Shares of Sharps Expertise surged 70% on Tuesday after the corporate introduced a landmark $400 million financing deal to construct what it claims would be the world’s largest Solana (SOL) treasury.

The transfer marks one of many boldest company bets but on a blockchain-based treasury technique and signifies rising institutional confidence in Solana’s position as a monetary infrastructure layer.

The financing, structured as a non-public funding in public fairness (PIPE), brings collectively heavyweight backers together with ParaFi, Pantera Capital, and Monarq Asset Administration.

Sharps Expertise (Nasdaq: STSS / STSSW) accomplished a $400M PIPE financing to construct the world’s largest Solana (SOL) treasury, with buyers together with ParaFi, Pantera, and Monarq. It signed an MoU with the Solana Basis to purchase $50M SOL at a 15% low cost.…

— Wu Blockchain (@WuBlockchain) August 25, 2025

The transaction, priced at $6.50 per unit with stapled warrants exercisable at $9.75, is predicted to shut on August 28 pending customary approvals. Sure buyers additionally acquired pre-funded warrants to be exercised as soon as the deal closes.

Sharps Expertise Eyes Management in Blockchain Finance With $400M Solana Play

Within the announcement, the corporate famous that the proceeds can even go towards normal company functions and dealing capital, however the major aim stays establishing a large-scale SOL treasury to capitalize on the community’s development.

As a part of the plan, Sharps signed a memorandum of understanding with the Solana Basis to buy $50 million price of SOL at a 15% low cost to the 30-day common market value. The settlement reveals shut alignment between the corporate and the inspiration as Solana continues to place itself because the blockchain of alternative for institutional-grade functions.

“Solana defines the usual for digital infrastructure, offering a high-throughput, low-cost, real-time settlement layer for all the pieces from blue-chip equities to bonds to personal property,” mentioned Alice Zhang, Sharps Expertise’s newly appointed chief funding officer and board member.

Zhang emphasised that the timing of the transfer displays accelerating institutional adoption of Solana because it positions itself because the spine of a world digital market.

To strengthen its standing within the ecosystem, Sharps additionally introduced on James Zhang, co-founder of Jambo and a outstanding determine within the Solana neighborhood, as a strategic adviser.

James has spoken at Solana Breakpoint, Davos, and Forbes occasions and has described Solana as “web capital markets, the subsequent evolution in international finance.”

James famous that Solana at the moment leads all main blockchains in staking yield, chain income, and app income, with staking yields hovering round 7%. “We imagine making a digital asset treasury will generate vital long-term worth for Sharps Expertise’s shareholders,” he added.

Sharps, Galaxy, DeFi Corp Lead $1.5B+ Wave in Solana Treasury Offers

The Sharps Tech deal comes amid an intensifying race for Solana treasuries, with Mike Novogratz’s Galaxy Digital main a separate $1 billion bid alongside Bounce Crypto and Multicoin Capital.

Earlier as we speak, the businesses had been in superior talks to boost about $1 billion to amass SOL, with Cantor Fitzgerald tapped as lead banker.

@galaxyhq, @multicoincap and @Jump_ have reportedly sought $1B for a Solana treasury, with Cantor Fitzgerald as lead banker.#Solana #Cryptohttps://t.co/qR5l5ptALO

— Cryptonews.com (@cryptonews) August 25, 2025

The plan includes creating a brand new digital asset treasury firm by taking on a public entity, which might make it the most important Solana-focused treasury up to now. Backed by the Solana Basis, the deal might shut in early September, although not one of the companies concerned have commented.

In the meantime, DeFi Growth Company introduced a $125 million fairness increase, turning into the primary U.S. public firm to undertake a treasury technique centered on accumulating Solana. The providing, priced at $12.50 per share, is predicted to shut on Aug. 28, 2025.

1/ We’re excited to share that DeFi Growth Corp. (Nasdaq: $DFDV) has raised $125M to speed up our $SOL treasury development.

