Japanese Metaplanet has introduced the contemporary addition of 136 Bitcoin on Monday, for a complete value of $15.2 million. The company BTC accumulator has achieved a BTC Yield of 487% YTD 2025.

Metaplanet has acquired 136 BTC for ~$15.2 million at ~$111,666 per bitcoin and has achieved BTC Yield of 487% YTD 2025. As of 9/8/2025, we maintain 20,136 $BTC acquired for ~$2.08 billion at ~$103,196 per bitcoin. $MTPLF pic.twitter.com/nwEAv0NzQq

— Simon Gerovich (@gerovich) September 8, 2025

Per CEO Simon Gerovich, the corporate holds a complete of 20136 Bitcoin, with a cumulative buy quantity of $2.8 billion. The corporate stands sixth among the many prime company Bitcoin holders after the US-listed crypto trade Bullish surpassed Metaplanet with a complete of 24,000 BTC.

The latest addition of Bitcoin comes per week after the Tokyo-listed agency acquired 1,009 BTC, lifting its complete stash to twenty,000 Bitcoin.

Metaplanet Boasts BTC Yield of 487% Yr-To-Date

Metaplanet has been aggressively accumulating Bitcoin all through 2025, ramping up from simply above 12,000 BTC on the finish of June to 20136 BTC as of September 8.

The most recent announcement has additionally introduced Metaplanet a large 487% Bitcoin yield year-to-date.

“The corporate makes use of BTC Yield to evaluate the efficiency of its Bitcoin acquisition technique, which is meant to be accretive to shareholders,” Metaplanet famous.

From July 1 to September 8, 2025, the Firm reported its BTC Yield of 30.8%, reflecting its aggressive technique. The BTC yield acquire displays Metaplanet’s complete Bitcoin holdings at the start of a interval multiplied by the achieved BTC yield for that interval.

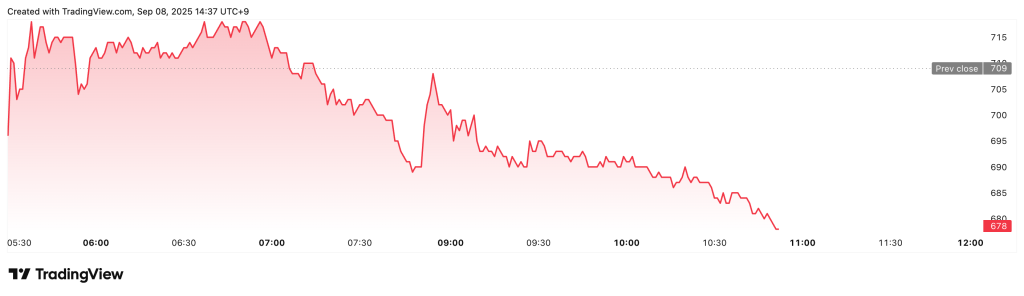

Metaplanet’s Shares Fall 2.3% in Tokyo Commerce

The most recent BTC acquisition has additional pushed down the shares of the Japanese hotelier to 2.3% in Tokyo buying and selling hours on Monday. The shares prolonged a virtually 20% rout from the previous week.

Per Yahoo Finance information, Metaplanet shares had been at a close to four-month low, marking a 63% decline from this yr’s peak.

Technical indicators level to an extra draw back being extremely probably, as shares broke beneath the essential assist degree of ¥723. Additional, the RSI reveals a bearish sentiment, and a “loss of life cross” formation is seen, a warning signal of additional losses.

In addition to, Bitcoin treasury technique critics have warned that aggressive investments would make an organization’s shares extra susceptible to volatility in crypto markets.

“The sustainability of company crypto treasuries will rely much less on short-term enthusiasm and extra on the leverage and steadiness sheet buildings behind them—particularly the place convertibles and convexity are concerned,” Thomas Fecker-Boxler, Interim CEO of the Web3 Basis, informed Cryptonews.

The submit Metaplanet Scoops 136 BTC for $15.2M, Now Holds 20136 Bitcoin appeared first on Cryptonews.