporations.

The highest ten additionally consists of Switzerland, the United Arab Emirates, Eire, Canada, the Netherlands, Vietnam, and Hong Kong.

The info reveals two clear adoption fashions. Nations corresponding to Singapore, the U.S., Switzerland, Lithuania, and the UAE replicate an institution-driven sample formed by regulation and monetary infrastructure.

In distinction, Vietnam, Nigeria, Ukraine, and the Philippines depend on crypto for on a regular basis capabilities corresponding to remittances, funds, and financial savings throughout forex strain or banking restrictions.

This sample is per earlier research from Chainalysis and TRM Labs, which additionally discovered excessive adoption in markets dealing with financial constraints.

Ukraine, Moldova, and Georgia proceed to steer when measured towards inhabitants measurement.

International RWA Market Climbs 63% as Establishments Speed up Adoption

The report additionally highlights how rapidly real-world asset tokenization has expanded. The marketplace for tokenized RWAs, excluding stablecoins, has risen greater than 63% since January 2024, reaching $25.7 billion in early 2025.

Notably, non-public credit score and U.S. Treasuries dominate the sector, holding 15.6 billion and 6.7 billion {dollars}, respectively.

The USA maintains the strongest institutional readiness with an ideal rating, supported by regulatory readability and deep Wall Road engagement.

BlackRock’s BUIDL fund stays one of many fastest-expanding tokenized portfolios, reaching between 1.8 billion and a pair of.28 billion {dollars} throughout a number of blockchains.

Main banks like JPMorgan, Citi, and Goldman Sachs have expanded tokenized settlement and inside buying and selling applications.

Canada now ranks second in institutional readiness with a rating of 0.93, supported by new guidelines for banks and insurers that may take impact in 2026.

The Philippines can also be gaining momentum, turning into a regional instance for Southeast Asia because it units tips designed for remittance-heavy markets.

International Information Exhibits Surging Stablecoin Use as Singapore Leads Tokenization Push

Singapore’s broader position in tokenized finance has grown as effectively. In November, the Financial Authority of Singapore confirmed plans to pilot tokenized MAS payments settled utilizing a central financial institution digital forex.

Native banks have already examined interbank lending utilizing a wholesale CBDC, reinforcing the shift from experimentation to actual operational use.

MAS officers say asset-backed tokens have clearly moved past the laboratory stage.

The report additionally identified that stablecoins stay essentially the most constant asset kind throughout all revenue teams.

Ukraine information the best stablecoin move relative to GDP at 3.6%, adopted by Nigeria, Georgia, Vietnam, and Armenia.

These flows underline how digital {dollars} have develop into a monetary software in each developed and rising areas.

Separate analysis in March confirmed sturdy momentum within the Gulf area. The UAE recorded a 210% surge in adoption, the best of any nation in 2025, supported by excessive possession ranges and powerful search exercise.

Singapore and america adopted, with adoption development of 150% and 220%, respectively.

The submit Singapore Tops 2025 International Crypto Rankings as RWA Tokenization Jumps 63%: Report appeared first on Cryptonews.