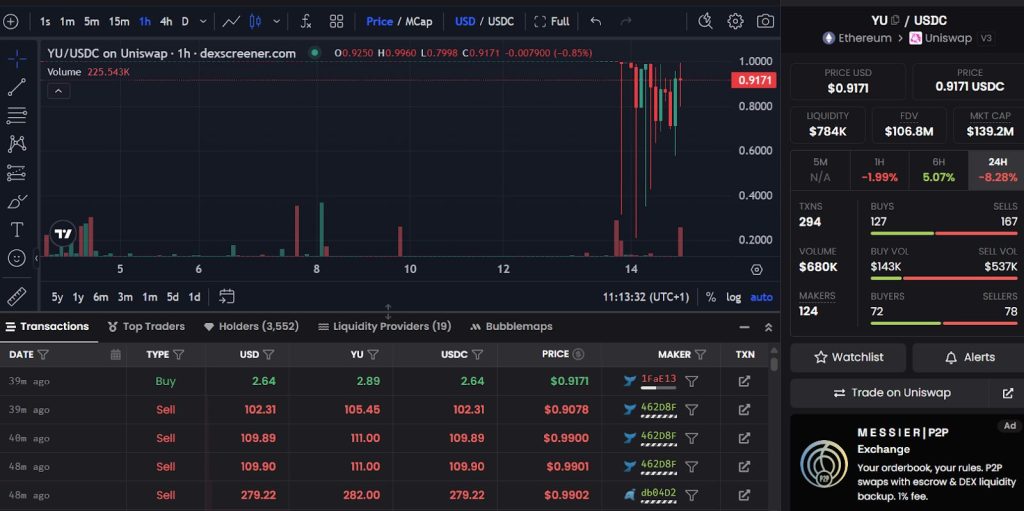

The Yala stablecoin (YU), a Bitcoin-native over-collateralized stablecoin backed by Polychain, misplaced its greenback peg round 5:14 UTC+8 right now following a protocol assault that despatched YU crashing to $0.2074 earlier than recovering to $0.917.

The Yala workforce promptly addressed the incident on X (previously Twitter), confirming the assault and its influence on the YU stablecoin’s worth stability.

“Our protocol not too long ago skilled an tried assault that briefly impacted YU’s peg,” the workforce mentioned.

Our protocol not too long ago skilled an tried assault that briefly impacted YU’s peg. Because of the short collaboration with @SlowMist_Team and our safety companions, we’ve recognized the problem and are already rolling out enhancements to strengthen the system.

All person property…— Yala (@yalaorg) September 14, 2025

“Property Stay Protected”- Yala Stablecoin Crew Scrambles to Restore Belief

Yala Co-founder Vicky Fu disclosed that the workforce is now working with exterior safety specialists, together with SlowMist and Fuzzland, to research the breach.

The workforce assured customers that every one property stay safe whereas they concentrate on restoring stability and strengthening protocol safety.

After the announcement, YU, designed to keep up a secure $1 worth, fluctuated between $0.798 and $0.996.

At present, solely $784,000 in USDC liquidity exists within the YU stablecoin pool on Ethereum.

The Yala workforce has quickly disabled the Convert and Bridge capabilities to make sure full stability throughout system enhancements.

In a September 14 X submit, the workforce said, “All different protocol capabilities stay unaffected, and person property stay protected. We’ll share extra updates as soon as upkeep is full.”

As a part of ongoing safety enhancement and system upgrades, the Convert and Bridge capabilities might be quickly unavailable to make sure full stability whereas enhancements are utilized.

All different protocol capabilities stay unaffected, and person property stay protected. We'll share extra…— Yala (@yalaorg) September 14, 2025

Nonetheless, in response to Lookonchain, the suspected Yala stablecoin attacker minted 120 million YU tokens on Polygon and bought 7.71 million throughout Ethereum and Solana for 7.7 million USDC.

The USDC was then swapped for 1,501 ETH and distributed throughout a number of wallets.

The hacker nonetheless holds 22.29 million YU on Ethereum and Solana, with 90 million YU remaining on Polygon.

