Key Takeaways:

- Fartcoin led April’s meme coin rally with a 145% value leap, however consultants warning that the sector stays fragile and closely depending on Bitcoin’s efficiency.

- Sui stood out amongst L1s with a 56% acquire, supported by sturdy DeFi metrics and stablecoin integration, although token unlocks may carry near-term volatility.

- AI tokens continued to achieve traction, with Bittensor and Digital Protocol amongst April’s high performers, however analysts warn that sustained development will rely upon real-world adoption.

The final days of April gave merchants cause to be hopeful. Bitcoin (BTC) climbed again above $90,000, serving to elevate sentiment throughout the broader crypto market. As BTC rebounded, altcoins adopted.

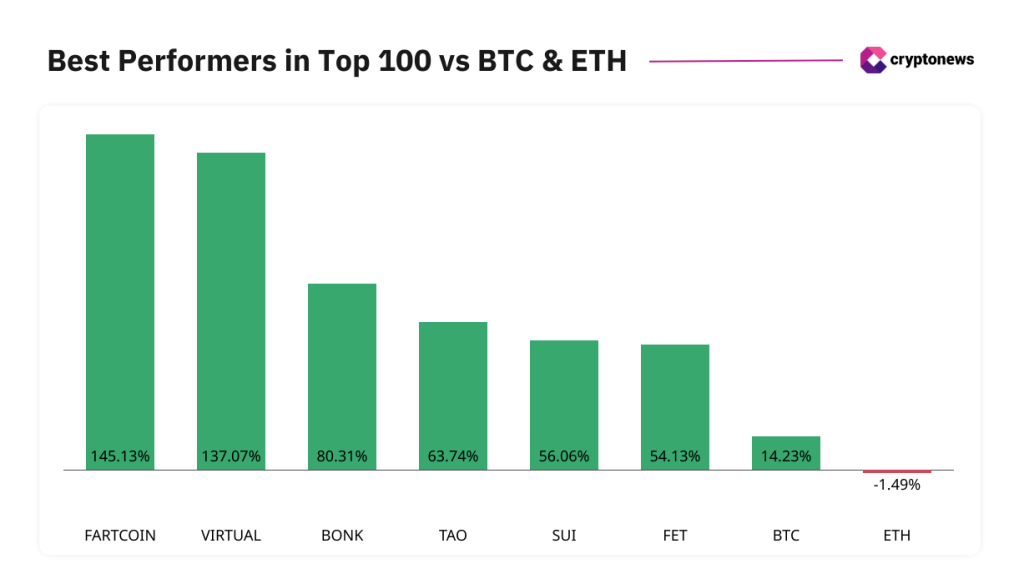

Among the many high 100 tokens by market capitalization, Fartcoin (FARTCOIN) led the month-to-month features with a 145% improve in April. One other meme coin, Bonk (BONK), additionally made the highest three with an 80% rise. The renewed curiosity in such high-risk property could sign that merchants are once more keen to tackle extra publicity after steep losses in March and April.

The Synthetic Intelligence (AI) sector additionally noticed sturdy momentum. Three AI-related tokens, Virtuals Protocol (VIRTUAL), Bittensor (TAO), and Synthetic Superintelligence Alliance (FET), all landed within the high 10 month-to-month performers.

Sui (SUI), a Layer 1 blockchain token, additionally stood out with a 56% acquire. For this April altcoin recap, Cryptonews spoke with consultants about what may form the market in Might.

Desk of Contents

- In This Article

Meme Cash Again in Play? FARTCOIN Leads with 145% Soar 'Indicators Recommend Sui Is on the Verge of Inflection Level' What Are the Value Predictions for AI Tokens After Their April Growth? What to Count on in Might Key Altcoin Occasions to Watch in Might 2025

- In This Article

- Meme Cash Again in Play? FARTCOIN Leads with 145% Soar

- 'Indicators Recommend Sui Is on the Verge of Inflection Level'

- What Are the Value Predictions for AI Tokens After Their April Growth?

- What to Count on in Might

- Key Altcoin Occasions to Watch in Might 2025

Present Full Information

Meme Cash Again in Play? FARTCOIN Leads with 145% Soar

April introduced a wave of pleasure to the meme coin market. Fartcoin surged by 145% and rapidly turned probably the most talked-about tokens of the month. However whereas some merchants see this as an indication of revival, consultants say it’s nonetheless too early to name it a full comeback.

Matas Čepulis, Founder & CEO of LuvKaizen, advised Cryptonews that the sector is displaying indicators of life, however total, “it’s removed from restoration nonetheless.” Whereas a number of initiatives like FARTCOIN are gaining traction, many common tokens, together with Pepe (PEPE), stay effectively under their all-time highs.

Čepulis attributes FARTCOIN’s breakout efficiency to its fast-growing social media presence and strategic execution:

Fartcoin bought insane traction and flooded social media immediately whereas creating FOMO. The group performed very effectively on the execution, market making, listings — and bought instantaneous traction.

Nevertheless, the skilled notes that almost all different meme cash failed to point out any significant restoration in April:

Sadly, Murad’s tokens like SPX6900, Retardio, Sigma and others are nonetheless down exhausting with zero to no constructive restoration within the final month.

The general image stays difficult by Bitcoin’s dominance. In response to Čepulis, when BTC is climbing, altcoins usually battle to maintain up, and when it drops, they have an inclination to fall even more durable. “Memes are those who get the largest purple candle,” Čepulis stated.

