Robinhood had a powerful begin to the yr, posting a 50% soar in income for the primary quarter, with a lot of that development coming from its cryptocurrency enterprise.

The surge in buying and selling volumes, as buyers regarded to hedge their positions in a risky market, helped the platform’s income greater than double, surpassing analysts’ expectations.

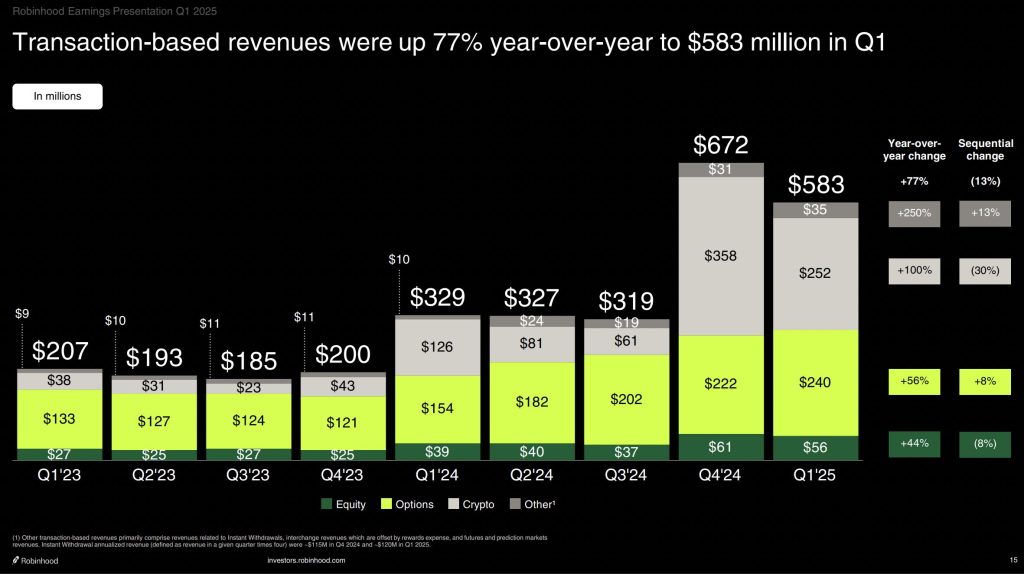

The corporate’s transaction-based income, which incorporates revenue from choices, crypto, and equities buying and selling, shot up by 77% this quarter.

A big chunk of this got here from crypto, which introduced in $252m in income, marking a 100% soar from the identical time final yr. That determine barely exceeded the $247m that analysts had predicted, underscoring the power of Robinhood’s crypto enterprise.

Robinhood Markets has simply launched monetary outcomes for the primary quarter of 2025.

Take a look at the highlights from @vladtenev beneath, and catch our earnings name stay at: https://t.co/W92tO1JASh pic.twitter.com/62L4RYpfHY— Robinhood (@RobinhoodApp) April 30, 2025

Robinhood Leans on Crypto Success however Goals to Diversify for Lengthy-Time period Stability

Crypto buying and selling, significantly Bitcoin, was an enormous driver of development. Regardless of market volatility, crypto transactions remained robust, a development that’s been essential for Robinhood’s success.

CEO Vlad Tenev mentioned that whereas the corporate continues to depend on crypto volumes, it’s working to diversify past that. Over time, Robinhood plans to make the crypto facet of its enterprise much less depending on transaction volumes.

“We’re centered on diversifying the enterprise outdoors of crypto,” Tenev mentioned in the course of the earnings name. “This may make us much less reliant on crypto transaction volumes sooner or later.”

Picture Supply: Robinhood

Robust Efficiency Throughout Choices, Equities, and Margin Investments Gas Robinhood’s Q1 Success

However it wasn’t simply crypto that fueled Robinhood’s success. The corporate additionally noticed spectacular development in choices and equities buying and selling. Income from choices jumped 56%, whereas equities grew by 44%.

Internet curiosity income, which primarily comes from margin investing, jumped 14% to $290m. Robinhood’s platform belongings rose by 70% year-over-year, reaching $221b, with document internet deposits of $18b.

Tenev identified that clients aren’t solely buying and selling extra, however they’re additionally entrusting Robinhood with extra of their belongings. The corporate’s internet revenue for the quarter hit $336m, or 37 cents per share, in comparison with $157m, or 18 cents per share, final yr. Analysts had forecasted a revenue of 33 cents per share.

This robust efficiency got here regardless of the continuing commerce tensions between the US and China, which stored markets on edge. The primary quarter was marked by vital swings in each shares and crypto costs, largely on account of President Donald Trump’s commerce insurance policies.

Whereas some markets have began to get better from the losses in April, the uncertainty continues, creating alternatives for platforms like Robinhood to achieve the present risky setting.

The put up Robinhood Posts 50% Soar in Q1 Income as Crypto Enterprise Doubles from Final Yr appeared first on Cryptonews.