The marketplace for tokenized real-world property (RWAs) is estimated to succeed in $18.9 trillion by 2033. Trade specialists imagine that this forecast might even be conservative, as stablecoin adoption signifies a a lot bigger market enlargement.

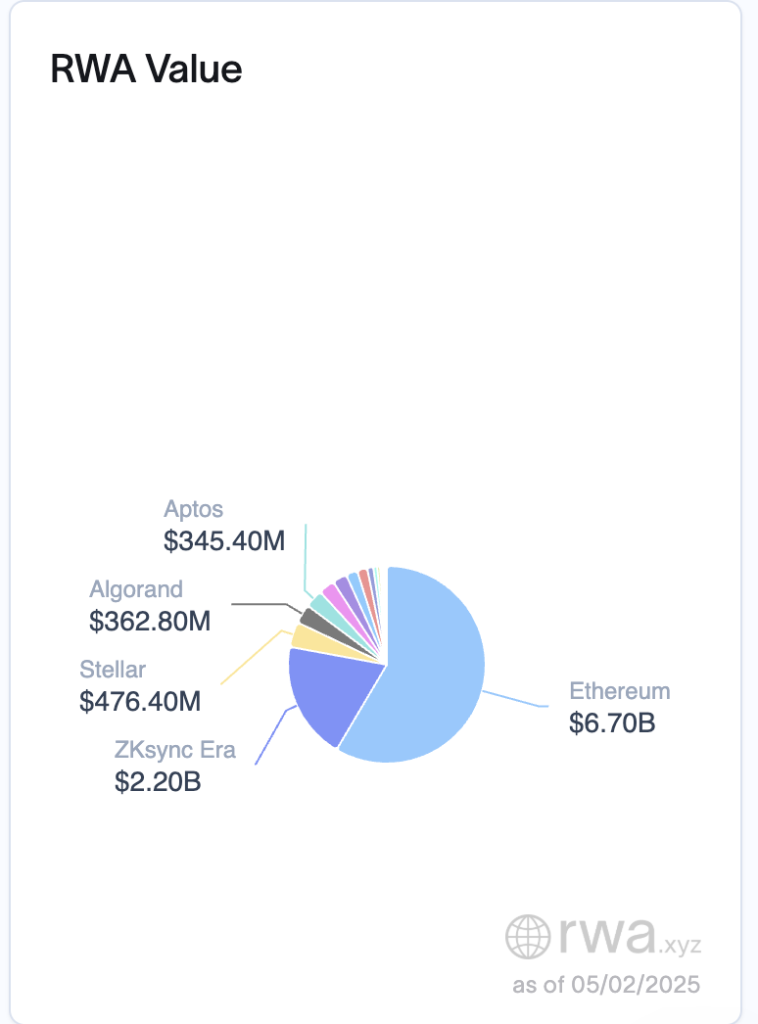

The fast development of tokenized RWAs can be boosting blockchain adoption metrics, as 60% of RWA tokenization worth is being pushed by Ethereum.

Stellar Focuses on Billions in Tokenized RWAs

However Ethereum isn’t the one Layer-1 (L1) blockchain contributing to the expansion of tokenized RWAs.

Denelle Dixon, government director of Stellar Improvement Basis, informed Cryptonews that the Stellar community ranks second, proper behind Ethereum, for probably the most tokenization use instances.

“Stellar is the second largest Layer-1 for RWA worth after Ethereum, with round $470 million in tokenized treasuries, commodities, and yield-bearing stablecoins on the community,” Dixon acknowledged.

Dixon elaborated that in November 2019, Franklin Templeton—one of many world’s largest monetary establishments—began planning to construct a tokenized cash market fund on Stellar.

Franklin Templeton has since grown its “OnChain U.S. Authorities Cash Market Fund” (FOBXX) to be the third-largest tokenized cash market fund. The fund is obtainable on Ethereum, Coinbase’s Layer-2 Base, Aptos, and Avalanche, however the Stellar community capabilities as the first blockchain.

In response to Dixon, the OnChain U.S. Authorities Cash Fund has about $701.7 million in complete asset worth, with the vast majority of $466.5 million being on the Stellar community.

“By tokenizing securities, this integration allows establishments to cut back transaction prices from $1 to lower than a penny—the $50,000 value of fifty,000 transactions turns into simply $120,” Dixon famous.

Franklin Templeton explains as follows: If 50,000 transactions are processed within the conventional monetary system, the charges alone quantity to about $50,000.

Nevertheless, once they utilized Stellar to tokenize RWA (Actual-World Property) and handle operations, the price of processing 50,000… pic.twitter.com/IuWATLpEpJ— Dao world (@Koreanteacher1) January 4, 2025

For an establishment like Franklin Templeton that manages $1.7 trillion in property, such effectivity positive aspects may possible reshape operational economics.

Transferring ahead, Dixon shared that Stellar aspires to energy $3 billion in RWA worth on-chain inside this yr alone. She defined that Stellar has set particular objectives round new partnerships to make sure this.

For instance, Dixon identified that funding agency Societe Generale-Forge has launched its EUR-backed stablecoin (EURCV) on the Stellar community. As well as, asset administration agency Ondo has plans to launch its yield-bearing stablecoin, america Greenback Yield (USDY), on Stellar within the coming months.