This isn’t nearly elevating capital – it’s about compounding $SOL Per Share (SPS).

Right here's what it is best to know.pic.twitter.com/heInKpsvoT

— DeFi Dev Corp. (DFDV) (@defidevcorp) August 25, 2025

Solana has climbed sharply this 12 months, rebounding from April lows to commerce close to $200, up 6.6% over the previous 30 days. Renewed community exercise, developer momentum, and a wave of company treasury accumulation have fueled the surge.

In response to the Strategic SOL Reserve tracker, 9 entities now maintain 6.05 million SOL, price $1.21 billion, or 1.05% of the circulating provide, with the highest 5 controlling almost all of the reserves.

Solana Leads Crypto Ecosystems With $1.3B Income, 8.9B Transactions in 2025

The bullish guess on Solana comes because the community strengthens its place as one of many busiest and most liquid ecosystems in crypto.

Within the first half of 2025, Solana-based apps generated $1.3 billion in income, greater than every other chain. Exercise on the community has been equally sturdy, with 8.9 billion transactions processed final quarter, $6 billion in each day buying and selling quantity, and a mean of three.8 million each day energetic wallets this 12 months.

Developer curiosity can also be surging. Greater than 7,500 new builders joined Solana in 2024, the quickest development price amongst main blockchains. On the monetary aspect, staking yields hover round 7%, the best amongst main proof-of-stake networks, making Solana more and more engaging as a treasury asset.

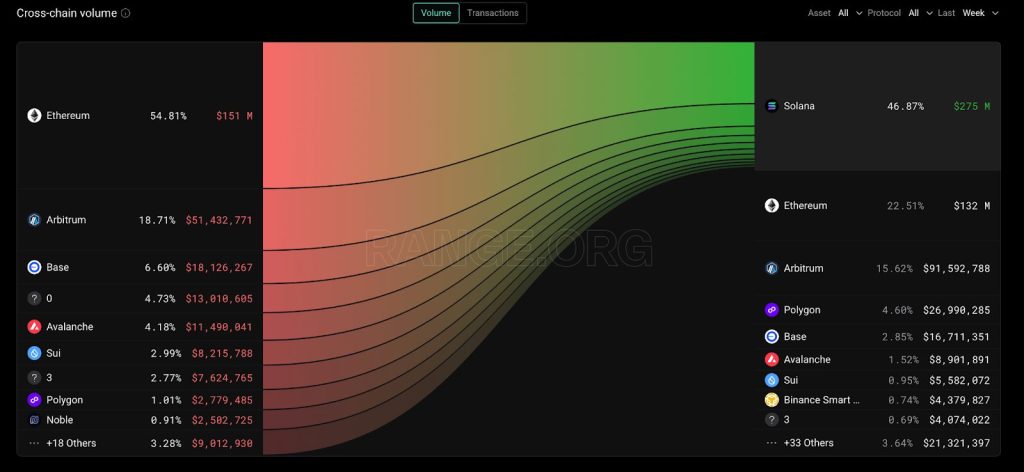

Capital can also be flowing in. Over the previous week, almost $280 million was bridged to Solana from different chains, together with greater than $155 million from Ethereum.

Solana DApps now lead the market in each day income, producing $6.06 million previously 24 hours, forward of Hyperliquid at $5.07 million and Ethereum at $3 million.

NEW: @Solana DApps surpass all L1 and L2 DApps in income over the past 24 hours. pic.twitter.com/M3dQN4uvvI

— SolanaFloor (@SolanaFloor) August 25, 2025

Institutional curiosity is following swimsuit. Solana-based ETFs, ETPs, and funds recorded $12 million in inflows final week, extending their streak to 11 consecutive weeks, a pointy distinction to Bitcoin and Ethereum merchandise, which noticed file outflows of $1 billion and $440 million.

The put up Sharps Tech Skyrockets 70% After Inking Huge $400M Solana Treasury Deal – $1.5B in One Day appeared first on Cryptonews.