The newest PCE inflation information from the U.S. is predicted on Friday — and Bitcoiners will likely be preserving a really shut eye on the headline figures.

Whereas it’s completely different from the Shopper Value Index, we’ll get an replace about that on April 10, this report gives a useful perception into how the financial system is faring.

For context, the Private Consumption Expenditures metric helps gauge adjustments within the costs that customers are paying for widespread items and companies — in addition to how the general public’s habits is shifting.

Because the Bureau of Financial Evaluation notes, this index “will get loads of consideration” due to how a lot weight it’s given by the Federal Reserve, particularly as policymakers look at whether or not it’s time to chop rates of interest.

So: what’s anticipated to occur when the studying for February emerges? Properly… not rather a lot.

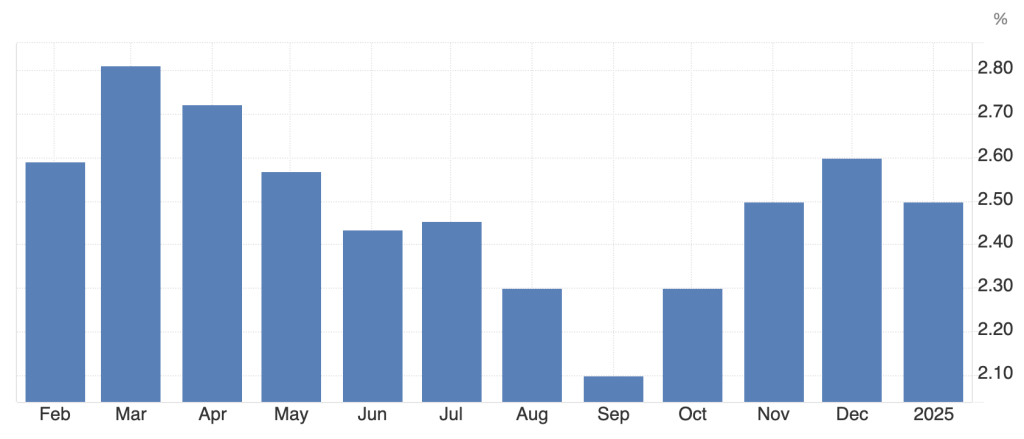

January’s information had proven a year-on-year rise of two.5%, which stays effectively above the Fed’s goal of two%. That, in flip, was a modest enchancment on December, the place an annual acquire of two.6% was recorded.

Analysts are forecasting that February’s PCE will stay unchanged at 2.5% — fueling the narrative that inflation is proving cussed, and charges are going to remain elevated for a while to return.

However what’s worrying economists particularly is that these figures don’t mirror the impression of Donald Trump’s tariffs. Punishing new import taxes on items from China are already in drive, whereas widespread hikes concentrating on merchandise coming into the U.S. from each Mexico and Canada have been postponed twice.

Additional tariffs are deliberate on aluminum and metal, whereas a brand new 25% tariff on imported automobiles is the newest measure to be proposed by the White Home.

All of those insurance policies would go away retailers with little selection however to up their costs — and that can feed by to customers on the until. When it does, inflation will start to spike up once more, making it tougher for the Federal Open Markets Committee to justify rate of interest cuts.

The newest figures from the CME FedWatch software recommend merchants imagine there’s simply an 11.6% likelihood of the goal price being diminished through the subsequent assembly on 7 Might. With regards to the next assembly on 18 June, 34.5% suppose they’ll stay unchanged but once more — with a 58.4% probability of a reduce.

Given how Trump has been repeatedly calling for the Fed to chop charges, any resolution to take care of the 4.25% to 4.5% vary would probably appeal to staunch criticism.

What Does This Imply for Bitcoin?

Sadly, it’s extremely unlikely that Friday’s PCE information will give Bitcoin a lift — particularly primarily based on the present forecasts. A shock determine to the upside might find yourself giving the world’s largest cryptocurrency a bit elevate.

However the larger fear for the crypto markets, and Wall Road extra broadly, stays how this commerce conflict is unfolding.

Jerome Powell just lately revealed that he anticipates the inflationary impression of Trump’s tariffs will likely be “transitory” — in different phrases, it gained’t final for lengthy. However critics level out that the Fed mentioned this when the coronavirus pandemic started too, and that noticed the Shopper Value Index overheat to ranges not seen for the reason that Eighties.

Alberto Musalem from the St. Louis Fed publicly declared that he disagrees with this evaluation, saying:

“The direct price-level results are anticipated to have solely a short and restricted impression on inflation, however the oblique results might have a extra persistent impression on inflation.”

BitMEX co-founder Arthur Hayes — who has admitted that a lot of his predictions find yourself falling effectively off the mark — believes that Bitcoin’s subsequent transfer is extra prone to see a surge again to $110,000 reasonably than a stoop to $76,500. The dealer added that, if BTC as soon as once more exams its earlier all-time excessive, “we ain’t wanting again till $250,000.”

Sadly, this can be an excessively optimistic take. Bitcoin’s efficiency is carefully tied to the inventory market. And proper now, Wall Road is on tenterhooks as a result of Trump’s presidency is proving to be risky and extremely unpredictable. This lack of certainty is suppressing the S&P 500, Dow and Nasdaq 100.

Within the brief time period, $90,000 is proving to be a tricky nut to crack for Bitcoin. And primarily based on the place we are actually, that is anticipated to be BTC’s worst March since 2020.

The submit PCE Inflation Information: What Does It Imply for Bitcoin? appeared first on Cryptonews.