ProShares will introduce three XRP-linked exchange-traded funds this week, following current approval from the US Securities and Trade Fee (SEC).

The brand new merchandise embody an Extremely XRP ETF providing 2x leveraged publicity, a Quick XRP ETF, and an Extremely Quick XRP ETF with -2x leverage, in response to regulatory filings.

A 2x leveraged ETF goals to ship twice the each day efficiency of XRP costs, whereas a -2x leveraged ETF seeks to ship twice the inverse of XRP’s each day returns, permitting buyers to doubtlessly revenue when the token’s worth falls.

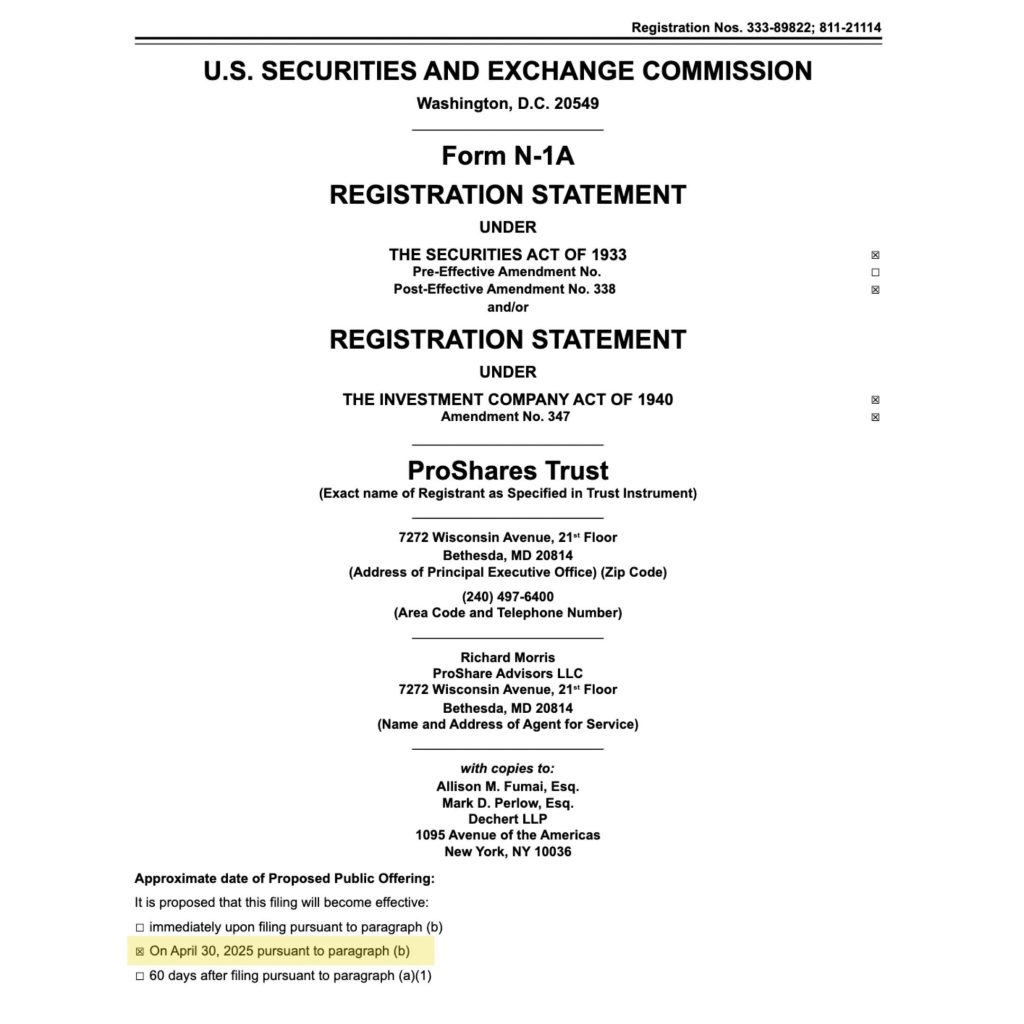

Picture Supply: SEC

ProShares Readies XRP ETFs as Spot Approval Stays Elusive

The ETFs are set to go dwell on April 30, 2025, marking one other milestone for XRP-related funding merchandise in america. Nonetheless, no approval has but been granted for a spot XRP ETF.

A number of functions, together with one from fund supervisor Grayscale, stay beneath evaluate, with a important SEC choice deadline looming on Could 22.

ProShares’ transfer comes shortly after Teucrium launched the first-ever XRP futures ETF earlier this month. Teucrium’s 2x XRP fund recorded greater than $5m in buying and selling quantity on its debut day, making it the agency’s most profitable launch to this point.

New XRP Listings Sign Softer Regulatory Stance After Court docket Victory

The current surge of XRP-focused funding merchandise displays a shifting regulatory panorama.

Final week, CME Group introduced that XRP futures would quickly be listed on its derivatives change. The brand new choices will seem alongside Bitcoin, Ether and Solana merchandise. In consequence, momentum round XRP funding merchandise continues to construct.

This surge follows the decision of a years-long courtroom battle between Ripple Labs and the SEC. In March, Ripple secured a last authorized victory. Consequently, vital regulatory hurdles for XRP’s use and itemizing throughout monetary markets have been eliminated.

Traders and issuers have lengthy awaited a spot XRP ETF. Such a product would monitor the token’s worth instantly, slightly than by means of futures contracts. Nonetheless, spot crypto ETFs have traditionally confronted higher resistance from regulators. Not too long ago although, approvals for spot Bitcoin ETFs have raised hopes that different tokens might finally observe.

For now, ProShares’ futures-based merchandise present buyers with an alternate approach to achieve publicity to XRP’s worth actions. In consequence, the market’s response within the coming weeks can be intently watched. Consideration can be particularly excessive because the SEC approaches its subsequent main choice on Grayscale’s spot XRP proposal.

The submit SEC Clears ProShares XRP Futures ETFs to Launch on April 30 appeared first on Cryptonews.