Helius Medical Applied sciences, now working as HSDT Solana Firm, has grown its Solana treasury to greater than 2.2 million SOL tokens price over $525 million, mixed with money holdings exceeding $15 million, the corporate introduced on October 6.

The acquisition was made lower than three weeks after the preliminary $500 million personal placement closed on September 18, with the mixed worth already surpassing the gross proceeds from the unique capital increase.

Cosmo Jiang, Common Companion at Pantera Capital and Board Observer, famous the corporate is “targeted on maximizing shareholder worth by effectively accumulating Solana.”

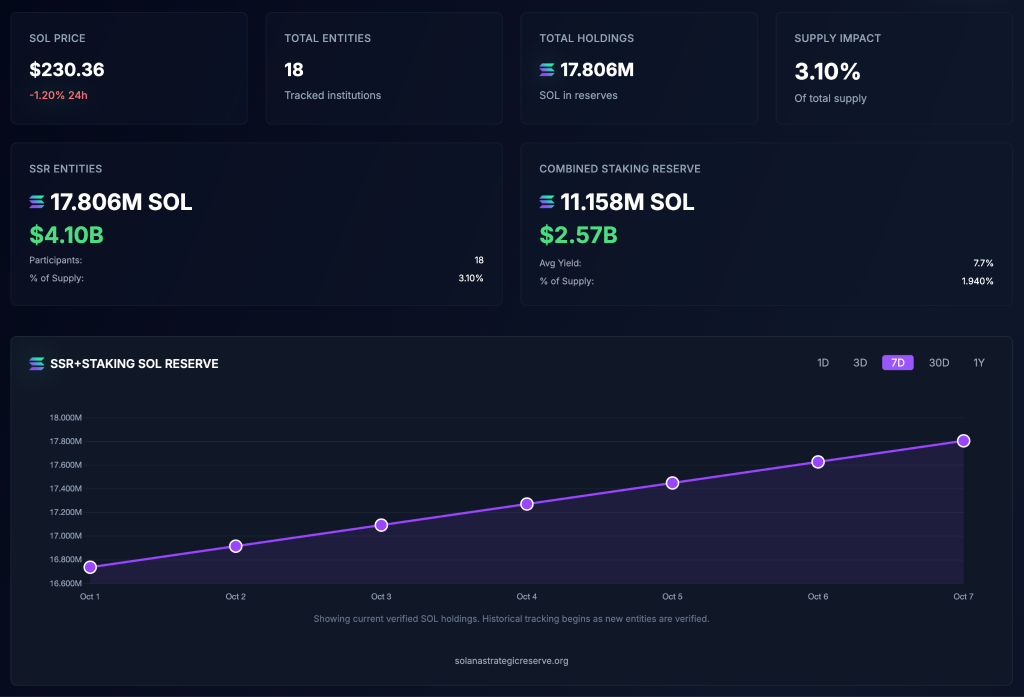

Institutional Solana treasury holdings have surged previous $4 billion throughout 18 tracked contributors controlling 3.1% of the circulating provide, in line with Strategic Solana Reserve information.

Ahead Industries leads with 6.8 million SOL valued at $1.69 billion, adopted by Sharps Know-how with 2.1 million SOL and DeFi Improvement Corp with simply over 2 million SOL.

Multi-Billion Greenback Treasury Commitments Drive Company Adoption

Ahead Industries closed a $1.65 billion personal placement on September 11, led by Galaxy Digital, Leap Crypto, and Multicoin Capital.

Kyle Samani from Multicoin Capital grew to become the Chairman of the Board.

On the identical time, the corporate filed plans for a $4 billion fairness program and partnered with Superstate to tokenize its inventory on the Solana blockchain.

As talked about earlier, Helius Medical secured $500 million via an oversubscribed placement led by Pantera Capital in September, with an extra $750 million in stapled warrants, doubtlessly bringing complete treasury capital to $1.25 billion.

