The Russian tax company, the Federal Tax Service (FTS), has unveiled a tax calculator software for crypto miners working within the nation.

Per a report from the Russian state-run information company TASS, the FTS has additionally “posted info” on crypto “alternate” charges for taxpayers.

Russian Crypto Miners: Able to Pay Taxes?

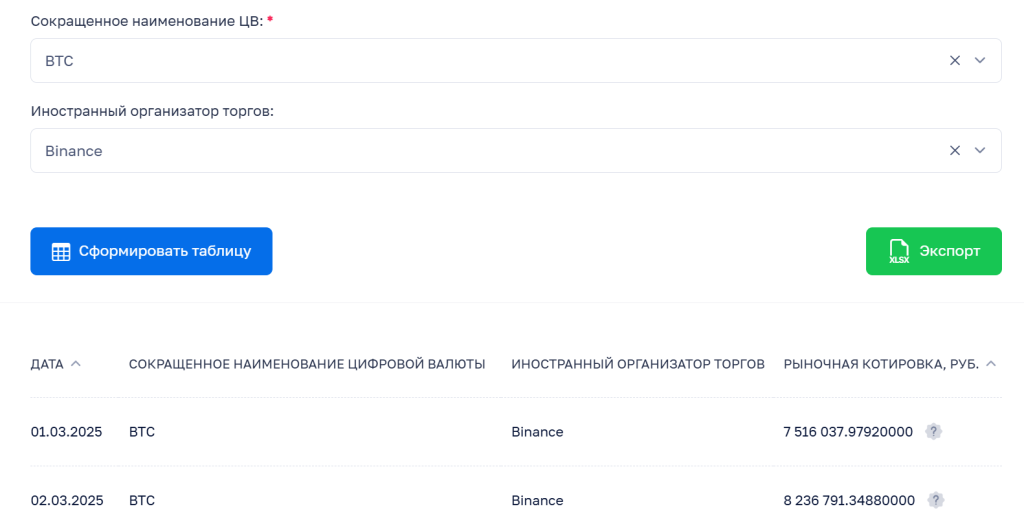

The FTS software lets miners verify on the precise “minimal closing worth” in fiat rubles of standard cash on “international buying and selling [platforms]” (crypto exchanges) on particular dates within the interval January 1, 2025, to March 31.

Quoting the FTS’ press service, TASS reported that the company’s web site “has printed info on market quotes for digital currencies and complete volumes of every day trades with international commerce organizers for taxpayers.”

This, the FTS mentioned, will assist “taxpayers” to “decide revenue from digital foreign money transactions based mostly on info from open sources.”

“It will assist taxpayers calculate the tax base for digital foreign money transactions on every particular person date of revenue recognition.”

Russian Federal Tax Service

A Russian Soyuz rocket carrying an American astronaut and two Russian cosmonauts blasted off from the Baikonur cosmodrome in Kazakhstan for the Worldwide Area Station, Russia's Roscosmos area company mentioned https://t.co/P57xmvV9Nk

— Reuters (@Reuters) April 8, 2025

The FTS famous that “digital foreign money obtained on account of mining” is taken into account as a taxable type of revenue.

And it wrote that “the worth of digital foreign money is set based mostly on market costs on the date of the particular receipt of revenue.”

The FTS clarified that cryptoassets turn out to be revenue on “the day when the one who acquired them has the suitable to promote them.”

‘Framework’ in Place

The software, nonetheless, seems to be considerably imperfect. On the time of writing, it solely carries knowledge from seven crypto exchanges, together with Binance, ByBit, KuCoin, and MEXC.

And whereas it collates knowledge on a variety of standard cash, together with Bitcoin (BTC) and Dogecoin (DOGE), some high-cap cash like Ethereum (ETH) and XRP seem like lacking from its database.

The FTS has additionally added disclaimers to its new useful resource, noting that the data it supplies “is topic to impartial verification by the taxpayer.”

Russia has already “legalized” crypto mining. And in November 2024, President Vladimir Putin signed a legislation stipulating the creation of a “framework” for taxing crypto miners.

Russia's oil exports slipped to their lowest in a month within the 4 weeks to April 6, dropping 220,000 barrels a day from their current peak, writes @JLeeEnergy https://t.co/BXGwBJfmEm

— Bloomberg (@enterprise) April 8, 2025

Nevertheless, the FTS and lawmakers are nonetheless but to finalize the finer particulars of the legal guidelines governing taxes for miners.

The November legislation stipulates that crypto-related trades are topic to a two-tiered stage of revenue tax.

These with earnings of as much as 2.4 million rubles ($28,000) should pay levies of 13% on their earnings.

Anybody incomes greater than this will likely be obliged to pay 15%, with companies ordered to pay the common company tax charge (25%) on their earnings.

Tax Company’s Register

All miners utilizing over 6,000kWh of electrical energy per thirty days to energy their rigs should signal as much as an FTS-curated register.

Non-compliance is punishable by a system of fines, with miners who fail to register set to pay 40,000 ruble ($466) fines.

These working below the brink shouldn’t have to declare their operations, nonetheless. It isn’t fully clear but if Moscow will ask sub-threshold customers to declare their coin holdings or pay taxes on them.

Russian Crypto Miners: Tax Windfall Incoming?

The Russian crypto mining business has beforehand assured Moscow that the Treasury can count on to make over half a billion USD per 12 months from taxing miners.

The FTS’ new internet assets additionally include directions for what it calls “mining infrastructure operators.”

It defines these as people or corporations who “present companies for the availability of mining infrastructure for the actions of miners and mining swimming pools.”

Russian crypto consultants have beforehand claimed that 9 out of 10 mining companies focus their efforts on BTC (though some knowledge compilers dispute this declare).

Nevertheless, Russian crypto fanatics have beforehand instructed Cryptonews.com that many home-based miners desire to mine ETH.

All consultants additionally agree that Litecoin (LTC) – which is included within the FTS’ database – additionally enjoys a minority curiosity amongst main home mining gamers.

The submit Moscow Releases Tax Calculator for Russian Crypto Miners appeared first on Cryptonews.