Robert Kiyosaki, creator of the best-selling guide Wealthy Dad Poor Dad, has as soon as once more sounded the alarm that america could also be heading towards a monetary collapse much like the 1929 inventory market crash and the Nice Despair.

“Do you’ve got a 401k or IRA crammed with shares?” That was the query posed by Wealthy Dad Poor Dad creator Robert Kiyosaki on X, as he issued a stark warning in regards to the U.S. economic system.

Drawing comparisons to the 1929 inventory market crash, Kiyosaki stated he’s staying out of conventional property and going all-in on Bitcoin, gold, and silver.

DO YOU have a 401k or IRA crammed with shares?

DO YOU know funding legends Warren Buffet and Jim Rogers have bought most if not all of their shares and bonds?

They’re each in money or silver.

In case you have no idea why Buffet and Rogers have bought their shares and bonds it’s possible you’ll…— Robert Kiyosaki (@theRealKiyosaki) July 28, 2025

Robert Kiyosaki Warns of ‘One other Nice Despair’ as U.S. Debt Hits $36.6 Trillion

The bestselling creator pointed to the strikes of funding icons Warren Buffett and Jim Rogers, noting each have trimmed their publicity to shares and bonds. “They’re each in money or silver,” Kiyosaki wrote.

“In case you have no idea why Buffett and Rogers have bought their shares and bonds, it’s possible you’ll need to discover out.”

In the identical submit, he warned of “one other Nice Despair” and described America’s mounting debt as unsustainable. “You possibly can solely print cash to pay your payments… for thus lengthy,” he added.

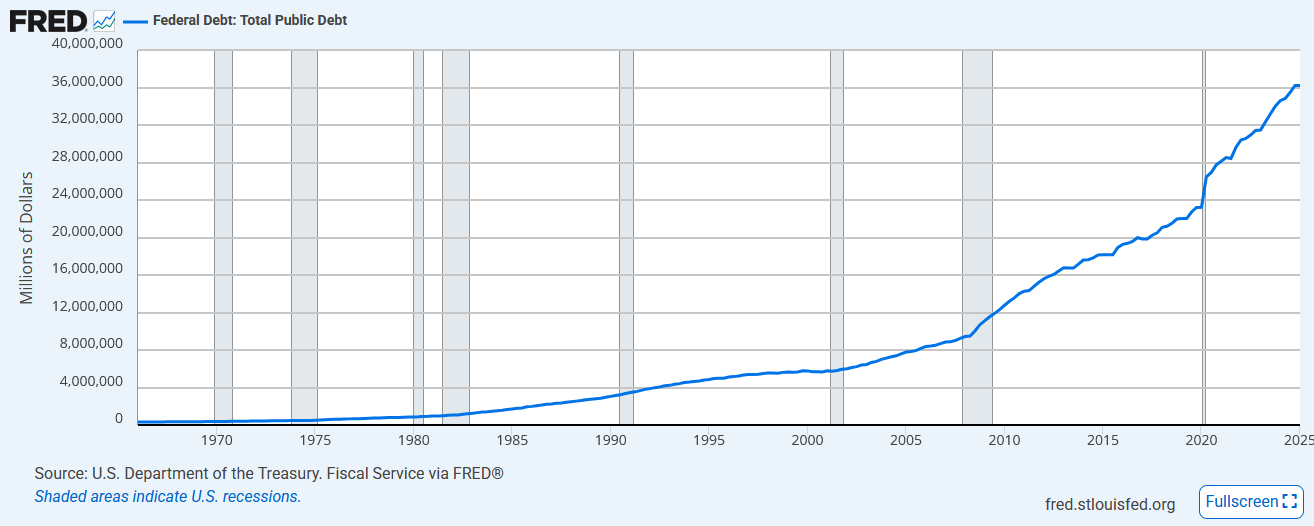

Kiyosaki’s feedback come because the U.S. nationwide debt hits historic ranges. This month alone, debt rose by $367 billion, reaching $36.6 trillion, an all-time excessive. The bounce adopted President Trump’s approval of a sweeping spending invoice that raised the debt ceiling by $5 trillion.

The rise is anticipated to hold the federal government by means of to 2027 with out a default.

The ballooning debt is inserting rising stress on federal funds. Curiosity funds already devour 13% of the nationwide funds and are projected to high $1 trillion yearly by 2033. That trajectory, analysts say, dangers forcing future cuts to Social Safety, Medicare, and protection spending, whilst world tensions escalate.

Analysts are additionally pointing to early indicators of financial stress. In keeping with Kurt S. Altrichter of Ivory Hill Wealth, the U.S. housing market is flashing recession indicators. Stock for brand new single-family properties has swelled to just about 10 months’ value of provide, a degree traditionally seen simply earlier than or throughout financial downturns.

The months’ provide of latest single-family properties is now at 9.8.

Traditionally, ranges this excessive have solely occurred throughout or proper earlier than recessions. Builders aren’t simply preventing excessive charges, they’re preventing demand evaporation.

The housing market is weak. pic.twitter.com/XEXjgNKBwk— Kurt S. Altrichter, CRPS® (@kurtsaltrichter) July 7, 2025

Jack Mallers, CEO of Strike, additionally weighed in. In a submit on X, he stated the U.S. Treasury has no actual possibility left apart from to develop the financial base, which successfully means extra money printing.

Kiyosaki Reaffirms Help for Bitcoin as U.S. Inflation and Debt Worsen

Bitcoin, typically seen as a hedge towards inflation, dipped to an intraday low of $117,914 on the day Kiyosaki made his feedback. The drop adopted $47.5 million in liquidations as leveraged lengthy positions had been flushed out.

Regardless of this, Bitcoin stays up greater than 60% from its April lows, and market members nonetheless see its long-term construction as bullish.

Brief-term volatility has intensified, particularly close to the $118K to $120K vary, the place massive clusters of leveraged bets have constructed up. Every push towards $119K has confronted sharp resistance, typically triggering automated sell-offs.

Regardless of the market’s turbulence, Kiyosaki continues to emphasise Bitcoin’s function as a protected haven, stating that “I sit tight with gold, silver & Bitcoin,” he reaffirmed.

Kiyosaki’s warnings, although extreme, echo considerations voiced by a rising variety of buyers and analysts. As financial pressures mount and belief in conventional monetary techniques erodes, Bitcoin and different scarce property are more and more being positioned as a response to long-term fiscal instability.

Whereas critics argue that such alarmist views could exaggerate the dangers, Kiyosaki’s message is evident. “Please take care,” he wrote. “And do your individual analysis.”

The submit Wealthy Dad Poor Dad Creator: “1929 Crash Warning!” – All in on Bitcoin, Gold and Silver appeared first on Cryptonews.