Traders included Summer season Capital, Arrington Capital, Animoca Manufacturers, and HashKey Capital. Following the announcement, HSDT inventory surged over 159% from $7.91 to $45.51 earlier than settling at $19.63.

VisionSys AI inventory has fallen 57% after unveiling a $2B Solana treasury plan with @MarinadeFinance. Shares later partly recovered. #VisionSysAI #Solana #SOLhttps://t.co/gaUYAVnjOf

— Cryptonews.com (@cryptonews) October 1, 2025

This month, VisionSys AI has unveiled plans for a $2 billion Solana treasury program in partnership with Marinade Finance, beginning with a $500 million SOL acquisition over six months.

Australian health firm Fitell Company additionally secured a $100 million credit score line for its treasury technique with plans to rebrand as Solana Australia Company.

The corporate added 216.8 million Pump.enjoyable tokens, valued at $1.5 million, and appointed David Swaney and Cailen Sullivan as advisers.

One of many oldest and main corporations, SOL Methods, commenced buying and selling on Nasdaq underneath ticker STKE on September 10, with $94 million in holdings, managing 3.62 million SOL underneath delegation and participation from 8,812 distinctive wallets.

Inventory Buybacks Emerge as Shares Lag SOL’s 55% Rally

Sharps Know-how introduced a $100 million inventory repurchase program on October 2, following its $400 million personal placement in August.

Nonetheless, STSS shares closed at $6.67, down 43% over the previous month regardless of Solana rallying 55.5% throughout the identical interval.

DeFi Improvement Corp has additionally authorized a rise in its repurchase program from $1 million to $100 million, with an preliminary threshold of $10 million requiring further board notification.

Upexi Inc., which now holds 2 million SOL, valued at $377 million, has launched an “adjusted SOL per share” metric, which stands at 0.0197, representing a 56% enhance since launching the initiative.

The corporate additionally appointed former BitMEX CEO Arthur Hayes to its advisory committee.

Technical Indicators Recommend Binary End result at Multi-12 months Resistance

Multi-year chart evaluation reveals an enormous cup and deal with formation, with SOL buying and selling at $231.34, close to important resistance round $260-280, representing the 2021 cycle highs.

The sample’s measured transfer theoretically targets a $400 – $500 vary, representing 70-115% upside from present ranges.

Weekly Fibonacci extensions undertaking potential targets at $406.90, $672.37, $1,103.30, and in the end $2,247.46.

SOL has recovered roughly 2,800% from 2022-2023 cycle lows close to $8, efficiently reclaiming most main Fibonacci retracement ranges.

The consolidation close to 2021 highs represents a important determination level the place SOL should both break via with conviction or face potential rejection.

Furthermore, the ultimate deadline for spot SOL ETF approval is simply 4 days away, with analysts assigning excessive approval probabilities this week.

Massive week for Solana.

The ultimate deadline for spot $SOL ETF approval is simply 4 days away.

Excessive probabilities we get the approval this week. pic.twitter.com/nAVUr2g7PC— Lark Davis (@TheCryptoLark) October 6, 2025

In September, SOL outpaced Ethereum with a 26% month-to-month acquire, in comparison with ETH’s 8%.

Upcoming upgrades, together with Firedancer, Alpenglow, and state compression, are anticipated to assist additional progress.

In actual fact, VanEck nonetheless maintains a bullish outlook, predicting SOL may attain $520 earlier than year-end.

Because it stands now, Solana faces binary outcomes at multi-year resistance round $260-280, the place a profitable breakout may drive development towards $350-400, supported by company treasury accumulation and potential ETF approval.

Failure at resistance may set off a correction towards $150 – $180 assist ranges, with prolonged consolidation inside $200 – $280 vary additionally attainable.

The publish Nasdaq-Listed Solana Firm Grows Treasury to $525M in SOL Holdings – Solana About to Explode? appeared first on Cryptonews.