Singapore-based Lion Group Holding Ltd. (NASDAQ: LGHL) is making a daring wager in crypto markets, asserting it’ll dump all of its Sui (SUI) and Solana (SOL) holdings in favor of Hyperliquid (HYPE). The agency plans to dump roughly 1 million SUI and 6,600 SOL, changing them steadily into HYPE to scale back acquisition prices and handle volatility.

This follows LGHL’s earlier announcement that it intends to carry $600 million in reserves with HYPE as its main treasury asset, making this conversion a key step in aligning its stability sheet with that technique.

Why Hyperliquid? LGHL Reallocates to HYPE as Hyperliquid Captures 70% of DeFi Perpetuals

In line with LGHL, the transfer displays its technique to optimize reserves by leveraging Hyperliquid’s high-performance Layer 1 blockchain and its decentralized perpetual futures trade (perps). Hyperliquid has quickly develop into the chief in DeFi perpetuals, capturing 70% market share.

Hyperliquid smashes income report with $106M in August, dominating 70% of the DeFi perps market as lean 11-employee crew outperforms monetary giants.#HyperLiquid #DeFihttps://t.co/EsYDUloLz8

— Cryptonews.com (@cryptonews) September 2, 2025

In August 2025, Hyperliquid generated $106 million in income, up 23% from July’s $86.6 million, with $383 billion in month-to-month buying and selling quantity. It now ranks sixth amongst decentralized exchanges (DEXs), with $420 million in day by day flows and a $1.75 billion complete worth locked (TVL).

The reallocation comes shortly after BitGo Belief Firm launched institutional custody options for HYPE within the U.S., giving company buyers like LGHL regulated, compliant, and safe storage choices.

CEO Wilson Wang mentioned the corporate will pursue a phased accumulation technique, changing SUI and SOL holdings into HYPE steadily to decrease common acquisition prices and capitalize on market volatility.

Wang highlighted Hyperliquid’s on-chain order e-book and environment friendly buying and selling infrastructure as a “compelling alternative” within the DeFi sector.

The reallocation away from SUI and SOL reveals a shift in priorities for LGHL. Whereas each SUI and SOL stay sturdy ecosystems in their very own proper, neither instructions the extent of income development and buying and selling exercise that Hyperliquid now delivers.

The transfer follows a development of Nasdaq-listed corporations including HYPE to their treasuries. Eyenovia was the primary publicly traded U.S. firm to commit vital reserves to the token, elevating $50 million to accumulate multiple million HYPE.

Tony G Co-Funding Holdings disclosed a smaller however notable buy of 10,387 HYPE value simply over $438,000. Additionally, Sonnet BioTherapeutics introduced a digital asset treasury plan anchored in HYPE, with 12.6 million tokens valued at $583 million, alongside an extra $305 million earmarked for future acquisitions, pushing the whole to just about $888 million.

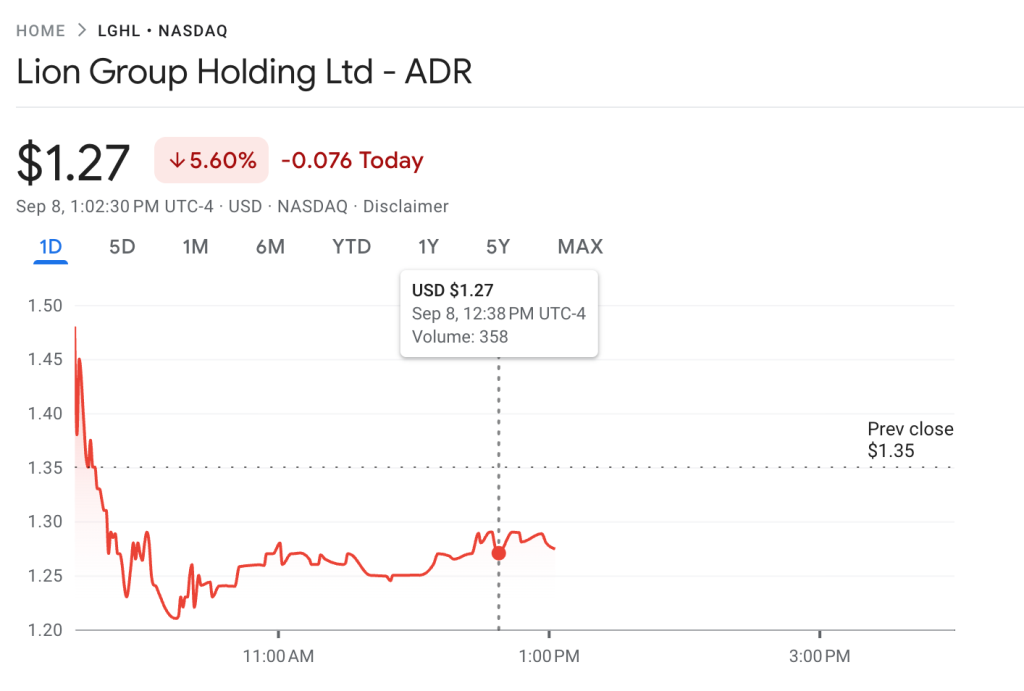

Regardless of this momentum, LGHL’s inventory dipped 5.60% on the information, as buyers weighed the dangers of the crypto-heavy technique.

HYPE Hits $51.50 ATH, Up 450% Since April — Analysts Eye $52 Breakout

HYPE has reached a contemporary all-time excessive, hitting $51.50 after posting a robust 9.21% day by day acquire, marking a breakout above current resistance round $48, pushing the token to its highest degree but.

HYPE has now seen a powerful 15.7% prior to now week, extending its rally to 18.6% prior to now month. Notably, since bottoming out close to $9.30 in April, HYPE has staged a outstanding rally of greater than 450%.

As HYPE continues to commerce above the $44–$46 assist degree, analysts labeled $52 because the vital degree to look at, as a decisive breakout above this resistance may set off accelerated momentum, paving the best way for brand new highs and increasing the token’s bullish rally.

Notably, Arthur Hayes has earlier predicted Hyperliquid’s HYPE to surge 126x by 2028 as $10 trillion in stablecoin adoption reshapes DeFi.

@CryptoHayes says HYPE may surge 126x by 2028 as $10T stablecoin increase is ready to reshape finance.#Hyperliquid #Stablecoinhttps://t.co/HhuG7nx0RE

— Cryptonews.com (@cryptonews) August 28, 2025

However the dump of SUI and SOL hasn’t dented these tokens, no less than for now. SUI climbed 2% to $3.48, trimming its month-to-month loss to 12.4%. Solana jumped 5.2% to $214, extending its rally to 7% on the week and 19% on the month, with some analysts forecasting a run to $300 by month-end if bullish momentum continues.

The publish Nasdaq Agency Dumps 1M SUI & 6.6k SOL for HYPE – What Do They Know? appeared first on Cryptonews.