The Philippines has moved a step nearer to becoming a member of the ranks of countries stockpiling Bitcoin after Congressman Miguel Luis Villafuerte launched the Strategic Bitcoin Reserve Act within the Home of Representatives.

The invoice, filed in the course of the Twentieth Congress’ first common session, proposes the federal government purchase 10,000 BTC over 5 years to function a long-term strategic reserve asset.

Proposed Legislation Would Lock Philippine Bitcoin Reserves for Two A long time

Home Invoice No. 421, launched by Consultant Miguel Luis R. Villafuerte, proposes an annual acquisition of two,000 BTC by means of the Bangko Sentral ng Pilipinas (BSP). The bought Bitcoin could be positioned in chilly storage services distributed throughout the nation and held in belief for at the very least 20 years.

A Strategic Bitcoin Reserve Invoice has been filed by Rep. Miguel Villafuerte within the Home of Representatives. The Invoice seeks to buy 10,000 BTC over a 5-year interval. pic.twitter.com/0coTMQrVvh

— Dicki Devesa (@57twl57) August 22, 2025

In response to the invoice, the holdings might solely be bought below strict circumstances, corresponding to retiring sovereign debt, and not more than 10% of the reserve could also be liquidated in any two-year interval after the minimal holding interval expires.

As of November 2024, the Philippines’ debt had risen to ₱16.09 trillion ($285 billion), with home obligations accounting for practically 68% of the overall.

Supporters argue that diversifying nationwide reserves past gold and the U.S. greenback is important for monetary stability, notably as different international locations speed up their very own Bitcoin methods.

Underneath the invoice, the Bangko Sentral ng Pilipinas (BSP) would oversee this system, buying 2,000 BTC yearly and inserting them into chilly storage services distributed throughout the nation.

The Bitcoin could be locked for at the very least 20 years, stopping gross sales or swaps apart from restricted use in retiring authorities debt.

Underneath the proposed legislation, the BSP governor would oversee the reserve with assist from the Division of Finance, Division of Protection, and Securities and Alternate Fee (SEC).

The act mandates quarterly public “proof-of-reserve” audits verified by unbiased third events, with reviews revealed on-line to make sure transparency. The invoice additionally explicitly protects non-public property rights, affirming that people and companies stay free to purchase, maintain, and commerce Bitcoin with out authorities interference.

The Philippines, the invoice argues, can not afford to be left behind. “It’s critical that the nation stockpile strategic belongings corresponding to Bitcoin to offer monetary stability and safeguard our nationwide curiosity,” the observe reads.

Proponents imagine that different governments following go well with might set off a worldwide wave of Bitcoin shopping for, additional constraining provide. With simply 21 million BTC ever to be mined, and practically 20 million already in circulation, advocates say early accumulation is vital.

