Whereas the crypto area continues to buzz with flashy Web3 branding, formidable AI integrations, and the speculative attract of meme cash, there’s a basic transformation occurring. One that’s nonetheless being obscured. This revolution — which I name Money2 — will redefine the best way we use cash and the way we perceive monetary belief.

Not like conventional currencies constructed on centralized oversight, Money2 is powered by a synthesis of DeFi, stablecoins, and trustless sensible contracts. On this ecosystem, layers of intermediaries are stripped away and belief is embedded within the code, bringing a brand new stage of effectivity and safety to monetary transactions.

DeFi is on the Coronary heart of the Subsequent Monetary Revolution

On the core of Money2 is decentralized finance, which is progressively changing the standard infrastructure, providing an open monetary system out there to just about anybody with an web connection. The ideas behind DeFi are basic: belief is supplied not by a government or an insurer, however by the clear and immutable nature of blockchain-based sensible contracts.

For hundreds of years, belief in folks or establishments has been the cornerstone of monetary programs. We’ve at all times needed to depend on banks, brokers, or governments to make sure that the transaction goes easily. Nevertheless, these establishments are fallible, and there have been numerous situations the place this belief has been betrayed. Even with authorized frameworks designed to carry them accountable, threat stays inherent.

Money2 eliminates the necessity for that belief altogether. On this new paradigm, sensible contracts substitute intermediaries, and no financial institution will delay your switch or freeze your account. Transactions are clear, verifiable, and self-executing based mostly purely on code. This reduces corruption and forms, presenting a chance to create a extra accessible world monetary system.

By means of DeFi, the world now faces a profound shift in how we take into consideration cash and belief.

Stablecoins because the New Financial Narrative

Stablecoins will kind the bedrock of Money2, as they characterize the perfect of each worlds, providing the steadiness of conventional cash mixed with the technological benefits of blockchain.

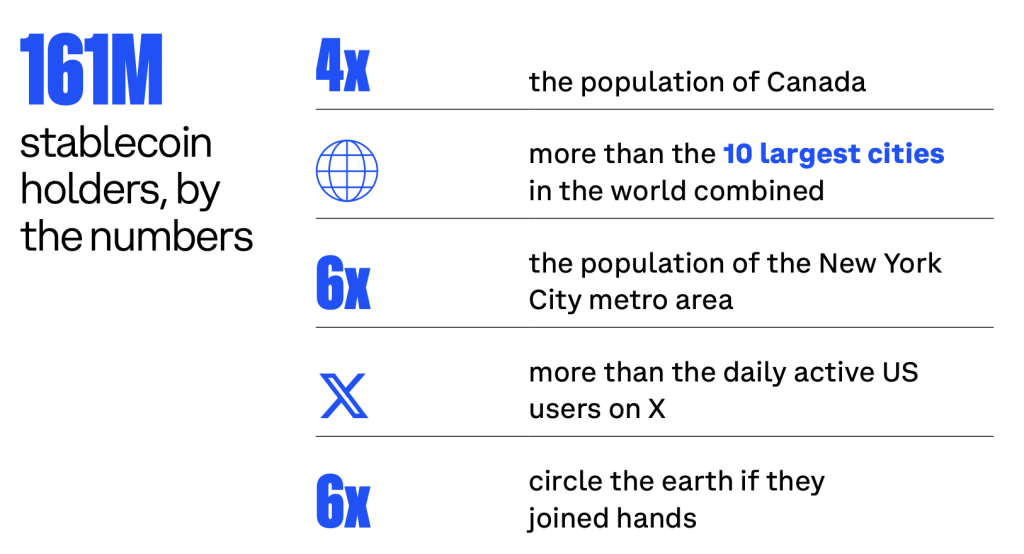

Knowledge from Coinbase reveals that over 160 million folks now maintain stablecoins — which is greater than all of the mixed customers of main conventional banks like JPMorgan, Financial institution of America, Wells Fargo, and Citibank. This speaks volumes in regards to the quantity of belief and reliability these belongings have garnered from the worldwide public over time.

Not like the speculative nature of many digital belongings, stablecoins serve an actual, utilitarian perform. They supply a constant medium of alternate and a safe retailer of worth in an more and more unstable digital economic system. This intrinsic stability is extremely essential because the world progressively shifts away from legacy monetary programs which have typically proved inefficient.

The Roadblocks to Mass Adoption

That stated, regardless of its promise, there are a number of obstacles that proceed to carry Money2 again. The transition to a trustless system doesn’t come with out challenges. Questions nonetheless linger relating to safety, person expertise, and regulatory oversight.

As governments and regulatory our bodies all over the world scramble to catch up, inconsistent authorized frameworks proceed to create friction. With out harmonized laws, adoption of Money2 might be stifled by uncertainty, and buyers may turn into cautious of participating totally with these programs.

One other problem lies in bridging the hole between cutting-edge monetary expertise and person accessibility. Whereas early adopters and tech-savvy buyers have embraced DeFi programs, the broader public stays cautious, and far of this warning is because of the complexities concerned in utilizing decentralized platforms.

To deliver Money2 into the mainstream, training and improved person interfaces are important. Any world monetary transition ought to have folks’s comfort at its coronary heart, making certain that the advantages of this revolution can really lengthen to everybody.

These are all important hurdles to beat, however they don’t seem to be insurmountable. The best way I see it, the present imperfections are merely a mirrored image of a system that’s nonetheless in transition. A single section within the longer journey towards a extra resilient and inclusive monetary future. And there are already many events within the trade that actively work to handle these points.

Banks in a New Period

Amid this shift, even conventional monetary establishments are starting to discover the potential of crypto and blockchain expertise. Noteworthy headlines are floating round, declaring how massive names in banking are exploring the concept of venturing into the crypto world.

This isn’t nearly using the pattern — I, for one, see it as an acknowledgment that the basic panorama of finance is present process a significant transformation. By trying into incorporating crypto components, these banks acknowledge that the way forward for cash might certainly shift away from the entrenched programs they’re used to.

Their involvement and willingness to adapt function a big endorsement of the underlying ideas of Money2 and have the potential to speed up its integration into the worldwide monetary ecosystem.

A Future Constructed on Code and Transparency

In the end, Money2 is greater than a technological improve — it’s a paradigm shift that has the potential to democratize finance. It opens the door to a monetary system the place expertise instills belief, not the promise of establishments that may generally falter.

The adoption of trustless sensible contracts ensures that each transaction is executed based mostly on pre-defined, clear logic, eradicating the necessity for middlemen who traditionally have launched inefficiencies and biases. Nevertheless, bringing this future into actuality would require a collective effort from DeFi builders, regulators, and institutional gamers alike.

Disclaimer: The opinions on this article are the author’s personal and don’t essentially characterize the views of Cryptonews.com. This text is supposed to offer a broad perspective on its matter and shouldn’t be taken as skilled recommendation.

The submit Opinion: Web3 is a Distraction. The Actual Future is Money2 appeared first on Cryptonews.