Bitcoin has dropped 2.4% within the final 24 hours, buying and selling at $83,797, with a $24.98 billion buying and selling quantity. As BTC struggles to reclaim the $86,000 degree, merchants at the moment are watching a sudden whale motion of 534 BTC that might sign main volatility forward.

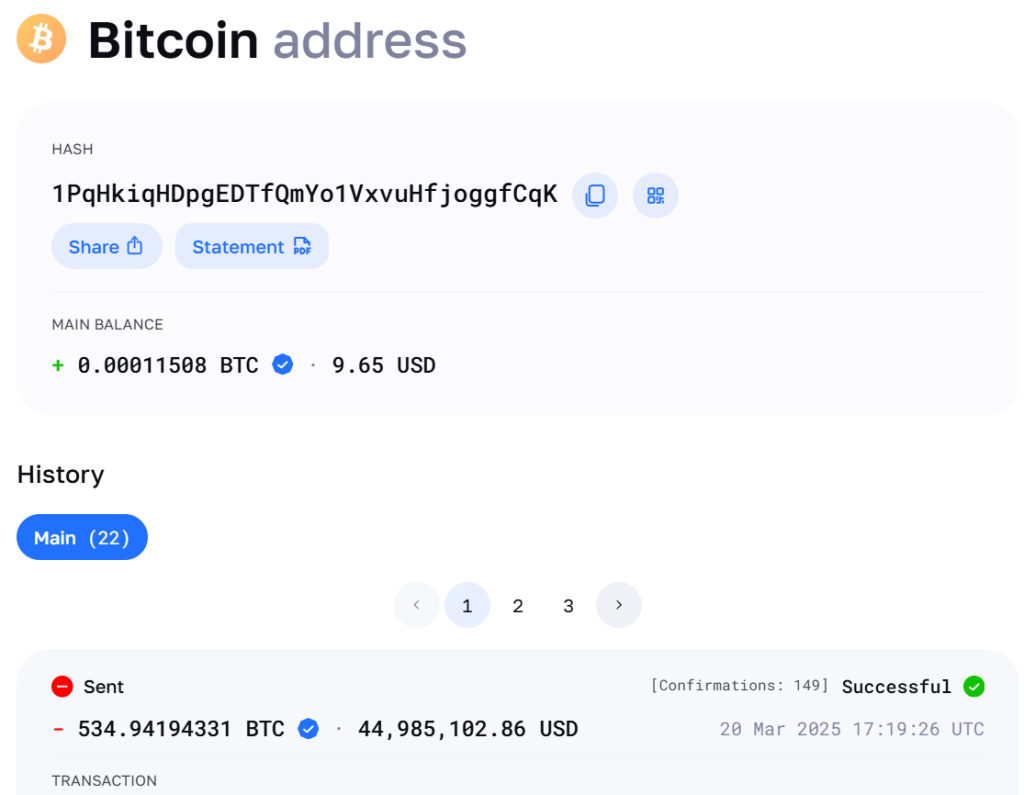

A dormant Bitcoin pockets, inactive since 2016, has simply transferred 534.94 BTC ($45 million) to a brand new deal with. The huge transfer has sparked fears of a possible sell-off, particularly as BTC has already fallen 10% up to now month. Is that this only a routine fund switch, or are large gamers getting ready for a market shake-up?

Volatility Surges as Market Uncertainty Grows

The sudden motion of a long-dormant Bitcoin pockets has caught the crypto neighborhood’s consideration. A pockets created in March 2016 transferred 534.94 BTC—valued at roughly $45 million—to a different deal with at block peak 888,655.

This Bitcoin, initially acquired for simply $222,000, has appreciated by an astounding 20,272% over time.

- The transaction was detected by btcparser.com, with a minimal charge of simply $1.12 at a price of 5 satoshis per digital byte (sat/vB).

- Notably, the Bitcoin Money (BCH) linked to this pockets was already spent in 2017, elevating additional hypothesis concerning the whale’s intent.

- The transferred BTC stays in one other legacy deal with, with no rapid indicators of liquidation.