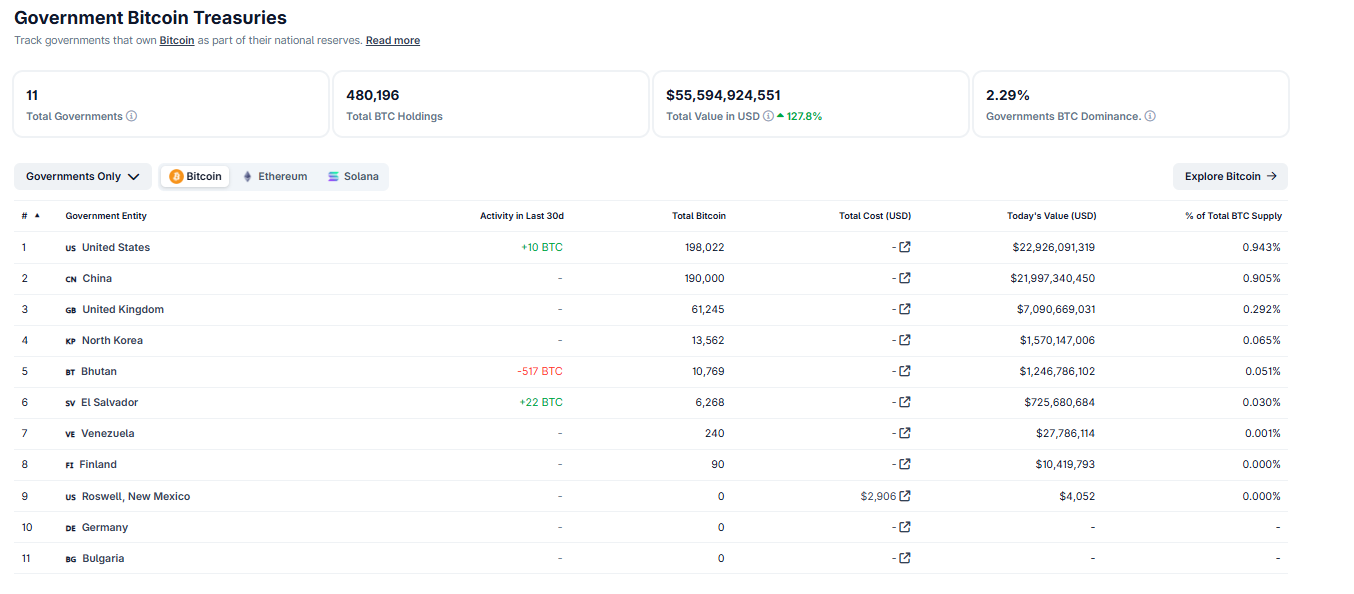

World Governments Management 2.29% of Bitcoin Provide, Information Exhibits

Governments worldwide are more and more turning to Bitcoin as a strategic reserve asset, positioning it alongside gold and different vital sources. Villafuerte pointed to the rising world context driving the measure.

Hong Kong legislator Johnny Ng has proposed that Bitcoin be used as an official monetary reserve for the area.https://t.co/zk8EQQwRmA

— Cryptonews.com (@cryptonews) July 29, 2024

In Asia, Hong Kong lawmakers have referred to as for official BTC reserves, Bhutan operates state-owned mining services, and China has lengthy held seized Bitcoin. Russia, below sanctions, has leaned on Bitcoin for commerce, with President Vladimir Putin calling it “unstoppable.”

Within the West, the US and the UK at the moment are among the many largest sovereign holders by means of legislation enforcement seizures. Thailand, Malaysia, and several other European international locations are additionally exploring reserve frameworks.

Information from CoinGecko reveals that as of August 2025, 11 governments collectively management 480,196 BTC, price about $55.6 billion, equal to 2.29% of Bitcoin’s provide. The U.S. leads with 198,022 BTC ($22.9B), adopted by China with 190,000 BTC ($22B), largely tied to confiscations.

Supply: CoinGecko

The U.Okay. ranks third with 61,245 BTC ($7B). Smaller holders embrace North Korea (13,562 BTC), Bhutan (10,769 BTC), and El Salvador (6,268 BTC).

El Salvador stays the flagship instance of sovereign adoption after making Bitcoin authorized tender in 2021. Whereas retail utilization has waned, the federal government continues to build up, not too long ago including 22 BTC to its holdings, now price over $725 million.

El Salvador has expanded its Bitcoin holdings as soon as once more, buying 5 extra BTC amid a market dip that noticed the asset fall to $83,000. #ElSalvador #Bitcoinhttps://t.co/bVwm7Hs5s8

— Cryptonews.com (@cryptonews) March 4, 2025

Argentina and Venezuela have additionally turned to Bitcoin and stablecoins to navigate inflation and greenback shortages.

Momentum is spreading to South America. On August 20, Brazil’s Chamber of Deputies debated Invoice 4501/24, which might set up a $19 billion Bitcoin reserve often known as RESBit.

Philippines Ranks seventh Globally in Crypto Adoption Amid New Regulatory Push

Notably, the Philippines are third within the area in each buying and selling quantity and adoption, rating seventh worldwide in Chainalysis’ 2024 Geography of Crypto report.

The laws arrives because the Philippines continues to refine its stance on digital belongings. In April, the SEC launched its Strategic Sandbox (StratBox) program, a regulatory framework permitting crypto companies to check new services in a managed atmosphere.

In December, the BSP accomplished Venture Agila, a wholesale central financial institution digital foreign money (CBDC) trial geared toward enhancing interbank settlement effectivity utilizing distributed ledger know-how. These initiatives recommend the nation is looking for a steadiness between innovation, regulation, and monetary stability.

On the identical time, regulators have ramped up enforcement. Earlier this month, the SEC issued an advisory towards 10 main worldwide exchanges, together with OKX, KuCoin, Kraken, and Bybit, for working with out correct authorization within the nation.

Officers warned that unlicensed platforms expose Filipino traders to “important danger” and pledged to work with tech giants like Google, Apple, and Meta to limit entry.

The put up Philippines Proposes Large 10,000 Bitcoin Purchase for Strategic Reserve appeared first on Cryptonews.