Dixon additionally talked about that Etherfuse is bringing “stablebonds” to the Stellar community, which is able to supply asset-backed merchandise designed to carry worth and supply potential returns.

Avalanche Plans To Accomplice With TradFi Establishments

L1 blockchain Avalanche can be in search of to drive billions into the tokenized RWA market. Morgan Krupetsky, senior director of enterprise growth, establishments, and capital markets for Ava Labs, informed Cryptonews that Avalanche’s major mission has been to digitize and tokenize the world’s property.

“Avalanche was purpose-built for this subsequent era of blockchain-enabled finance,” Krupetsky remarked. “The community has excessive throughput, sub-second finality, low transaction prices, and customizability, making it an excellent basis for real-world asset (RWA) tokenization, commerce, and switch at web scale.”

Asset administration agency WisdomTree just lately expanded its institutional funding platform, WisdomTree Join, to incorporate 13 tokenized funds throughout numerous blockchains, together with Avalanche.

“We’re dedicated to cultivating a high-quality tokenized asset ecosystem by deepening relationships with giant, respected asset managers and issuers,” Krupetsky remarked.

She added that Avalanche plans to develop the variety and scale of tokenized RWAs on the community. This consists of providing stablecoins and different money equivalents to shares, bonds, personal credit score, and different alternate options.

“In parallel, we’re targeted on distribution—each inside Avalanche’s crypto-native and DeFi ecosystem, in addition to by means of extra conventional capital markets companions and challenger corporations,” Krupetsky famous.

To place this in perspective, Krupetsky shared that finance firm Intain developed a platform that leverages Avalanche structure to launch an on-chain market for tokenized asset-backed securities (ABS).

Referred to as “IntainMARKETS,” it facilitates asset issuance, funding, administration, and buying and selling. The platform has already administered over $6 billion in tokenized loans.

Intain has launched the primary institutional Subnet on #Avalanche

IntainMARKETS, an on-chain market for asset-backed securities, hopes to facilitate environment friendly, value efficient, and clear asset issuance, funding, and administration.

See why Intain #ChoseAvalanchehttps://t.co/nFT6O3M0Hd

— Ava Labs

(@AvaLabs) January 31, 2023

Injective Focuses on RWA Utility in DeFi

L1 community Injective can be targeted on reshaping finance by making RWA tokenization compliant by means of a local token manufacturing facility and permissions module.

Eric Chen, co-founder of Injective, informed Cryptonews that Injective’s on-chain trade module lets any issuer create secondary markets for his or her property.

“Libre, an RWA issuer, just lately launched tokenized variations of a BlackRock cash market fund and a Laser Digital carry fund,” Chen stated. “They’re organising a BlackRock/Laser Digital market on Injective, the place over 15 institutional market makers can quote costs, permitting customers to enter and exit these funds seamlessly in a liquid method.”

Chen famous that this unlocks liquidity and democratizes entry to merchandise beforehand solely accessible to a choose few.

He added that one other key use case for Injective is collateralization. Because of this Injective permits customers to margin Bitcoin (BTC) or Ethereum (ETH) perpetuals with yield-bearing stablecoins.

“The aim for us isn’t nearly RWA issuance, however moderately activating actual utility in DeFi, from secondary buying and selling to margin and lending use instances,” Chen commented. “Whereas we haven’t disclosed a goal determine, Injective is constructed to seize a serious share of the RWA market, which already exceeds $10 billion in complete worth locked.”

Challenges To Take into account

Whereas it’s clear that blockchain networks are driving the expansion of RWAs, challenges stay.

Though tokenizing an asset is an more and more commoditized course of, Krupetsky defined that creating constant demand, together with secondary market liquidity, has been a hurdle.

“With out lively markets or integration into broader DeFi or TradFi workflows, tokenized RWAs danger staying static representations moderately than purposeful property,” she talked about.

To fight this, Krupetsky believes that the business ought to deal with “distribution-first tokenization,” the place RWAs are built-in first into DeFi merchandise. Trade specialists ought to then take into consideration how these choices can match into extra conventional distribution channels.

Whereas it’s spectacular to see BlackRock and Franklin Templeton enter the sector, Krupetsky additional acknowledged that almost all monetary establishments and market individuals nonetheless function on legacy techniques.

“This implies there nonetheless isn’t seamless integration bridges, onboarding, servicing, and reporting on tokenized property,” she stated. “To fight this, the business ought to spend money on middleware, token requirements, and integration instruments that allow compatibility with each DeFi and TradFi techniques, whereas working intently with custodians, fund directors, and compliance suppliers to bridge on- and off-chain infrastructure.”

Unclear regulatory frameworks throughout jurisdictions stay an additional problem, however business specialists are assured that 2025 can be a milestone yr for tokenized RWAs.

Bhaji Illuminati, CEO at RWA platform Centrifuge, informed Cryptonews that it’s changing into clear that institutional curiosity is popping into motion. She added that regulatory readability is slowly enhancing, whereas the infrastructure powering tokenization is maturing.

“Tokenized RWAs are shifting from pilot applications to actual allocation methods, and we count on exponential development in on-chain volumes as tokenization turns into a core a part of asset issuance and buying and selling,” Illuminati stated.

The publish RWAs Increase as Layer-1 Blockchains Ignite $18.9T Tokenization Surge appeared first on Cryptonews.