YU holders at the moment are in panic mode because the stablecoin has plunged greater than 22% because the incident, elevating doubts about whether or not it may possibly regain its peg.

A stablecoin’s core perform is sustaining a 1:1 “peg” to fiat forex worth; with out this peg, the basic function fails.

YU operates as an over-collateralized stablecoin, that means it’s backed by digital asset reserves (BTC) that exceed the stablecoin’s personal worth.

With YU nonetheless struggling to keep up its peg, Yala faces a vital interval for securing person belief and trade confidence.

At roughly $140M market cap, YU stays small in comparison with established stablecoins like Tether (USDT) and Circle (USDC), which maintain $170 billion and $73 billion market capitalizations, respectively.

Even newer stablecoins like Ethena (USDe) and WLFI (USD1) command $13.5 billion and $5.8 billion valuations, respectively.

Nonetheless, YU’s peg struggles aren’t the primary of their type within the crypto market.

Even Tether’s USDT quickly misplaced its greenback peg in 2023 when two main buying and selling swimming pools turned closely imbalanced.

Tether CTO Paolo Ardoino defined that risky stablecoin markets create alternatives for attackers to take advantage of liquidity pool imbalances.

Extra not too long ago, in April, artificial stablecoin sUSD, lengthy pegged to the U.S. greenback inside the Synthetix ecosystem, dramatically misplaced its peg, dropping to $0.68.

In contrast to YU, sUSD didn’t face an assault. As a substitute, its depeg resulted from the protocol’s transition to new debt and collateralization mechanisms below SIP-420, designed to enhance capital effectivity.

@synthetix_io’s sUSD stablecoin crashes to $0.68, exposing algorithmic peg vulnerabilities and sparking DeFi stability considerations amid protocol modifications.#Stablecoin #DeFihttps://t.co/u3kSo3zZTD

— Cryptonews.com (@cryptonews) April 18, 2025

Somewhat than enhancing effectivity, the code improve by chance dismantled key mechanisms that beforehand maintained sUSD’s greenback peg.

Why Do Billion-Greenback Stablecoins Preserve Dropping Their Peg?

In October 2023, TrueUSD, a serious fiat-collateralized stablecoin, misplaced its peg after asserting suspended minting actions via expertise companion Prime Belief.

Many TUSD holders interpreted the minting suspension as proof that the corporate couldn’t keep enough fiat collateral backing.

The dramatic collapse of terraUSD (UST) and your complete Terra (LUNA) ecosystem in 2022 continues to solid doubt on stablecoin reliability.

Terra founder Do Kwon and the Luna Basis Guard spent as much as 80,000 bitcoin, price roughly $9.2 billion, in an try to defend UST’s greenback peg earlier than finally failing.

Former Individuals’s Financial institution of China Governor Zhou Xiaochuan has now warned that stablecoins face a one-in-three collapse chance over the subsequent decade as a consequence of crisis-induced arbitrage failures.

He cautioned that even fully-backed stablecoins can amplify danger via deposit-lending, collateralized financing, and asset buying and selling actions.

Stablecoins aren’t all the identical.

We see “$1” throughout USDC, USDT, PYUSD, FDUSD, crvUSD, GHO… Not each “$1” is created equal.

The distinction? Settlement.

Who can redeem, how briskly, and at what high quality of reserves.

Let’s break down stablecoin fragmentation & why settlement danger… pic.twitter.com/oqqM9QjkMg— DOLAK1NG (@DOLAK1NG) September 12, 2025

Zhou criticized insufficient reserve custody requirements, citing Fb’s early plans to self-custody Libra property as a problematic design.

Whereas the Hong Kong Stablecoin Ordinance and U.S. GENIUS Act tackle some considerations, Zhou famous that regulatory gaps stay.

He really useful compiling precise circulation information to evaluate redemption dangers, calling present oversight frameworks “removed from adequate.”

The submit Polychain-Backed Yala Stablecoin YU Crashes to $0.20 After Protocol Assault appeared first on Cryptonews.