Whereas some analysts consider this motion is a routine fund reallocation, others concern it may precede a large-scale market sell-off. If the whale decides to liquidate the BTC holdings, Bitcoin’s value may face extra downward strain within the quick time period.

Key Takeaways:

- A 2016 Bitcoin pockets moved 534.94 BTC, sparking hypothesis.

- The transaction was low-cost and stays unspent.

- Merchants concern a possible sell-off, impacting BTC costs.

Bitcoin Faces Uncertainty Amid Fed Insurance policies and Whale Exercise

On the U.S. entrance, the Federal Reserve’s choice to keep up rates of interest has launched extra uncertainty in monetary markets. Fed Chair Jerome Powell has flagged considerations about inflation dangers tied to current tariff insurance policies, fueling investor warning.

DOT PLOT: The dot plot is a vital supply of clues to dissent throughout the FOMC.

Right here's what to know concerning the March dot plot https://t.co/CorFrVX7tP pic.twitter.com/mrSrggKA3V— Bloomberg (@enterprise) March 19, 2025

Regardless of Bitcoin’s value drop, Grayscale’s Zach Pandl stays optimistic about BTC’s long-term potential, arguing that this correction may very well be a shopping for alternative. Traditionally, Bitcoin has benefited from looser financial insurance policies, which means future rate of interest cuts may drive BTC increased.

Trying Forward:

- Whale exercise may introduce short-term volatility.

- The Fed’s insurance policies will form Bitcoin’s subsequent transfer.

- A breakout may push BTC previous key resistance ranges.

Bitcoin (BTC/USD) Technical Outlook: Breakout or Breakdown?

Bitcoin (BTC) is consolidating close to $84,085, holding above key assist amid growing market volatility. The worth motion is forming a symmetrical triangle sample, a technical construction that always precedes a breakout. The 50-day EMA at $84,002 serves as a essential assist degree, reinforcing the bullish bias.

- Instant resistance is at $84,341, with potential for a rally towards $87,411 and $89,901 if BTC breaks increased.

- If BTC fails to carry $84,000, the following assist degree sits at $81,552, adopted by $79,087.

- A possible EMA crossover additional helps a bullish breakout situation.

With rising quantity and tightening value motion, merchants ought to look ahead to a breakout from the symmetrical triangle sample. A transfer above $84,341 may gas a robust rally, whereas a break beneath assist ranges could set off a short-term correction.

Key Insights:

- BTC is consolidating inside a symmetrical triangle, holding above $84,000.

- The 50-day EMA at $84,002 acts as a robust assist degree.

- A breakout above $84,341 may push BTC towards $87,411 and $89,901.

Remaining Ideas: Is Bitcoin Poised for Extra Draw back or a Rebound?

Bitcoin’s value motion stays unsure, with whale actions and macroeconomic pressures fueling volatility. The subsequent main transfer hinges on whether or not BTC holds key assist at $84,000 or breaks increased towards $87,411.

For now, merchants ought to stay cautious and monitor on-chain exercise—particularly whale actions—to gauge market sentiment within the coming days.

BTC Bull: Earn Bitcoin Rewards with the Hottest Crypto Presale

BTC Bull ($BTCBULL) is making waves as a community-driven token that mechanically rewards holders with actual Bitcoin when BTC hits key value milestones. In contrast to conventional meme tokens, BTCBULL is constructed for long-term traders, providing actual incentives by way of airdropped BTC rewards and staking alternatives.

Staking & Passive Revenue Alternatives

BTC Bull gives a high-yield staking program with a formidable 119% APY, permitting customers to generate passive earnings. The staking pool has already attracted 882.5 million BTCBULL tokens, highlighting sturdy neighborhood participation.

Newest Presale Updates:

- Present Presale Value: $0.00242 per BTCBULL

- Complete Raised: $3.9M / $4.4M goal

With demand surging, this presale gives a possibility to amass BTCBULL at early-stage pricing earlier than the following value enhance.

The publish Thriller Whale Strikes 534 BTC – Is a Huge Bitcoin Promote-Off Coming? appeared first on Cryptonews.