‘Indicators Recommend Sui Is on the Verge of Inflection Level’

Amongst Layer-1 protocols, Sui emerged as an sudden chief in April. It outperformed each Solana (SOL) and Ethereum (ETH) in value features, regardless of lingering market volatility. Nevertheless, some consultants warning towards untimely optimism.

Jason Tucker-Feltham, CEO of the Stablepor platform, advised Cryptonews that Sui’s latest rally could also be partly as a consequence of timing, and never simply fundamentals. The broader market hasn’t seen a powerful altcoin season but, and world financial uncertainty continues to weigh on sentiment:

The market has nonetheless but to see a convincing altcoin season, and with unstable macro developments, we may proceed to see volatility throughout your entire crypto market.

Nonetheless, Tucker-Feltham sees constructive indicators in Sui’s growth technique. He believes stablecoins will likely be a key theme for 2025 and sees their integration on Sui as a development catalyst:

Integration of Circle’s USDC on Sui units the stage for real-world funds. Stablecoins on Sui, coupled with the cross-chain capabilities enabled by Sui Bridge, may see it take a extra significant chew out of the worldwide stablecoin alternative.

Kelghe D’Cruz, CEO of Pairs, factors to encouraging on-chain information:

Key indicators would counsel that Sui is on the verge of an inflection level. Transaction counts and pockets development sign rising person engagement, whereas growing DeFi TVL interprets into extra property, extra trades, and extra demand.

He additionally highlights the significance of strategic partnerships that assist strengthen the broader Sui ecosystem. However regardless of these positives, D’Cruz warns of a number of dangers that would decelerate momentum:

Nonetheless, it’s not all clean crusing. The Transfer language, whereas modern, carries safety dangers as a consequence of its relative newness. Regulatory strain on DeFi’s yield mechanics may additionally gradual momentum. And liquidity fragmentation throughout chains may dilute capital effectivity.

24h7d30d1yAll time

What Are the Value Predictions for AI Tokens After Their April Growth?

April was a powerful month for the AI token sector. Three synthetic intelligence–linked initiatives landed within the high 10 gainers throughout the crypto market. Virtuals Protocol led the surge with a 137.07% acquire. TAO adopted with almost 64%, serving to elevate your entire section. On condition that TAO stays the biggest AI-focused token by market cap, its development probably performed a key position in driving the sector ahead.

In a dialog with Cryptonews, Abbas Abdul Sater, Head of Gross sales at Capital.com, pointed to TAO’s restricted provide as a significant component behind its attraction:

There’s solely 21 million TAO tokens in whole. That type of exhausting cap naturally creates shortage — and in crypto, shortage is usually a highly effective driver of value.

He famous that TAO at the moment holds a market cap of round $3 billion, with a totally diluted valuation of $6.8 billion. A pointy uptick in buying and selling quantity suggests rising investor curiosity, however Abdul Sater additionally urged warning:

It’s not but clear if that is only a hype-driven rally or one thing extra elementary. We’re watching carefully to see if this momentum holds.

Abdul Sater added that TAO’s latest development could have been supported by the launch of a brand new system referred to as the SN44 Rating. This software expands TAO’s utility by introducing real-world video information integration, and one thing traders are beginning to discover:

Integrating real-world video information is an enormous step. It’s opened up a brand new use case for TAO, and traders are paying consideration.

Whereas the tech continues to be in its early levels, Abdul Sater says many gamers are already “taking positions prematurely,” betting on long-term potential. Nonetheless, the sustainability of the development will rely upon how real-world adoption unfolds. If demand for utilized AI use circumstances continues, TAO may strengthen its lead within the sector.

Different AI tokens, outdoors of VIRTUAL TAO and FET, additionally posted features in April. In the meantime, among the many high AI tokens by market cap, solely Web Pc and Story posted destructive returns. NEAR Protocol (NEAR), which has positioned itself as AI-compatible, ended April with a modest 0.65% improve.

What to Count on in Might

Might has began with indicators of cooling after a turbulent April. The meme coin market nonetheless attracts consideration, notably following the surge in Fartcoin. Nevertheless, the dearth of sturdy fundamentals and continued reliance on Bitcoin could restrict additional upside.

Within the Layer-1 sector, Sui continues to face out due to bettering DeFi metrics and an increasing stablecoin ecosystem. The chance of a sell-off following its Might 1 token unlock stays a priority.

AI tokens are additionally holding the highlight. Sustained demand for TAO and technical updates just like the SN44 Rating may assist the present uptrend. Nonetheless, a lot will rely upon whether or not short-term hype turns into lasting momentum.

Key Altcoin Occasions to Watch in Might 2025

- Might 5: Hyperliquid Payment & Staking Tier Replace. New construction for charges and staking goes stay, probably affecting liquidity on the platform.

- Might 6: Aave aUSDC MetaMask Card Dialogue. Governance debate on whether or not aUSDC must be built-in as a spendable token for MetaMask Card customers.

- Might 7: Pet.enjoyable Launch. A brand new meme coin-focused launchpad anticipated to draw speculative curiosity and take a look at meme market momentum.

- Might 22: SEC Altcoin ETF Determination Deadlines. Essential rulings anticipated on ETF filings tied to XRP and different altcoins — potential market mover relying on final result.

The put up Might 2025 Altcoin Outlook: SUI, Meme Cash, and AI Tokens Skilled Predictions appeared first on Cryptonews.